How to properly close a mortgage and remove encumbrances from an apartment

Right / / January 06, 2021

What to do if the mortgage is paid off

1. Get a certificate from the bank that the loan is closed

Let the institution's mobile app show zeros, and the manager frowns at requests for a document. You definitely need a certificate confirming that the bank no longer has financial claims against you. It comes in handy in case of system failure, human error, and other problems.

For example, it may turn out that an unpaid kopeck is stuck in the system, which in a year can turn into thousands of debt due to the alleged delay in payments. If you have a certificate with stamps and signatures in store for such a case, it will be much easier to resolve the issue.

2. Remove encumbrance

That is, in fact, to get the right to completely dispose of the apartment.

Reading now🔥

- How we paid off an eight-year mortgage in a year and two months, using Lifehacker's advice

What is encumbrance

Mortgage assumes that you are taking a large amount of money from the bank. And to make him calmer, you do it on the security of real estate. Most often, we are talking about exactly the apartment that you buy with a mortgage, but it can be another object.

The mortgaged property cannot be sold, donated or otherwise sold by the recipient of the loan. To achieve this for sure, an encumbrance is imposed on the housing, and this is recorded by the Rosreestr when registering the transaction. From now on, and until you pay off the debt, the extract from the Unified State Register of Real Estate will indicate that the property is pledged.

Encumbrances are also imposed on other reasons, for example, when property is seized for debts. But we will analyze specifically the credit option.

To become a full-fledged owner of an apartment and get the right to it dispose of at your own discretion, you must remove the encumbrance.

How to remove an encumbrance from an apartment

This will be done by Rosreestr after you send the necessary documents there. Some credit institutions take on this function - check this specifically with yours. For example, Sberbank assuresRemoval of encumbrancethat the process will begin within two days, and after 30 days the encumbrance will be removed. And everything starts automatically.

Personal experience suggests that the term can be extended two or more times, even if you constantly remind yourself of yourself. Moreover, you will receive extremely contradictory information from employees. For example, one will write that the mortgage was lost, the other - that nothing of the kind happened (all chat correspondence is saved).

On the other hand, meeting deadlines can be a problem only if you urgently need sell an apartment. Otherwise, you can wait and periodically correspond with the bank. Sooner or later, the encumbrance will be removed without any effort on your part.

If the institution does not do this, or you certainly want to act yourself, you can transfer the documents to Rosreestr as follows.

- Through a multifunctional center. It is better to make an appointment in advance so as not to sit in line. Keep in mind: if you submit documents through the MFC, you will have to go there a second time to pick up what you have passed. How you will be notified of the receipt of papers - find out on the spot.

- In electronic form on website Rosreestr. You will need a qualified electronic signature.

- By mail. The shipment must be with a declared value, a list of attachments of documents and a return receipt.

What documents are needed to remove the encumbrance from the apartment

Rosreestr itself advisesAnswers to important questions have the following documents with you:

- Borrower's passport.

- Borrower's application for the removal of encumbrance (template). If you submit documents through the MFC, an employee will help fill it out.

- A mortgage from the bank with a note from the representative of the institution that the debt has been fully repaid. A loan agreement is usually attached to it, as well as a notarized power of attorney, which allows an employee of the institution to sign documents on behalf of the bank.

If the mortgage is lost, the bank can request it from Rosreestr or re-register it on its own. Another option is to submit a joint application from you as the mortgagor and the bank as the mortgagee and accompany it with an account statement. The same is done if there was no mortgage at all or it was electronic.

How much will the encumbrance be removed from the apartment

Rosreestr has three working days for this from the date of receipt of the documents. When registering through the MFC, you need to add two more days to the deadline - for the transportation of documents from the receiving point to the processing point.

How to check that the encumbrance has been removed

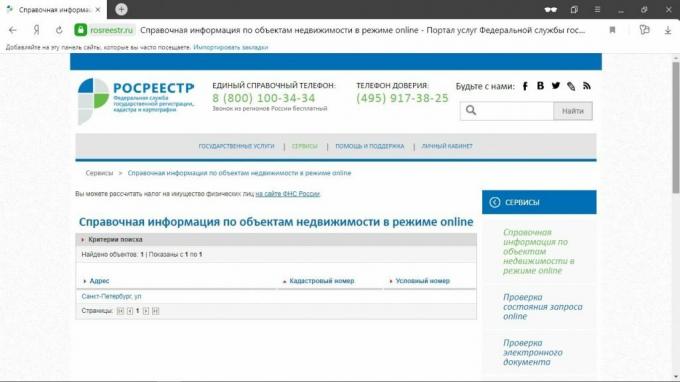

On the Rosreestr reference service page

Find on the home page site Rosreestr section "Reference information on real estate objects online".

Enter in the form that appears, either the cadastral number, or conditional, or address, or number of the right.

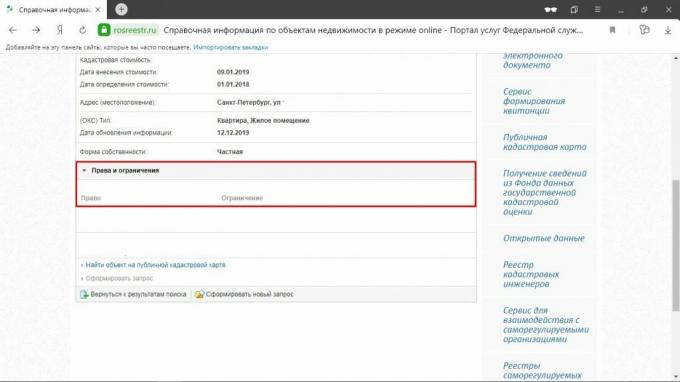

You will receive the result instantly. The "Restrictions" column should be empty. The column "Rights" usually contains the cadastral number and the date of registration of the transfer of ownership. They are smeared in the screenshot, so don't be alarmed if you have data there.

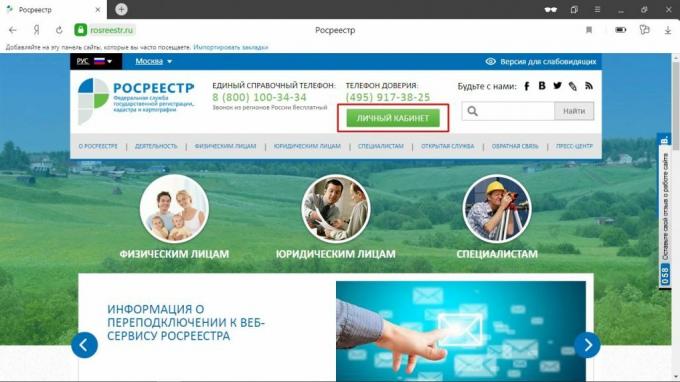

In the personal account of Rosreestr

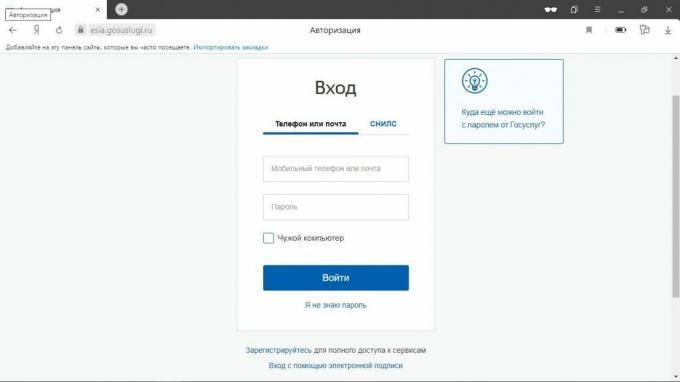

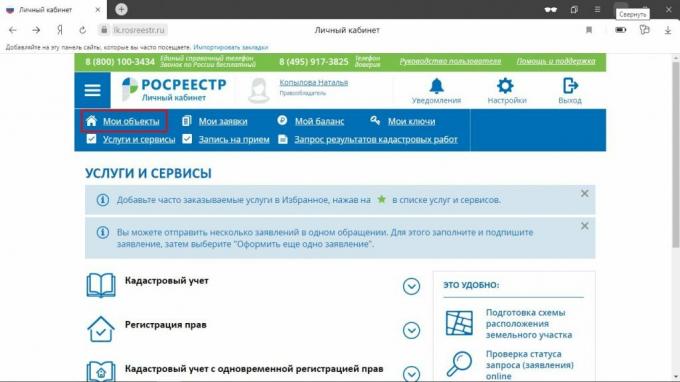

Go to your personal account from the main page. You can log in using your login and password from "Public services». Then click the "My Objects" button.

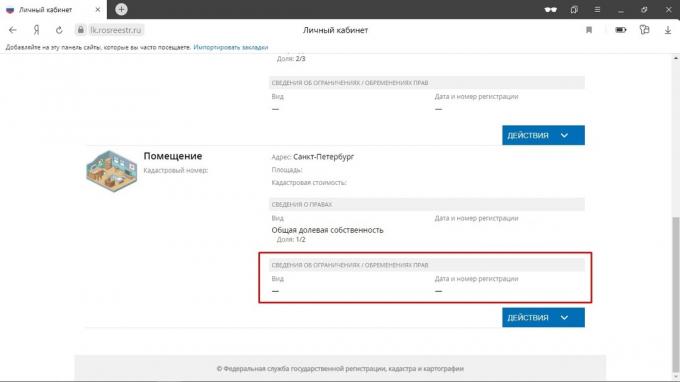

You will be given information about the property registered to you. Find the object you want. There should be dashes in the section "Information about restrictions / encumbrances of rights".

Using an extract from the USRN

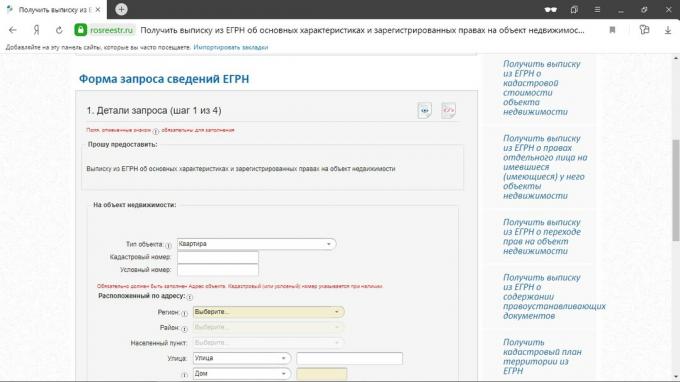

An extract from the USRN on the main characteristics and registered rights to the property is issued for money. For the electronic version you will haveObtaining information from the Unified State Register of Real Estate pay 290 rubles, it can be obtained through the Rosreestr website.

Select the service "Obtaining information from the USRN" on the main page.

Fill in the details of the object. It is imperative to register the address of the apartment.

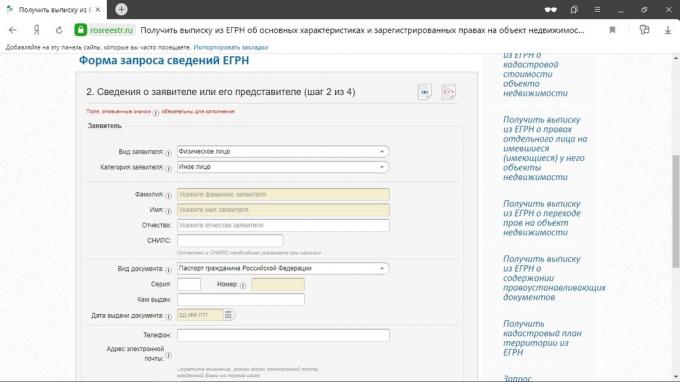

Enter information about yourself. Please make sure the email address is correct. All further instructions will be sent to you.

Submit your application and wait. After a while, you will receive a letter in your mail with a proposal to pay for the certificate. This can be done through the services of Mobi. Money ”(portal of payment for public services),“ Transcapitalbank ”,“ Gazprombank ”and“ QIWI Bank ”.

The term for obtaining an extract from the moment of filing an application isTerms of receipt three days. In practice, the process can be delayed.

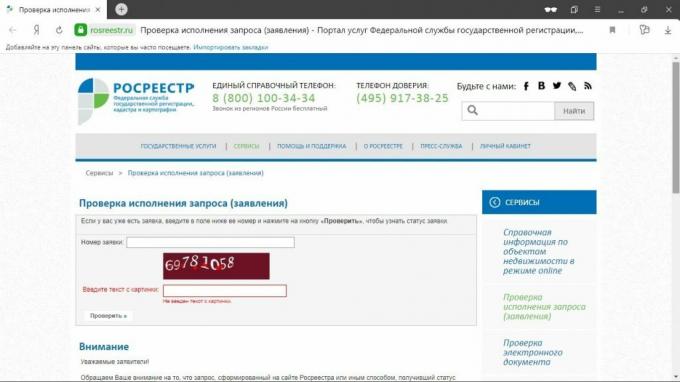

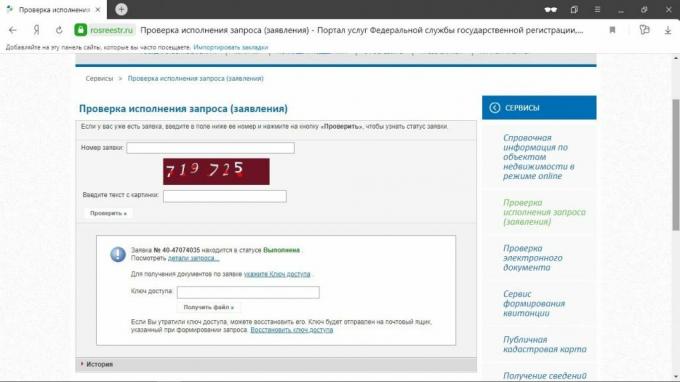

As a result, you will receive an email with a link and a key. Accordingly, you need to follow the link and first enter the captcha, and then the key.

Then the archive will be downloaded automatically or upon clicking on the link. It will contain files with XML and SIG extensions. They need to be downloaded on a special page on the Rosreestr website, and you will finally get access to the document.

If the encumbrance is removed, the corresponding lines will indicate “Not registered”.

Read also🏠

- How to pay off a mortgage ahead of schedule: reduce the term or payment

- 7 bonuses from the state to help pay off your mortgage

- Rent an apartment or take a mortgage: which is more profitable