Kakebo: how to spend and save money in Japanese

Get Rich / / December 20, 2019

What is Kakebo

Word Kakebo - the three characters for the book home economy. The financial system with the same name invented Japanese Motoko Hani.

Kakebo system aimed at increasing savings and operates on the principle of "penny ruble protects." Postponing have small amounts but regularly.

What you need to Kakebo

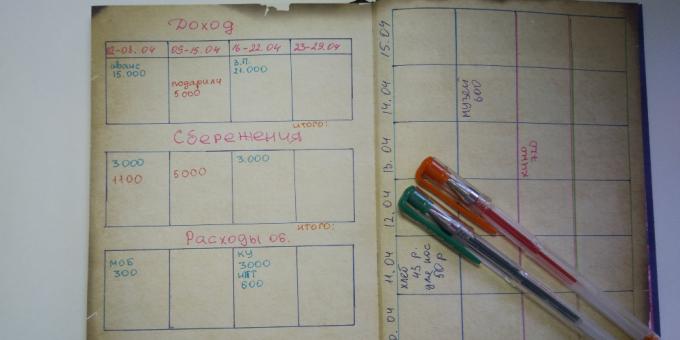

For the reference of the precepts of Motoko Hani budget you need two notebook - large and small. The more you record all income, expenses and savings plan. Little need to carry with you to capture all spending in real time and do not forget anything.

How to write

With a small notebook everything is clear: you simply make the appropriate entry each time to spend money in it. Large pad can raschertit as you are comfortable. As it should be reflected:

- revenue plan for the month. It can take the form of tablets or list. It is important that in it you can record all the income funds: advance payment, salary, debt, proceeds from the sale b / a laptop and so on. Earlier this month, make to the table income, in which you believe, then you can add entries to the handle of a different color, or, for example, in block letters.

- Savings plan for a month. On the following page, you specify how much money would be to put the piggy bank or a savings account. And with the amount you need to decide before you start to plan costs.

- A spending plan for the month. It made all the permanent expenses: utilities, rent for apartments, and internet.

Remaining after deduction of mandatory spending and saving money proposed to be divided into four categories:

- Living costs: products, household cleaning products, clothing, footwear.

- Culture and Education: education, training, museum tickets.

- Entertainment: meeting friends, going to the cinema, short trips.

- Other: all costs, do not fall into the first three categories.

To determine the proportions in which you will divide the money into four parts, to be you. If you plan on spending wisely, you can manage for a month can easily stay within the categories.

One records Kakebo system is not limited. At the end of each month, you will have to analyze whether you follow the plan, where you were able to save, where you have spent too much. This will help to more accurately budget for future months and see what expenses need to be adjusted.

How to save on system Kakebo

The system has more tricks to help you increase savings efficiently.

- Daily fold stays in your pocket change into a piggy bank. What today seems a handful of coins at the end of the month will be a weighty sum.

- Returned to submit debts to the treasury of the whole. In fact, it is not income, you simply returned the money, which were missing in the previous months.

- When the exchange of the major denominations small percentage of delay in the treasury. Enough 50-100 rubles, later they transform into larger amount.

- Develop a system of penalties for themselves. Punish yourself financially for bad habits or, for example, skipping a workout: delay of 100 rubles a piggy bank. Use in any case will be: either you get rich or become more disciplined.

- Money that are going to spend, divide by four weeks. All that remains of the seven-day budget, at the end of the week was transferred into savings.

- Non-urgent purchases put off for a month. If after 30 days you still want to buy something, do it. But you may find that it is not so necessary.

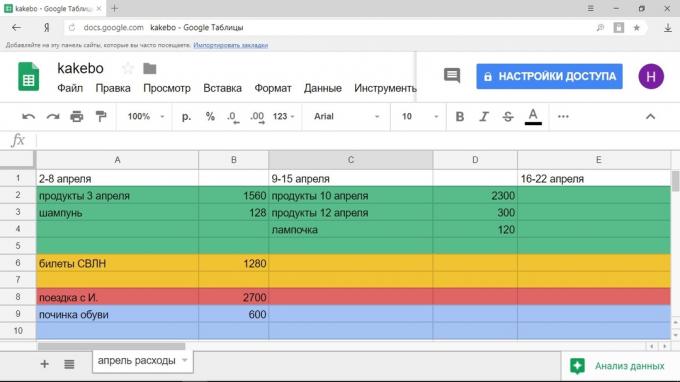

How to adapt to modern technology Kakebo

The system is tied to the two notebooks, but nothing prevents you to record the current expenses attachmentAnd instead of the main financial books to use the table in Excel.

Similarly, things and with the replacement of cash to a bank card. Instead of putting a trifle out of the pocket in the treasury, to translate part of the card means an additional expense to her left round sum. For example, with the balance of 42 350 rubles you scroll to the savings account 350 rubles.

see also

- 20 free courses that will be taught to understand the finances →

- 10 books that will become rich →

- 18 signs that you know how to handle money →