What is the patent taxation system and who benefits from it

His Work Educational Program / / January 05, 2021

What is the patent tax system

This is a special tax regime for individual entrepreneurs. It allows you to pay a fixed amount for the year and get exemption from other taxes (but not insurance premiums).

Who is the patent tax system suitable for?

Entrepreneurs who are engaged in certainRF Tax Code Article 346.43 activities. The list is rather large and contains items mainly related to services and retail, for example:

- Computer Repair;

- production of bakery and confectionery;

- slaughter, transportation, distillation and grazing;

- repair of jewelry and bijouterie;

- looking after children and the sick.

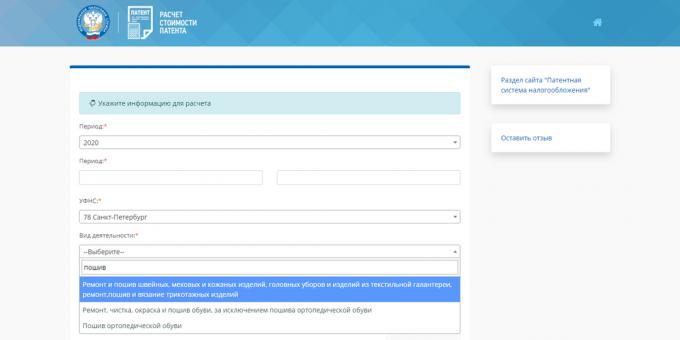

The regions can independently expand this list, so it is better to double-check if you can switch to this tax regime in a special service FTS.

There are other restrictions as well. An individual entrepreneur loses the right to the patent taxation system (PSN) if his annual income exceeds 60 million or he hires more than 15 employees under labor contracts and agreements civil law.

In general, it should be understood that the regional authorities have the authority to change the terms of the patent taxation system. In addition, there are additional requirements for some activities. So in any incomprehensible situation, it is better to consult with an experienced lawyer or accountant.

How to switch to a patent tax system

You must submit an application to the Federal Tax Service no later than 10RF Tax Code Article 346.46 days before the start of the use of PSN. You should contact the tax office at the place where the entrepreneur plans to do business. This can be done in person, through a representative, by letter with a list of attachments or in electronic form.

The answer must be given within five days. It will be either a patent or a refusal to issue it. Usually lead to a negative result debts on taxes, lack of the right to use the special regime or incorrect filling of documents.

The date of tax registration is the day the patent starts valid.

One entrepreneur can acquire several patents and pay accordingly for each.

How much does a patent cost

This is determined by the regional authorities based on the average earnings of a business in your field of activity. If your income is below the level at which the region determines the value of a patent, it is more profitable to choose a different tax regime.

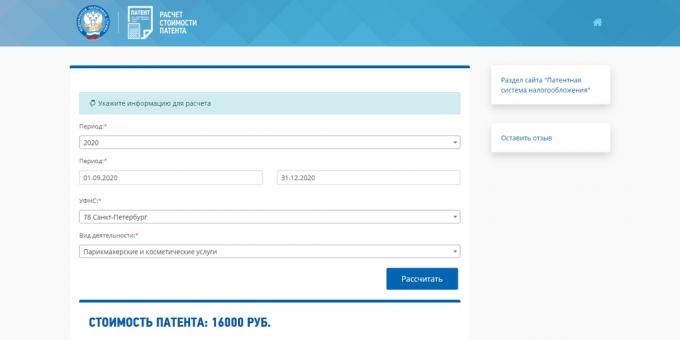

How much you have to pay will also be affected by the date when you issue the PSN. It is issuedArticle 346.45. Procedure and conditions for the commencement and termination of the application of the patent taxation system only within a calendar year for a period of one to 12 months. Therefore, in the middle of the year, a patent can be obtained until December 31st.

An easy way to find out the numbers you need is to use service FTS. The calculator will also tell you when to deposit money.

When to pay for a patent

It depends on the period of its validity:

- If a patent is issued for a period of less than six months, the money is paid in one payment while it is valid.

- If a patent is issued for a period of more than six months, one third of the cost is paid within 90 days from the date of its receipt, the remainder - until the expiration date.

How and when to report

Since the amount of tax does not depend on actual earnings, it is not necessary to file a declaration and report to the Federal Tax Service on patent activities. But you still have to keep the income bookArticle 346.53. Tax accounting.

From the need to submit tax reports for employees PSN does not release.

Read also🧐

- IE or self-employment: what to choose to stay in the black

- How to pay less taxes

- How to calculate and pay personal income tax for an employee