What are ESG investments and why they are important

Miscellaneous / / May 31, 2021

Everyone seems to think about ecology and social equality. And this brings benefits to private investors, and not only financial ones.

What is ESG investment

ESG investments are long-term investments in companies that protect the planet, improve the quality of life for people and are well managed.

In the Telegram channel “Life hacker»Only the best writing about technology, relationships, sports, cinema, finance and more. Subscribe!

In our Pinterest only the best texts about relationships, sports, cinema, health and much more. Subscribe!

To find such companies and invest in them easier, financiers and environmentalists have developed three factors that are abbreviated as ESG: ecology, social responsibility, corporate control. Different indicators are sewn inside each:

- Environmental. The company must not harm the planet: badly influence the climate, produce greenhouse gases, dump waste, destroy forests, deplete natural resources and use non-renewable energy sources like gasoline or diesel fuel.

- Social. The company must provide good working conditions, protect the health of employees, monitor occupational safety and gender equality, and build relationships with suppliers and consumers.

- Governance. The company must maintain a reasonable salary and management structure, conduct audits, develop a tax strategy, respect shareholder rights, and deal with internal security.

There are a lot of indicators, the specific set depends on the sector of the economy in which the business operates. For example, it is important for oil companies to consider environmental factors, while for banks it is important to consider corporate governance and customer relations.

Investors also prefer differentSocial Investment: Review of Foreign Practices strategyA Beginner's Guide to Responsible Infrastructure Investment ESG Investments:

- Thematic investments. Some people choose green companies for their investments. For example, some finance the construction of solar panels, while others finance wastewater treatment. It pays off: the cost of similar European companies has grown in 2007-2015Eurosif European SRI Study 2016 by 448%.

- Positive selection. Investors support companies that are the best in adhering to ESG principles in their industry. For example, solar power producer Sonnedix builtInfrastructure responsible investment strategies a power plant with such anti-storm standards that hurricanes damage no more than 0.5% of solar panels. Accordingly, the company loses less money in natural disasters than other manufacturers.

- Negative selection. Investors refuse to invest in specific companies or sectors that do not support ESG principles: in the producers of alcohol, tobacco, weapons or petroleum products. For example, although the Dakota Access Pipeline was built, its operator company was mired in lawsuits from tribes that were deprived of clean water. Investors in this firm lost some of their money, and an ESG investor would not even have invested in it.

- Direct participation. Some investors are beginning to actively influence the companies in which they have invested: they demand the adoption of resolutions and conduct voting on environmental and social issues; even change management for better governance.

Why you should consider ESG criteria in investing

Because you cannot ignore what you are interested inSustainable Signals: Individual Investor Interest Driven by Impact, Conviction and Choice. FROM. 4, column 1 half of the total US population and 70% millennials of this country.

| How many people in the US are interested in ESG investing? | How many millennials in the US are interested in ESG investing? | |

| 2015 year | 19% | 28% |

| 2017 year | 23% | 38% |

| 2019 year | 49% | 70% |

There are several more reasons why it is no longer possible to ignore ESG in financial strategies.

ESG companies rise in price because they are supported by large investors

Institutional investors - insurance companies, funds and banks - are promotingSustainable investing: fast-forwarding its evolution The ESG agenda is the most active: 91% of them develop ESG investment strategies. Such organizations take money from thousands of private investors, therefore run tens of billions of dollars. Thanks to institutional investors, the capital in responsible investments has stepped overESG factors in investing. FROM. 6 $ 30 trillion.

Only for 2020 and only in the United States did institutional investors investReport on US Sustainable and Impact Investing Trends 2020 $ 2.5 trillion in ESG assets.

Some investors set up ESG organizations like PRI, GSIA, GIIN, or IIGCC. The most active association is Climate Action 100+: it consists of more than 500 investors who manage 55 trillion dollars. They can push the stock of a firm up by the very act of investing.

The energy company NextEra, with their support, has grown by 443% in 10 years. This is because in 2011 it announced that it would generate electricity mainly from renewable sources: wind and sun.

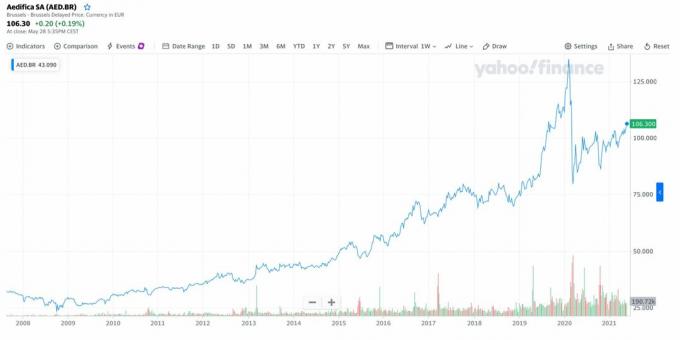

Another example is Aedifica, which invests in medical real estate for seniors in need of care. She suffered a little in 2008 crisis, but since then large investment funds have invested in the company and it has grown by 204%:

But the shares of oil companies BP and ExxonMobil over the same 10 years fell by 41% and 29%, respectively.

ESG companies receive aid and benefits from governments

States are developingPRI Consultations and letters 2021 laws and guidelines that force companies to disclose ESG performance information. Accordingly, it is easier for investors to make decisions:

- The European Union has adopted a classification of climate activities, a directive on sustainability reporting rules and a requirement to take ESG factors into account in financial advice.

- The UK is preparing disclosure requirements for climate-related financial information and guidelines for the publication of non-financial ESG information.

- The US is discussing guidelines to disclose information on environmental impact, gender equality, and the cost of political lobbying. Requirements are also being prepared to take ESG factors into account when assessing the risk and profitability of deposits.

- China encourages investors to take ESG factors into account and obliges companies to publish them in their reports.

- Russia createsThe concept of organizing a methodological system in Russia for the development of green financial instruments and responsible investment projects climate change adaptation plan for government agencies, the doctrine of environmental and energy security and the national project "Ecology", which requires the reduction of harmful emissions from enterprises.

States help and ESG companies themselves - exempt from taxes or reduce them. They also invest in research and development or subsidize products.

For example, the Chinese government is tryingElectric mobility after the crisis: Why an auto slowdown won’t hurt EV demand make electric vehicles from local manufacturers more affordable. Buyers are exempt from purchase tax and add up to 22,500 yuan (258,000 rubles). If an electric car, such as the Pocco Meimei, costs 29,800 yuan, then in fact you have to pay 7,300 yuan. It is also profitable for manufacturers, because sales are rising, and it is easier to compete with foreign models.

Incentives for investing in ESG projects giveGovernment Decree of April 30, 2019 No. 541 "On Approval of the Rules for the Granting of Subsidies from the Federal Budget to Russian Organizations for reimbursement of the cost of paying coupon on bonds issued as part of the implementation of investment projects to introduce the best available technologies " and in Russia. For example, for "green bonds" - securities, with the help of which they attract money for projects that help to improve the environment or minimize harm to nature. If the company places such bonds, then it will not have to pay interest out of its own pocket: the state will reimburse the coupon income to investors. And the investors themselves can make money on the price of bonds:

Investors may refuse to work with green companies

Large investment funds are already forcing companies to behave ethically:

- New York State's Three Largest Retirement Funds DroppingMayor de Blasio, Comptroller Stringer, and Trustees Announce Estimated $ 4 Billion Divestment from Fossil Fuels from $ 4 billion in investments in oil and gas companies: they gradually sell shares of these companies and transfer money to greener companies.

- Investment Bank Goldman Sachs refusedEnvironmental Policy Framework invest in the development of oil and gas fields in the Arctic.

- Purdue Farma Pharmaceutical Investor Group Goes BankruptWith $ 2,300 Phone Calls, Purdue Runs Up Huge Bankruptcy Tab her: They filed a $ 400 million claim over an opioid drug scandal.

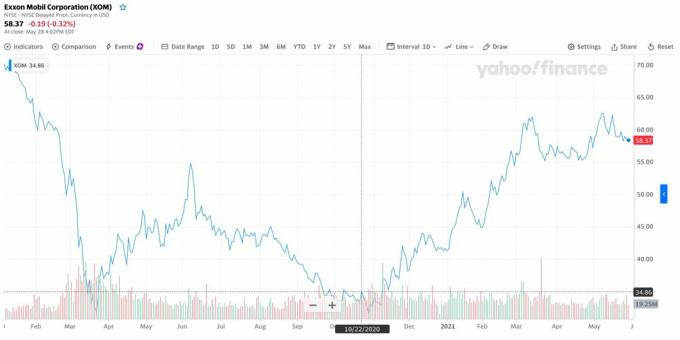

- Investors threatened to sell their shares and change directors if the oil company Exxon Mobil did not cut emissions. The corporation promisedExxon Mobil, under pressure on climate, aims to cut emissions intensity by 2025 cut them in half. After the announcement, its shares climbed 46% in five months:

Investors love caring for the world

This is a simple argument: it's nice to make money on what is good for the planet and humanity.

As noted in the articleNobility Market: Who Needs Highly Moral Investments and Why RBC, over the past century, people have begun to live better and have coped with global problems.

Dmitry Alexandrov

Investment Director of the Investment Company "Univer Capital".

This allows millennials to pay attention to fundamental values related to quality of life, even when making investment decisions.

How to rate companies by ESG

Investors study a variety of sources and then put it all together. This is where the professionals look forSustainable Investment Survey 2020. FROM. 20 information on potential ESG investments:

| Webinars and / or conferences | 64% |

| Marketing presentations and / or case studies | 54% |

| Organizations that research sustainable development | 53% |

| Media: TV, newspapers or podcasts | 42% |

| Own research | 40% |

| Investment organizations | 23% |

| Invited consultants | 20% |

| Regulators | 11% |

| "We are not looking for" | 6% |

| Other | 2% |

The average investor can appreciateWhat a Difference an ESG Ratings Provider Makes ESG company in three ways:

- Fundamental. Collect hundreds of ESG metrics that are published by firms or data providers like Bloomberg or Refinitiv. Then develop your own methodology by which to buy assets.

- Specialized. Examine company estimates for specific ESG factors: carbon metrics (greenhouse gas emissions, energy consumption and compensation), corporate governance or enforcement of rights person. Such data is published, for example, TruCost, Equileap or Carbon Disclosure Project. The method is suitable for investors who do not want to support ethics in general with their money, but to solve a narrow problem.

- Comprehensive. Use ESG ratings provided by financial companies. It combines objective and subjective data: public metrics and assessments by experts and analysts.

Almost all major investment and analytical companies make up ESG ratings: MSCI, TruValue, Vigeo eiris and Sustainanalytics. Not every business in the world goes there, but you can find famous or large ones.

For example, electric vehicle manufacturer Tesla has above average scores. The company is distinguished by corporate governance and sustainable production capabilities: the potential for the development of green technologies and the percentage of income that the company receives from them. At the same time, Tesla is failing product safety and HR management, sayMSCI ESG Ratings Corporate Search Tool rating compilers.

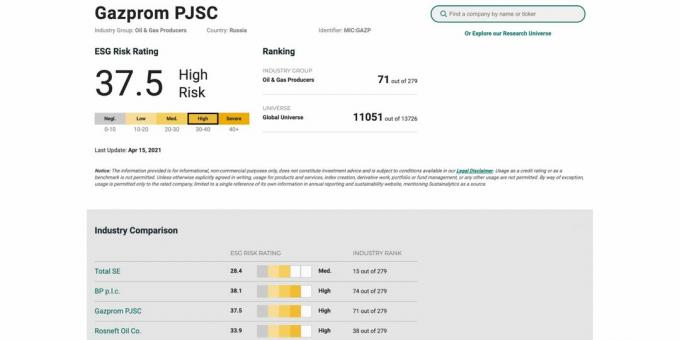

Resource firms have low indicators. Thus, Gazprom was recognized as the middle peasant in terms of ESG factors among oil and gas companies, and among all corporations it was in the last quarter of the rating. But they admitSustainanalytics Company ESG Risk Ratings list authors, management works well with ESG:

It is better to look for small companies in local analytical sources. For example, the energy company Enel Russia is assessed by the RAEX agency, which has compiled ESG ratings of Russian companies.ESG-ranking of Russian companies and regionsESG rating of Russian regions:

What is the difficulty with evaluating companies according to ESG

Investors have not yet agreed on what to count ESG and how to evaluate it. And the states have not decided who and for what to give benefits.

There is no universally accepted definition of ESG

The definition of ESG investing at the beginning of this article is just one version. In addition to it, there are several other ways to describe ESG, and everything is about the same factors: ethics, sustainability and social responsibility.

The problem is that ESG criteria, even if they are clear and measurable, can be applied to almost any company. Let's say the social network Facebook has a lowMSCI ESG Ratings, Facebook, $ FB ESG rating: although there is no negative impact on nature, corporate strategy and poor data privacy are pulling the social network down.

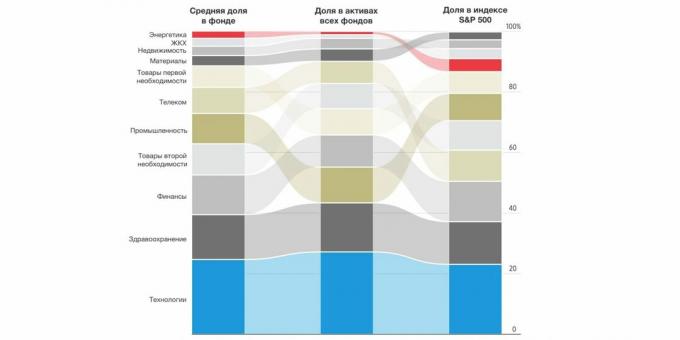

Therefore, the share of different sectors in ESG funds is practicallyESG Funds Mostly Track the Market the same as on the regular stock market. For example, the preponderance of technology companies and a small share of energy - although it was green energy that pushed the development of ESG:

ESG assessment methodologies vary widely

There are more than 600 ways in the worldESG data: Dazed and confused evaluate the company by ESG, and everyone will show their own result. Investors are discussing that it is time to create a common system, like accounting standards. Some finance companies are already writingCFA forges ahead with ESG standard despite criticism drafts of such a system, but it is still far from large-scale implementation.

Another consequence is that rating companies have different ESG criteria: some take into account emissions from production in the moment, others - in dynamics; highly qualified employees are important for one, the absence of discrimination at work is important for the second.

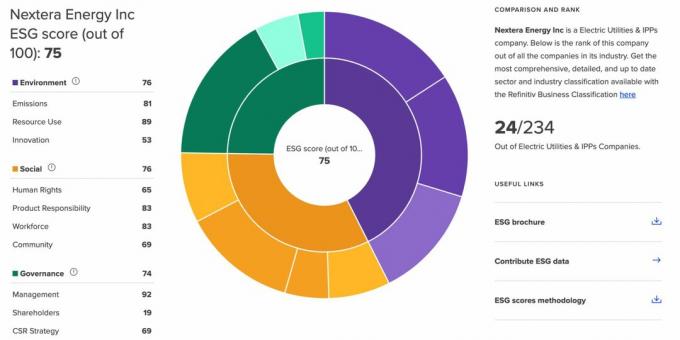

As a result, it turns out that the estimates of the same company differ. Electricity producer NextEra ranked as industry leader by MSCIMSCI ESG Ratings:

But this same company is a strong middle peasant from another agency, RefinitivRefinitiv ESG company scores:

Economists at the Massachusetts Institute of Technology also seeAggregate Confusion: The Divergence of ESG Ratings scatter of ratings. They note that this is a significant barrier to investing wisely in “responsible” firms. There is even a list of 25 companies with the largest scatter of ratings from major rating agencies:

The profitability of ESG companies is calculated in different ways

The benefits of investing in ESG companies also depend on who, how and why counts. It turns out that responsible investments are both profitable and unprofitable.

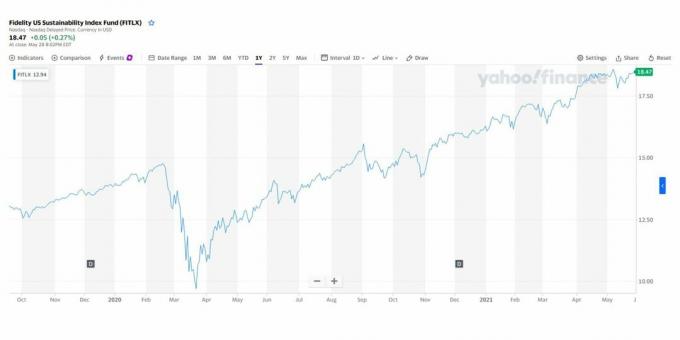

For example, Fidelity's ESG index fund grew 33% in 2020. For comparison, the regular S&P Global 1200 Index climbed 23% over the same time period:

ESG companies are also betterOutrunning a crisis: Sustainability and market outperformance. FROM. 3 showed themselves during the big fall of the markets in early 2020. Rating agencies give companies "ESG-points", where A - the highest category, E - the lowest. Here's how many firms of different categories lost between February 19 and March 26 (compared to the US market S&P 500 index):

| ESG rating | Profitability |

| A | −23,1% |

| B | −25,7% |

| S&P 500 | −26,9% |

| C | −27,7% |

| D | −30,7% |

| E | −34,3% |

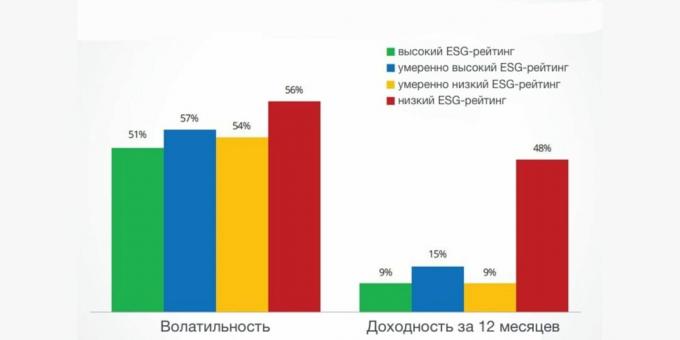

Other studies, on the contrary, show lower profitability of ESG companies in comparison with the market. Thus, the financial and analytical group Factor Research estimatedESG data: Dazed and confused 790 US firms with ESG ratings. It turned out that ESG companies are less volatile (the price deviates less from the average) than traditional companies, but they are also less profitable:

The third group of studies confirms that the returns on ESG indices differ littleU.S. Savings Rate Spikes from conventional stock indices. Both are indicators that track the price of a certain group of securities. The Daily Shot service compared them with each other: the difference turned out to be small.

| Return of the ESG-index for 5 years | Return of the regular index over 5 years |

| FTSE 4GOOD All-World Index: 97,8% | FTSE All-World Index: 95,8% |

| MSCI World ESG Universal Index: 57,4% | MSCI World Index: 55,4% |

| Dow Jones Sustainability World Index: 78,9% | Dow Jones Composite Average: 84,2% |

How to invest in ESG companies

ESG investing is a difficult task, you need to consider the pros and cons. But if it is important to you care about the planet and the people who live on it, then here's how you can invest in ESG companies.

Buy a stake in an ESG fund

The easiest way is to buy a share in the foundation, which has already selected assets according to ESG criteria. The choice depends on which stock markets are available to the investor:

- US exchanges. They are traded on140 Socially Responsible ETFs 140 socially responsible ETFs with different returns, asset mix and size. The largest is the iShares ESG Aware MSCI USA ETF, with $ 15 billion in assets. Over the year, it grew by 47%.

- St. Petersburg Stock Exchange. Through it, you can buy about 80 foreign funds, including ESG. The condition is to be a qualified investor, which not everyone can afford. This is a special status that requires assets worth six million rubles or a special financial certificate.

- Moscow Exchange. Two funds from Russian companies are available to ordinary investors: SBRI (450 million rubles under management) and ESGR (148 million rubles under management).

It is useful to see exactly which shares the fund bought: it so happens that this is a set of pharmaceutical or technology companies that only formally meet the ESG criteria.

Buy ESG shares or bonds yourself

Russian investors can buy shares of most companies through their broker. Before purchasing, it is worth studying:

- Ratings. It is better to look through several and calculate for yourself the average rating of the company that interests you. The largest providers of free ratings: MSCI, Sustainanalytics, Refinitiv and RAEX.

- Indices. They show how ESG companies have evolved over time: S&P Global, Bloomberg, FTSE Russell. Main indices for Russian companies - "Responsibility and openness" and "Vector of sustainable development" from the Russian Union of Industrialists and Entrepreneurs.

Green bonds are essentially the same as conventional bonds. The difference is that investments are spent on financing environmental projects: reducing greenhouse gas emissions, purchasing electric vehicles or recycling waste. Here's where to get them:

- The Moscow Exchange has sector, where one and a half dozen "green" and "social" bonds are traded.

- On foreign exchanges, there is a choice of bonds from individual companies or funds, for example Xtrackers J.P. Morgan ESG USD High Yield Corporate Bond ETF

Give capital to trust

Trust management is an agreement under which an investor transfers capital to a bank or a financial company, they invest it, and the profit is divided.

This strategy is suitable for investors who are ready to invest several hundred thousand rubles, they do not accept less. It is better to check the specific conditions and characteristics of investments with banks and management companies - everything is very different.

What to remember

- ESG investing is when you invest in the securities of companies that are trying to preserve nature or help society.

- ESG stands for enivornmental, social, governance, which translates as ecology, social development and corporate governance. These are groups of special criteria that are used to evaluate a business. Each indicator contains dozens of metrics. For example, “ecology” includes climate change, greenhouse gas emissions and industrial waste.

- Responsible Investing is supported by 90% of large investors. They invested $ 17 trillion in ESG companies worldwide for 2020.

- Investors evaluate companies by ESG in three main ways: they study special ratings, indices and analyst reports.

- Responsible investment is still evolving, so no one is sure how to properly award and weigh ESG factors. Uniform standards for investors and companies are just being developed.

- The easiest way to invest in an ESG company is to buy a share in an exchange-traded fund or a share of a particular company.

Read also💰📈📊

- 5 ways to save on broker commissions if you are a novice investor

- What are Eurobonds and is it worth investing in them

- What are futures and why are they bad for investing?

- What is the derivatives market and is it worth trading on it for a novice investor

- What is volatility and how not to lose money because of it