Investing on the stock exchange: Answers to Top 5 Questions

His Work / / December 26, 2019

We have a couple of times told a brokerage company and their service NETTRADER Tradernet.ru. Naturally, in the comments of many of our readers we wrote about the fact that all this divorce on money, not more.

Representatives NETTRADER lot of answered questions and objections, explained the principles of the brokerage firms and the differences between right and unscrupulous brokers, preying on the simple human desire to make money fast.

On the basis of these explanations, and other professional advice NETTRADER we compiled this article. We will respond to the concerns of users' questions and explain how to distinguish this from a rogue broker, and then another, and show what it looks like trading platform Tradernet.ru service and how to use it.

How is it going on sale on the stock exchange?

The first question that is sure to interest those who are thinking about trading on the stock exchange: Why do I need a broker? Why should I make transactions only through him? Is it possible to register directly on the stock exchange, to buy and sell shares as a private person?

Not. The law prohibits individuals independently make transactions on the exchange. Be sure to need a mediator - a legal entity with a license for brokerage activity. This can be a managing company, a bank or a brokerage firm.

The exchange function is to organize securities trading. In the process of buying and selling stocks is no big deal: you give the order to the broker by phone or trading platform - a program that is installed on the computer or running in the browser.

After receiving the order, the broker for the few seconds it takes to go public, and there are waiting for the transaction counterparty - an individual or a company that will sell you or buy your shares.

But to understand what stocks to buy and sell, you need to be able to navigate in the financial situation, and even have some flair. If you think that you can not yet plunged into the study of this question, but are willing to pay for those who already understands this, ask for help to the analysts: they make up the portfolio, and will help to give recommendations.

However, you can own and master the nuances of trading and traders to test their abilities, opening demo account. Everything is real, but at your disposal a million virtual money.

Of course, the sand - no matter replacement oats, as the Bill from the book "The leader of the Redskins." Even if your demo account swelled by unprecedented profits, it does not mean that you will be as successful in the real world. You will need to pay more commission to the broker, and profit tax. Furthermore, when you invest real money, the thrill of what is happening will be much sharper - you can skip the really good deal because I was scared, for example.

But thanks to the training trades you learn to navigate in the terminal, which is very important.

Do I need to economics, to learn how to trade shares on the stock exchange?

We will not loudly declare that actions can make anyone who has ever read, but special education is not required. At least degree you have to ask no one, and learn to understand the financial process you can own.

Before to get in the money system, it is necessary to practice on demo account, Read the articles, books, Watch webinars and training videos. We even have our own NETTRADER on YouTube channel. And every morning before the opening of the stock exchange the company's employees arrange a 15-minute webinar to discuss the economic situation.

You need to learn, to penetrate, to understand. Perhaps it will leave you more than one month. But if there is a profession that can be learned in a couple of days?

Exchange - it is not a casino where dornuv lever machine, you may suddenly lose all or, on the contrary, to get rich. Exchange - is a good way to invest money, plus a lot of the analytical work.

If you want to feel like The Wolf of Wall Street, first become at least a little to them, please be experience, knowledge and understanding of the internal processes of trade on the stock exchange, study risks. Then you will hardly be able to squander a million for a couple of days.

To start trading, you need a large start-up capital. As with their penny I can earn something?

The minimum deposit at NETTRADER - 3000 rubles. But this, of course, is not enough in order to buy shares deserve. For 3000, you will likely be able to buy back the lot of any one company. Such investments certainly bring a lot of nerves and a minimum income, because you need to diversify the portfolio - to buy shares of different companies. And yet, only you can decide how much you are willing to invest.

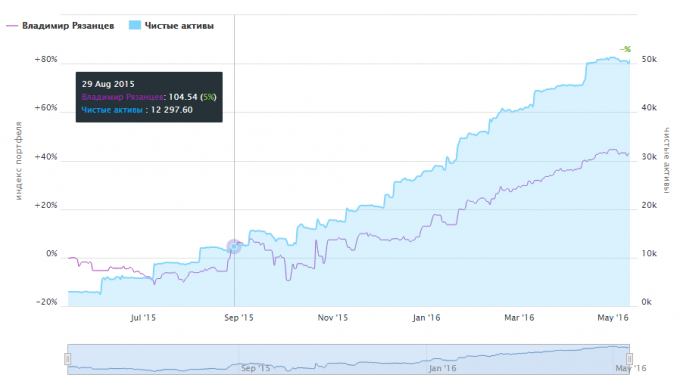

On this subject NETTRADER is an interesting case. Vladimir Ryazantsev, who is now 47 years old, decided to make their own savings for retirement and created a "personal pension fund" using NETTRADER.

What is interesting, it started just with a deposit of 3 000 rubles per month and now adds to the expense of 3000. If this money, he simply put off the card, but now he had amassed to 36,000 rubles. Bank deposit for the year would bring a very small profit. Now Vladimir counts nearly 54 000 rubles - quite respectable gain.

You can watch portfolio Vladimir Ryazantsev, read it blog, To communicate with him through Tradernet.ru messaging system.

on choosing the size of seed capital Council

Invest free money. This means that it is not necessary to invest the amount you have saved for treatment, moving, buying a car or something else you need in the near future, hoping to increase it twice and buy something better.

Insert the amount, without which you can do in the next 5 years. Account can be continually replenished. Therefore, even starting with a minimum deposit, as a result, you can bring it to this, which you can buy shares of solid companies and have been impressive gains.

How to choose a bona fide broker?

So, without a broker you do not get to the stock exchange. Consequently, the need to find a fair and acceptable to the Commission. But how do you know that the site can be trusted? Let's order.

1. Check the license

The activities of a broker must be regulated by law, which means that it should be of the license:

- license for brokerage activities;

- License for dealer activity;

- license for depository activity;

- license for activity on securities management.

Job brokers balances its Russian Service for Financial Markets, and it issues licenses. By the way, if you see in the FSFM license - it is also a real broker a license he received up to 2013 when they were given Federal Financial Markets Service (FFMS).

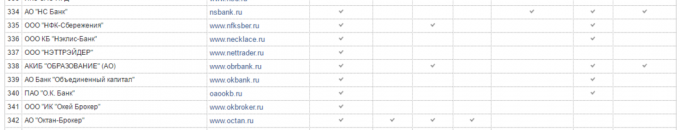

The group of companies includes NETTRADER Russian, Ukrainian and European brokers. Each of them has a license of its regulators.

2. They check whether the company has access to the stock exchange

There are so-called kitchen - middlemen who do not perform transactions on the Stock Exchange at the request of customers. In this case, the client creates a sense of reality. He sees online quotes, submits an application through the terminal, derives profits or bears the losses. Only here the values of quotes can be far of the real and the counterparty broker acts himself.

Thus psevdobrokeram beneficial to you suffered losses because all the profits, which is shown in the your personal account - it's only virtual money, as in the demo account, but in reality they are not exists. Kitchen brokers leave themselves customer's deposit. They are beneficial to people initially put into the account the amount of bigger and faster it squandered on non-existent and the failed transactions.

Truly beneficial to the broker that you remain by his client for many years and continue to make transactions. With them, he gets a commission (by the way, is very modest: a few tenths of a percent).

Yes, the broker will get a commission anyway: your trade is profitable or not. But if you spend all your money on the failed transaction, you leave. So, the broker actually useful your success.

So we check that the selected brokerage company admitted to trading. This can be done online Moscow Exchange and online TSB RF.

3. Get familiar with the commissions and additional payments

"So a lot of numbers that more study commissions and payment rules simply can not. Faster trade! Million itself will not work! "Op, and then you have caught by writing the fine print a lot of additional and hidden charges.

Attentively examine tariff plans, the commission fee for withdrawal. If you do not understand something, ask the company representative. You must be able to accurately calculate the cost of any transaction. Do not forget taxationTo yield a profit on the stock exchange Russian citizens pay 13%.

In NETTRADER several tariffs. You can choose a monthly subscription fee of 600 rubles, which includes commissions on transactions with shares and bonds on the Moscow stock exchange turnover up to 1.5 million rubles per calendar month.

You can pay 0.15% for each committed transaction with stocks and bonds. This is useful if you purchased securities and want to withhold them a couple of months.

What happens if the broker will close, go bankrupt or whatever might happen to him? I lost all the money invested?

The broker does not own shares of your money and it is only an intermediary between you and the stock exchange. Accordingly, if the broker will close (for example, it will be deprived of the license), you will translate their shares from the depositary at the expense of another broker.

Among NETTRADER customers money transferred to the calculated exchange organization: National Settlement Depository (NSD) or the bank "NCC". These organizations have the law forbids to make any of their own transactions in financial instruments, as well as lending operations and the allocation of funds.

The right to customers' securities are recorded in the depository company NETTRADER, and NetTrader a nominal expense holder in the National Settlement Depository, which takes into account the rights to admitted to trading securities customers. according to the law The depositary has no right to dispose of securities of customers.

If the broker loses license, it shall notify the customers about it for three days and to act according to their instructions: to return the money and to transfer the securities to the account of another broker.

We hope that this article will explain the nuances of the stock exchanges and brokerage firms. And if you still have questions, ask them in the comments: experts NETTRADER you to answer them. In the video below, we show how the trading platform online Tradernet.ru.