"The art of strategy. Lessons of Steve Jobs, Bill Gates and Steve Grove "- a book about how to achieve business goals

Books / / December 19, 2019

Play for high stakes, but do not put at stake the company

Strategy - the game is not for the faint of heart. Great strategists make non-obvious, difficult moves that sometimes seemed to contradict the logic and instincts - all in order to change the balance of competition in their favor. Big game requires high rates, whether major financial obligation or a desperate onslaught on all leaders in the industry at the same time. The amount of interest can scare not only competitors, but even partners and colleagues. But if the game is played skillfully, then profits can be fabulous.

In the early '80s, when Bill Gates decided to develop Windows and compete directly with IBM, he put his young campaign against the giant who actually created the whole computer industry. Gates won, and Microsoft eventually became the world's leading manufacturer of software. In 1985, when Andy Grove, Intel decided to change licensing policies and to make the company almost the only provider of a new generation of microarrays, he rewrote all the rules and laws of the industry. At the same time he - not surprisingly - was forced to invest billions of dollars in business. Costs will be repaid with interest: from a small private company Intel has become a true giant, a leader in its market. In 2009 Steve Jobs Macintosh risked the future of the series, going with a PowerPC processor on the Intel product, but the success of this venture gave new life and a Mac, and Apple's in general.

These examples show that a good strategist should be able to take a bold move, but it should not be put at stake his company. To keep the business afloat, Gates has postponed the gap with IBM as long as Microsoft's other projects have not started to generate sufficient funds. Grove reduce the risk of their bold move: broken investments into individual portions and phase. But Jobs is not unreasonable to choose the moment when the position of his company was consolidated and the risk was not so great.

The general formula seems to be this: Be of good cheer, but do not lose your head. "Dare", according to most dictionaries, means "to be fearless in the face of danger, show courage and determination." Many companies failed through the fault of a weak leader, unable or unwilling to make hard choices, to take responsibility. A true leader, on the other hand, is always ready to take the plunge, if you need to run your business or to breathe new life into it. The decisions of Gates, Grove and Jobs traced four principles that led them to success.

1. Play for high stakes, to change the rules.

2. Do not put your company on the line.

3. Be orderly self-forest.

4. Reduce losses.

Bob Dylan and Picasso and then played on the brink of a foul. Here for the Apple I - a game. No, I do not want to burn. <...> If I try very hard, but flunked the case - well, at least I try to be honest.

Steve Jobs, 1998

[…]

Choose the right time

In developing the Macintosh Jobs managed to avoid the extremes almost by accident and do not substitute the company at risk. But he obviously learned from this story is an important lesson for themselves. Fifteen years later he faced a difficult choice: move to Intel processors and are still holding on to PowerPC. Intel strongly suggested its technology Apple since Jobs has once again appeared on the scene. However, Jobs at first refused. In the late '90s Apple has so much depended on the revenue from the Macintosh, that any disruption in the sales company would have doomed to destruction. Sales of Macintosh computers and software bring more than 80% of the total income of the company. In addition, although the Intel and Apple were eager to attract to their side, but the deal did not offer too tempting. Jon Rubinstein even called them onerous from an economic point of view.

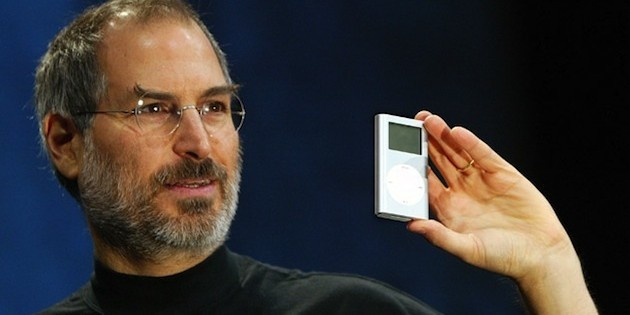

By June 2005, when Jobs at the Worldwide Developers Conference Apple announced the transition to Intel processors, the situation changed radically. In 2001 the iPod was launched, and in 2004 its sales got under way, which dramatically reduced the reliance on sales of Apple computers. Within two blocks of that same year, when Jobs finally decided to move to Intel chips, it has sold about 10 million iPod. It's not just Apple err in financial terms - Jobs are now even able to negotiate from a position of strength.

As noted in the summer one of the experts, "market triumph iPod train snagged and Mac sales. In short, it is difficult to imagine a more favorable moment for their bold move. " Over the last three months of 2005, It has sold 14 million players - three times more than in the previous Christmas quarter - and the company's revenue grew by 63% in one year. The popularity of iPod has protected the company from the consequences of a possible failure on the Mac line. In 2006, while Apple completes the transition to new processors, the iPod continues to provide revenue growth. By the time the company has received from the Macintosh sales less than 40% of total revenue. The rest gave music.

Fractions and distribute rates

If the financial vulnerability of Apple Steve Jobs forced to postpone the "big step" toward Intel and wait for the right moment, Microsoft since the mid 80's did not know the needs of funds. As a result, Bill Gates was able to play on a grand scale, without fear of bankruptcy. Nevertheless, he reduced the degree of risk for the company - and created an opportunity to further raise the stakes, - expanding and branching Microsoft activities.

At the dawn of his career, Gates has reduced the company's dependence on the operating system of production due to the development of applications - such as Word and Excel, - which gave Microsoft an alternative source of income. In addition, he saw to it that new applications were launched not only on computers running Windows or OS / 2, but also on the individual platforms of competitors - for example, the Macintosh. As acknowledged by John Shirley, Gates did not immediately saw the benefits of this strategy, but it was worth it to see the light - and he vigorously took up the matter: "Bill I did not think about the applications for the first IBM PC model, but then the market broke the Macintosh, and the ability to secure a new appeared territory. "

Creating applications - especially for foreign platforms - Microsoft, Gates has secured future. Even if Windows has lost the competition OS / 2, or Apple products, Microsoft still would remain a viable business. This strategy has also opened many doors for the company, while Windows was gaining momentum and gain market share. Although Gates believed that sooner or later, Windows replace OS \ 2, he could not know how long it will take. Speaking to the Boston Society of Cybernetics in 1993 and recalling its decision to take on Windows, it admitted: «Microsoft made quite a bold bet on the graphical interface. <...> But the fact that the graphical interface has become a mass product, it took much longer than I expected. " So, while waiting lasted, Gates tried not to make a complete break with IBM. Later, John Shirley said: "Gates did not burn the bridges behind them and in the extreme case was ready to re-write all Microsoft applications under OS / 2 - if IBM would like to be able to promote a product."

Stretch rates Time

Gates was difficult to predict how soon play his bet on Windows. Andy Grove, on the contrary, carefully and deliberately chose the moment to put on a single source strategy - so that it reduces the risk. In the long-term commitment to supply Intel microprocessors entire world demanded investments of tens of billions of dollars. However, initially the company has invested in the business microscopic fraction of that amount. When Intel was preparing to produce a series of processors 386, Grove ordered to build only one new plant. In the two years that have gone to the construction, the Intel expenses never exceeded the average indicators. In the previous ten years, the company is directed to the running costs of 15 to 20% of revenue. Within four years after the launch of the new chip running costs ranged from 13 to 16% of revenue. Intel's approach to the production and sales of a series of 386 different the same restraint and moderation. In 1988 series 386 brought less than half of the total revenues. In 1989 - four years after the start of production of 386 - 286 model overtook Sales 386 more than doubled. By 1992, when Grove has decided to expand its production and a sharp increase in investment, the transition to the role of sole supplier is no longer harbored any risk.

Of course, not all bets Grove were fortunate. You can recall the beginning of the 90's and Itanium project - jointly with Hewlett-Packard attempt to create a new 64-bit microprocessor. However, Itanium absorbed not so many resources to substitute a blow Intel and its main product lines.

Bitter lesson: Nokia puts on Windows

This story clearly shows how dangerous it is to do too high stakes. In 1999 Nokia was the most valuable company in Europe with a capital of 200 billion euros (about $ 250 billion). In the next decade, the company was the leader in the cell phone market. In 2010, three years after the emergence of iPhone, the share of Nokia is still accounted for 37% of the smartphone market. But bad decisions these ten years have made themselves felt. Nokia has failed to make its operating system Symbian worthy competitor to iOS and Android. In addition, the company left the US before America became the main market of smartphones in the world. In February 2011, when sales of Nokia and its stock price began to fall, Stephen Elop CEO of openly admitted: "We are behind, we missed new trends and lost time." Three days later, he said that Nokia gives its future in the hands of the former employer's - Microsoft. You could try to catch on Android phones or elaborate on several different platforms for greater reliability. Instead, Elop decided that he could pull the company linked its fate with Windows. In the next ten months, it became obvious that he had made a catastrophic mistake. phone sales on the Symbian platform collapsed, and phones with Windows and did not go - by 2013 They have won only 4% of the market. Thus, the sale fell, losses grew, and the company's market value since both Elop announced the decision, reduced by 90% - up to 4 billion euros (5.2 billion dollars). Desperate, Elop in September 2013 Microsoft sold the main business of the Nokia, mobile phones, for 5.4 billion euros ($ 7 billion).

"The art of strategy. Lessons of Steve Jobs, Bill Gates and Steve Grove, "David Joffe, Michael Cusumano

buy litres.ru