What is an investment strategy and how to create it

Miscellaneous / / August 01, 2021

There are options for both beginners and advanced ones.

What is an investment strategy and why is it needed

An investment strategy is a plan for buying and selling assets that helps the investor achieve financial goals. This plan depends on the tasks, risk readiness and other characteristics of the person.

In the Telegram channel “Life hacker»Only the best writing about technology, relationships, sports, cinema and more. Subscribe!

In our Pinterest only the best texts about relationships, sports, cinema, health and much more. Subscribe!

The choice of an investment strategy most of all affects the return on investment. It showedG. P. Brinson, L. R. Hood, G. L. Beebower. Determinants of Portfolio Performance / Financial Analysts Journal a classic 1986 study in which economists calculated what it depends on:

- The distribution of assets by class, that is, the strategy itself, affects 93.6% of the return on the entire portfolio. It's a choice between shares, bonds, cash and alternative assets.

- The decision to purchase specific securities determines the yield at 4.2%.

- The timing of the purchase and sale of assets affects even less, by 1.7%.

- Exchange and broker commissions account for about 0.5-0.6%.

Another investment strategy helps a person understand what kind of risk he is willing to take. Some people are able to withstand a temporary drop in the value of their portfolio by 20-30% for a chance to earn more. Others do not need such a swing at all: they will agree to a lower profitability and will not risk capital.

How to create an investment strategy

There is no single and suitable option for everyone. It all depends Michael M. Pompian. Finance and Wealth Management: How to Build Investment Strategies That Account for Investor Biases, 2012 from many factors: goals, lifestyle and health, financial situation, expected profitability and other personal details.

It also means that investors need to realign and reevaluate their strategies over time. But first, it's worth going through five difficult stages.

1. Understand why to invest

This is usually done to save money, earn or increase capital. Large-scale reasons are shifted to real life plans. For example, “passive income after 10 years” and “buying a car after two years” require different approaches.

A separate conversation is investment in a secure old age. To do this, you need to accumulate solid capital, so that it then begins to bring funds that will be enough to live without work.

2. Determine how much money will be available for investment

Investment instruments require different amounts: buy a share in ETF you can for 1-2 thousand rubles, a lot of shares of a foreign company - for 30-50 thousand. Become a shareholder venture fundand it costs even more, from 5-7 million rubles.

Therefore, it is important to figure out what the investor can invest in. Let's say, with two million in hand, you can immediately create the basis of a diversified portfolio and not risk investing in only one asset.

And if there is no starting amount, then you need to estimate the potential income and expenses for the coming years and understand how much of the free money you can invest. If you buy assets every month or quarter, this will allow you to "average" the portfolio. The investor will not spend all the money at the peak of the market and will be able to wait out losses in a crisis.

3. Understand when investment returns are needed

This point directly depends on the goals, because for different time horizons you need to choose the appropriate combinations of assets.

For example, if an investor intends to renew a car in two years, then a person will not be suitable for investments in profitable, but extremely volatile cryptocurrencies. A small but stable increase in savings is more important here. For example, with the help of safe bonds, stocks of stable companies, or even deposits.

And if retirement is in the plans in 30 years, then the investor does not care about the fluctuations in assets over the course of a year or three. A person can invest in young and promising companies that will one day take over the market and generate high profits. But we must remember that the idea may not work. It is possible that the company will remain small or even go bankrupt.

4. Select acceptable risk

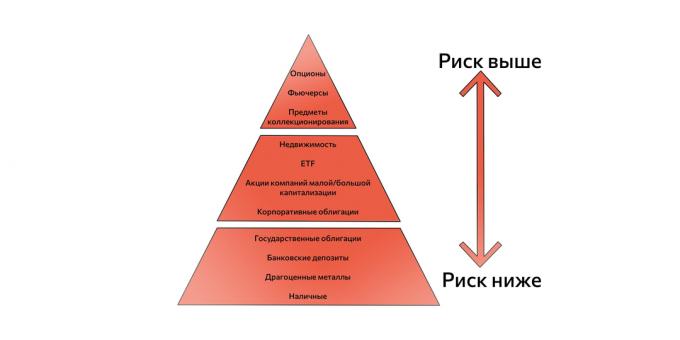

Some investments, like stakes in venture capital funds, can be completely nullified. These risks are too high for most people. It is worth considering the real and achievable profitability: not hundreds and thousands of percent per annum, but at least tens.

Therefore, investors diversify their portfolios - they distribute money among various financial instruments. It is difficult to guess which investment will turn out to beGuide to the Markets - U.S. 3Q 2021 / J. P. Morgan Asset Management unsuccessful, but it is compensated by the second, advantageous.

This means that you need to think about the distribution of investments. Financial advisors advise Richard A. A. Ferri. All About Asset Allocation, 2nd edition, 2010 split assets into three parts: a safety cushion, an investment portfolio, and speculative instruments.

The less a person is willing to take risks, the more conservative, low-risk assets he should acquire. Conversely, if the airbag and portfolio are already in place, then you can experiment with speculative and risky instruments.

Also, do not forget that no investment guarantees a profit. Any strategy, even the most reliable one, will one day bring a loss. You need to be ready for this.

5. Pick up assets in a portfolio

If the investor has completed the previous steps, then he will be able to compile a list of available assets that may be suitable. It's worth taking the time to sort out the pros and cons of each. For example, closed unit trust can show good returns, but requires initial capital and rarely publishes statistics for investors. Therefore, such an asset is suitable for those who want to multiply their savings, but do not understand the details themselves. Gradually, the investor narrows down a wide list of suitable assets to a small set that he is sure of.

Let's say a fictional investor is 50 years old, he has accumulated five million rubles during his life and wants to secure his pension. He does not plan debts, loans and large purchases.

| Elements of the plan | Solutions |

| Target | Fast growing portfolio until retirement at 65 |

| Available money | 5,000,000 rubles, plus 50,000 every month until retirement |

| Time horizon | 15 years, after which the opportunity to live on 30,000 rubles a month with interest |

| Risk | Profitable and risky instruments before retirement, then every year transfer 50,000 from the existing portfolio to stable assets |

| Potential assets | Emerging Sectors ETF Plus Replenishment IIS for tax deductions. After retirement - safe bonds and shares of stable companies |

Now the investor will only have to buy securities and from time to time check his portfolio against the strategy.

What investment strategies can you choose

The best investment strategy is the one that is more in line with the goals and capabilities of a particular investor. But professional financial managers and economists have developed many templates. You can strictly follow them, move away from them at some points, or mix them with each other. The main thing is to understand what it is for.

Growth investing

The essence of a "growth strategy" is to invest in stocks of firms that are rapidly increasing sales, occupying new markets, or increasing profits. Sometimes, not only individual enterprises but also entire sectors are growing rapidly.

For example, Netflix's video streaming service has grown in revenue over four yearsNetflix's Income Statement, ‘Total Revenue’ 2017–2020 by 113%. During the same period, shares have risen 3.1 times, which on average would have brought the investor 78% per annum.

The company is considered part of the telecommunications industry. In comparison, investments in the entire American sector would bring lessFive-year Communication Services Performance / Fidelity money - 50.8% for the same time.

Netflix has outperformed the market, and the strategy is to seek out such companies before they grow rapidly. Professionals analyzeFundamental versus Technical Research / Integrity Research Associates financial statements of corporations, assess market prospects and apply complex mathematical formulas.

It will be difficult for a novice private investor to figure it out. To help him, there are screeners - special services for analyzing securities. Of the popular and free ones, there are Finviz, Yahoo Finance Screener, TradingView and Zacks Screener.

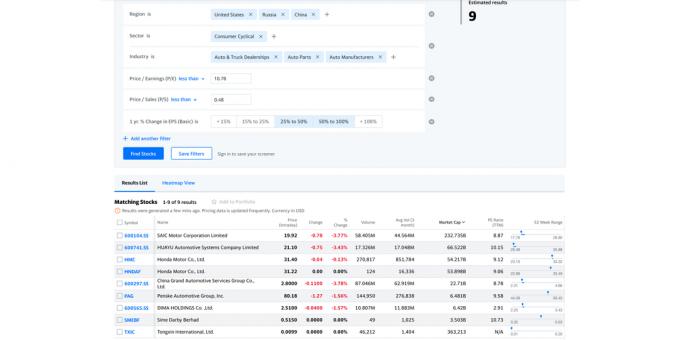

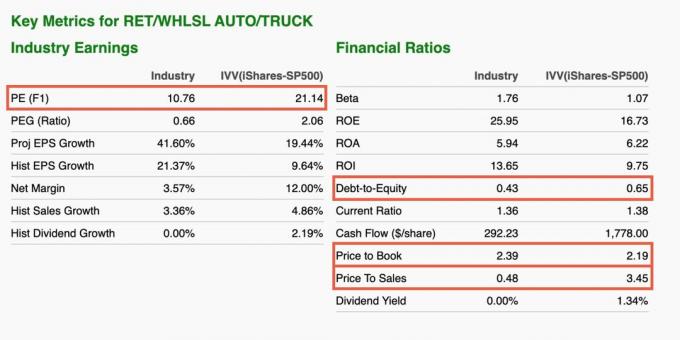

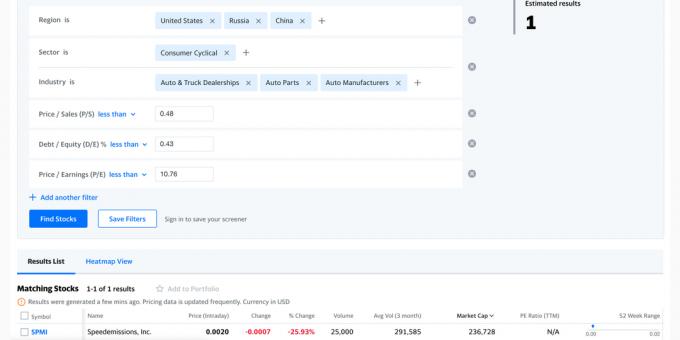

Let's say an investor believes in the growth of automakers after the 2020 crisis. First, a person needs to find out the average values for the entire sector and compare with the rest of the stock market, this is convenient to doAutomotive — Retail and Whole Sale, ’Key Metrics’ / Zachs Investment Research in the Zacks screener.

There are three indicators worth looking at.

- P / E, price to earnings. The ratio of the company's value to its annual arrived. The lower it is, the less you have to overpay. Using the indicator, you can understand how many years an investment in a company will pay off. That is, if an investor buys shares of a company with an indicator that is equal to three, then with its current profit, he will return the investment in three years. The auto sector companies will pay for themselves in almost 11 years, and the market will, on average, in 21 years.

- P / S, price to sales. The ratio of share price to revenue. If this indicator is less than one, then the company is undervalued, more than two is too expensive. The auto industry produces 0.48, while the broader market produces 3.45.

- EPS, earnings per share. The ratio of profit to the number of shares. It is not the number itself that is important, but the dynamics of growth: this year the automakers predict 41.6%, the rest of the market - 19.44%.

Now the investor knows the average data for the stock market as a whole and for a specific industry. Using these indicators, you can search for the most promising companies. For example, Yahoo Finance allows make all the necessary data, select the region and specific industries. In the markets of Russia, the USA and China, nine companies from the automotive sector meet the required conditions.

You can work with the sample further: look at detailed financial data, read the opinions and forecasts of analysts. If the investor is satisfied with everything, then he has a chance to make good money on these shares.

Investing in undervalued companies

The essence of the "cost approach" (eng. value investing) - look for good firms that for some reason are underestimated by the market. In the classic version of the strategy investors select companies whose shares are cheaper than their own assets. Suppose a plant has premises and equipment worth a million rubles, while shares are worth 900 thousand - the enterprise is underestimated.

In reality, this is a very difficult method. Need to understand 1. Technical versus Fundamental Forecasting / CMT Association

2. 2 schools of investing: Growth vs. value / Fidelity in fundamental analysis, financial ratios and balance sheets. And also imagine how to value intellectual assets. Let's say the social network Facebook has not only offices and servers, but also patents, a billion-dollar user base, and ad analysis technologies.

Another difficulty for an investor who finds an undervalued company is to understand why this happened. Perhaps due to a market error. Then the man stumbled upon a gold mine. But there is another option: the reporting of the company is below the expectations of analysts, or the company has nowhere else to grow in its market.

If a “value” investor still wants to try to find a suitable company, then first he also needs to understand the average values in the industry or in the broader market. Suppose an investor likes the same carmaker sector.

In addition to the two familiar indicators, P / E and P / S, it makes sense to study a couple more:

- P / B, price to book value. The ratio of the company's value on the stock exchange to its capital. It is good if the indicator is less than one. This means that in case of bankruptcy, the company will sell all its assets and be able to pay off the shareholders. The auto sector is doing badly, 2.39, even higher than the market average.

- D / E, debt-to-equity. Debt to equity ratio of the company. Automakers have 43 cents of borrowed money for every dollar they own, which is lower than the market.

With this data, the investor must go back to calculating suitable companies. However, these may not exist at all. For example, only one unknown company is suitable for the selected indicators and regions, and even that is not an automaker, but a serviceAbout US / Speedemissions Inc. to check the purity of the exhaust from cars.

Investing in projected income

Not everyone is ready to deal with trends, financial performance and reporting. For many, it is enough to choose stocks or bonds that will bring a stable income.

The simplest version of this strategy was calledDogs of the Dow stock picking strategy Dogs of the Dow. The point is to choose from index Dow Jones Industrial Average Highest 10 Stocks dividend profitability. The list should be rechecked and the portfolio rebalanced annually. For example, at the end of 2020, the set looks like this:

| Company | Price in USD | Dividend Yield |

| Chevron | 84,45 | 6,11% |

| IBM | 125,88 | 5,18% |

| Dow | 55,5 | 5,05% |

| Walgreens | 39,88 | 4,69% |

| Verizon | 58,75 | 4,27% |

| 3M | 174,79 | 3,36% |

| Cisco | 44,39 | 3,24% |

| Merck | 81,8 | 3,18% |

| Amgen | 229,92 | 3,06% |

| Coca-Cola | 54,84 | 2,99% |

Nothing prevents you from applying the same principle to other indices, stock exchanges and countries. For example, choose dividend stock or bonds with large coupons payments at the Moscow Exchange.

"Bought and Hold"

This is a general name for a whole group of strategies, which are also called "lazy portfolios". The point is that an investor buys securities and keeps them for years or even decades. Long-term returns will surpass short-term asset volatility and generate profits.

All-weather portfolio

American investor Ray Dalio came up withThe All Weather Story / Bridgewater Associates a strategy that must be stable to any economic disasters. You need to choose assets that behave differently during inflation and crisis.

| Asset class | Share in portfolio |

| Long-term treasury bonds | 40% |

| US stocks | 30% |

| Medium Term Treasury Bonds | 15% |

| Commodities and alternative assets | 7,5% |

| Gold | 7,5% |

You can't make a lot of money with such a set, but the strategy will save you from storms in the financial markets and will allow you to get profitability above inflation.

The portfolio has many variations. For example, there are Frank Armstrong III. Investment Strategies for the 21st Century, 1996 Risk-reward-adjusted ETF sets: for the S&P 500 index, long-term and short-term treasury bonds, small and large cap companies.

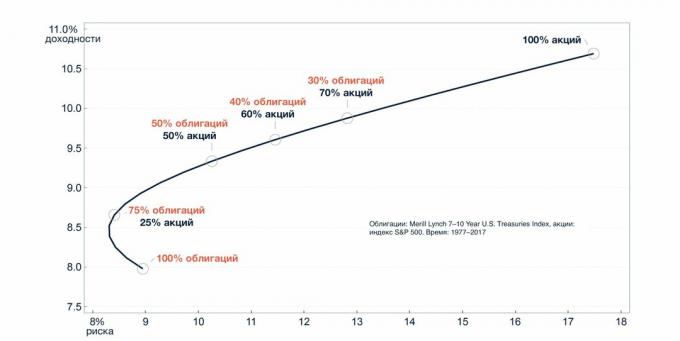

Modern portfolio theory

The idea is to findFrom the Studs Up: Building (and Rebuilding) a Portfolio with MPT / The Ticker Tape balance between the minimum level of market risk and maximum profitability. The strategy focuses on the proportions of different assets in an investment portfolio. For example, the best ratio is given by “75% of stocks, 25% of bonds”.

That is, if you add more conservative ones to a risky asset, you can lose a small part of profitability, but seriously reduce risks.

Tactical asset allocation

The approach that tries to connectTactical asset allocation: A proactive approach to portfolio management / RBC Wealth Management "All-weather" and "modern theory". The bottom line is to balance stocks, bonds and cash on the ratio of risk and return, and then check against stock indices.

The basis of the approach is analytical, as in “value” investing. It is necessary to assess the distribution of assets, and then carefully select specific instruments.

What is worth remembering

- Investment strategy - a plan for buying and selling investment assets in order to achieve financial goals.

- The choice of an investment strategy depends on personal circumstances: age, available money, risk tolerance, goals, time horizon.

- There are a lot of investment strategies. They are not only conservative and simple, but also extremely aggressive and difficult for a novice investor. There is no single and suitable approach for all.

- Nothing prevents an investor from combining different strategies. The main thing is to understand why this is being done.

- The investment strategy needs to be reassessed and rebuilt as goals, age and other circumstances change.

Read also💡📈

- 12 best free services and online courses to teach you how to invest

- 5 ways to save on broker commissions if you are a novice investor

- What are ESG investments and why they are important

- How to get an investment tax deduction

- Is it worth starting to invest during a pandemic and crisis

Scientists talk about dozens of COVID-19 symptoms that can persist for more than 6 months

Scientists have named the characteristic symptoms of the delta strain of coronavirus. They are different from the usual COVID-19