What you need to know before making a deposit in the bank

Miscellaneous / / May 10, 2021

Sometimes there is no point in chasing a high percentage, and it all depends on your goals.

How does bank deposit work

In its most general form, the mechanism is as follows: the client gives the money for storage to the bank. He puts these funds into circulation and makes money on them. And as a reward for the fact that the depositor temporarily provided funds, he is paid interest.

The money received from the placement of the deposit is officiallyFederal Law dated 01.04.2020 No. 102-FZ are considered income. If it exceeds a certain amount, from it have to pay personal income tax.

It should be understood that bank deposits can be called a tool for making money only at a stretch. According to the Central Bank, average rates fluctuateInformation on deposits (deposits) of individuals and non-financial organizations in rubles, US dollars and euros as a whole for the Russian Federation in the range from 2.35% to 4.26%. Inflation in March 2021 is estimatedKey indicators at 5.8%.

Therefore, the deposit is more suitable for those who want to keep money in a simple, familiar and relatively safe way and at the same time slow down the process of their depreciation due to inflation. And then pick them up in the same simple way and almost at any time. For those looking to multiply capital, it is better to consider other investment options, such as stocks and bonds.

Explore all the possibilities💰

- How to choose dividend stocks

- What is IIS and how to make money on it

- What are bonds and how to make money on them

How to choose a suitable deposit

Before deciding on the specific conditions and the bank where you will take your money, you need to figure out which deposit suits you best.

Now many banks offer clients to open a savings account. Formally, this is not a contribution, but often information about such products is located in the same section as information about contributions. Savings accounts can be used to generate small income. Consider them when deciding which deposit to open for you.

The contributions themselves may differ in several ways.

Term

Deposits are term and indefinite. In the first case, you give money for a certain period: six months, a year, three, and so on. Usually, interest on time deposits (also called deposits) is higherInformation on deposits (deposits) of individuals and non-financial organizations in rubles, US dollars and euros as a whole for the Russian Federationthan for indefinite ones. This is how the bank rewards you for your willingness not to withdraw money during the period for which you have entered into contract.

Naturally, the money will be returned to you at any time, as soon as you demand it. But if you do it ahead of schedule, then you will not receive interest on the term deposit.

Sometimes a preferential termination of the contract is possible. In this case, you will be given interest, but not all.

Perpetual deposits are also called "on demand". The rates for them are lower, but there are no restrictions on when you can withdraw money. The same applies to savings accounts.

What's better

It seems to be more profitable to choose the option with a higher interest rate. But that doesn't always work. For example, if you need money at any unexpected moment, you risk losing all interest. But if you are definitely ready to wait for the months or years offered by the bank, the deposit is your choice.

Interest accrual

There are accounts with and without interest capitalization. Capitalization means that every time you are charged interest - once a month or quarter, it is added to the money on the deposit. And in the future, interest is charged on the new amount.

For example, you put 50 thousand rubles in the bank for a year at a rate of 5%. Without capitalization, you will take 52.5 thousand in 12 months, with capitalization - 52 558.09. This is achieved thanks to the following process: for the first month you will be charged 205.48 rubles, which is 5% per annum of 50 thousand, for the second month - already 213.20 rubles, this is 5% of 50 205.48, which were formed in your account thanks to the previous accruals. The amount grows every month, as does the benefit.

Naturally, with more impressive amounts and higher percentages, the difference will be more obvious.

What's better

A capitalized investment is always more profitable. In savings accounts, interest is usually charged every month on the minimum account balance. This is the smallest amount that was there in the last 30 days. That is, such accounts are capitalized.

Replenishment

There are deposits that can be replenished with money and which cannot. From the point of view of increasing savings, the first option is more profitable. If you add funds to the account, the same process occurs as with capitalization - the amount on which interest is calculated becomes larger.

What's better

Usually banks offer a higher percentage on deposits that cannot be replenished at all or can be, but under rather strict conditions. Suppose, only on the 15th day and not in the first and last two months of the deposit's existence. And it seems that it is more profitable to choose a product with more flexible conditions, albeit with a lower percentage.

But here it is worth sitting down with a calculator and calculating different options for your specific situation. For example, if you are not sure that you will have free money, it is better to choose strict conditions and a favorable interest. And additional income can always be added to a savings account or a demand deposit. This way you will not lose anything.

Partial withdrawal

Some deposits are periodically allowed to withdraw small amounts, as well as from savings accounts. But this bonus can come in a package with a lower interest rate.

What's better

Depends on whether you need money from the deposit in the near future. If so, this option will not be superfluous.

Currency

Deposits are often opened in rubles, dollars or euros. However, if you search properly, you can find offers in exotic currencies.

Interest rates on foreign currency deposits are several times lowerInformation on deposits (deposits) of individuals and non-financial organizations in rubles, US dollars and euros as a whole for the Russian Federationthan in rubles. So it is not worth counting on a large income from interest. Nevertheless, this is still one of the good ways to keep savings in foreign currency, and not under the pillow.

What's better

It depends on what your goals are. If you save up for a purchase in rubles and intend to make it in the near future, the ruble contribution will be optimal. Long-term, your preference is the key.

Find out more💵

- In what currency is it better to store savings

How to choose a deposit

The approach depends on what you like best. Perhaps you are a longtime client of a particular bank and do not want to "cheat" on him with competitors. Then it is logical to choose from his products the one that meets your criteria better than the rest.

And if you are ready to consider different options, you can go to the sites of banks you know and study offers there or use an aggregator.

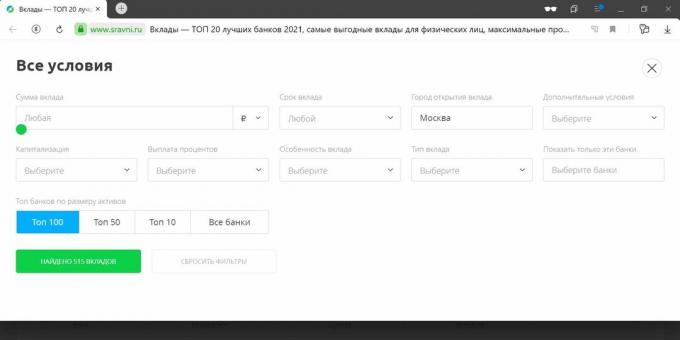

Compare.ru

Here you can choose a deposit or a savings account (such products are also taken into account when selecting), indicating the parameters that are important for you.

Select deposit →

Banks.ru

A similar service that helps to select a deposit.

Select deposit →

How to choose a bank

Sometimes the best deals are found in small or little-known banks. And here the question arises, how to check if this or that financial institution is right for you.

You can, of course, refer to the ratings of banks of the same aggregators "Compare.ru" or "Banks.ru", view reports and financial indicators. But sometimes banks, from which no one expected this, are deprived of licenses, and small institutions, on the contrary, do not always turn out to be unreliable.

Therefore, you need to pay attention to all available indicators. Several of them are especially important.

Deposit insurance

The first thing you should do when choosing a bank is to findCER participants him in the list of participants in the deposit insurance system on the website of the relevant agency. And if the bank is not there, then you definitely do not need to contact him.

The idea of insurance is that if something happens to the institution, the depositors will be refunded their money. True, this concernsFederal Law of 23.12.2003 N 177-FZ only amounts up to 1.4 million. If your accumulation more, it makes sense to distribute them to different banks or to pay close attention to the analytics of their stability in order to choose the most reliable one.

Disturbing news

Although deposits are insured, when something happens to the bank, it makes you nervous. So before carrying money, it is better to see what they write about the bank. If the media and especially specialized media report on disturbing processes inside and around the institution as a whole, there is a spirit of decline, choose another bank so as not to worry once again.

Too lucrative offers

An important investment rule is that the higher the profitability, the higher the risks. If someone promises mountains of gold, perhaps he has problems and is trying with all his might to attract new customers by any means.

Moreover, the bank will not necessarily disappear soon. A scenario is also possible, as in a financial pyramid: the first investors will have time to get their money, and the rest will not. But you are definitely better off not getting involved in such schemes.

Read also🧐

- 9 easy ways to save money without stress

- 13 habits that keep you from getting richer

- Where is it profitable to invest money, even if there are very few of them?

A photo of New York with a resolution of 120,000 megapixels has been published. Can you find a naked person on it?

Eldorado and M.Video sell MacBook Air with M1 and 16 GB of RAM at a discount of 8,280 rubles

Citylink sells Leatherman and Victorinox multitools. Selected 10 lucrative offers