How to choose a bank, and the rate for business

His Work / / December 26, 2019

Yana Antipova

comparison service specialist tariffs for RKO in Russian banks'RKO Tarify.ru».

Not to overpay for settlement and cash services, you need to carefully examine the description of the specific tariffs and conditions offered by the financial institution. Tell us what to pay attention to the most common situations faced by bank customers.

It is better to start with a choice of fare: promonitorte all available and make for yourself a list of matching. If you first select bankAutomatically limit itself to the rates: it may be that the other conditions are more favorable to the institution.

estimate rate

1. "Subscription fee 0 rubles," does not mean that you do not pay a penny

The client opened the scoring with a free service. For a month it received 300,000 rubles - the Commission was 3000.

This happened because the client did not read the fare conditions, which spelled out the Commission 1% of each receipt. In his case, it is not profitable: at a rate with a monthly fee of 1 000 rubles per month, and no fee for admission, he would pay three times less.

What to do

- Check for the Commission for admission to a particular tariff.

- Rate the estimated amount of income for the month and calculate the commission for that amount. Compare with fixed monthly payment on other tariffs.

2. Interest on the balance of the account, you can not always get

The client saw on the bank's website, "is charged up to 7% on balance" and chose the bank minimum tariff with the lowest monthly payment. On his account at the end of the month was 500,000 rubles, and it is expected to receive 2900 in the form of interest. But I did not receive. The fact that the Bank pays interest only at the maximum rate and average daily balance.

What to do

- Check the interest on the balance on the chosen tariff. banks often charge a maximum interest rate on the most expensive costs, and on the initial offer 1-2% or nothing at all.

- Find out what the limits give the percentage. Some banks set a lower threshold, for example, from 30 000 rubles. Others - and even the top, for example, up to 300 000 rubles. If your balance is more than the amount of excess interest is not credited.

- Check what kind of residue on your bank accounts for the rate - weighted average or the minimum amount in the reporting period.

3. Cash withdrawal: if not to read the fare conditions, will have to pay a commission

PIs can get cash from settlement account in three ways: translate a personal card physical persons, shoot with a corporate card or box office.

Entrepreneur read the bank's website: "withdraw cash up to one million rubles a month without a commission." And cashed the money from corporate card, which he gave to the bank. The first two transactions 50 000 passed without commission. When the third time he took 50,000, the bank took a commission of 1 000 rubles.

This happened because at the rate were additional conditions. For example, a customer can cash out 1 million rubles without a commission, but:

- corporate card - only 100,000;

- translate into a card physical persons - 500 000;

- remove the box office in the department - 400 000.

Client exceeded the limit, and the excess amount accrued bank commission.

What to do

- Do not be guided only on overall limit withdrawals without commission. Look limits on removal from the corporate card balances and to transfer to the card physical persons.

- When cashed the money from the account of IP, especially transfers to the card physical persons. This method limits is always higher than the other. Then - remove a corporate card. If the limit is still not enough, you will have to go to a bank branch or pay a commission.

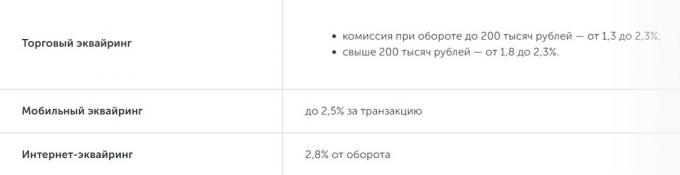

4. Acquiring: interests depend on the rate and method of payment acceptance

Businessman I read on its website: "The Commission for acquiring - by 1.3%." Acquiring hooked on your site and put the terminal in the store. For accepting payments at the store, he pays a commission of 1.3%, while for payments through the site it was 2.8%.

What to do

First, check the fees on the specific form of acquiring:

- Internet acquiring - for accepting payments online;

- shopping - for point of sale terminals;

- mobile - for portable terminals, which work in conjunction with a smartphone.

Second, check the fees on a particular tariff. In some banks the commission acquiring the same for all tariffs, in others different.

5. to replenish the account, the Commission is relevant only to those who sell for cash

If you accept payment only through the website or POS-terminal, the conditions for cash is not important to you.

If it will make cash on the account, check the two options:

- It is the percentage when funding a variety of ways: through a bank ATM services and other bank partners in the office.

- What set monthly limits on a particular replenishment rate.

6. The Commission on the translation of legal entities and individual entrepreneurs is important when working with contractors and suppliers

For example, the list on score Ltd. to pay for delivery of materials or supplies. If you are doing translations to companies and other entrepreneurs rarely or not done at all, this option can not watch.

7. Commission on transfers to individuals with a company account: salary project profitable

Transfers to your card from the account physical persons, SP we have considered above. Now let's talk about entrepreneurs and legal entities that pay wages to employees - transfer money to them on the map. Consider the examples of the two companies.

- The company A does not know about the project and pay the salary of 20 employees. The total amount - 700 000 rubles a month.

- The company B are connected to payroll project and also pay 700,000 rubles and 20 employees.

Company A has chosen tariff RKO, where you can transfer to individuals 300 000 rubles a month without commission. The remaining 400,000 rubles lists under 2% commission, that is, pay more 8000 rubles.

Company B took the project from a fixed commission for transfer salary. And it gives 50 rubles per transaction, as for the simple payment order. Commission to transfer the salary of 20 employees is only 1 000.

In some banks the commission on the transaction by salary project amounts to 0.5% of total salaries. But this is much cheaper than transfers to individuals cards.

What to do

Companies and entrepreneurs who transfer the salary to employees on the card, you need:

- Use a Payroll Service - a service offered by many banks.

- Compare the commission on payment of salary project in different banks and tariffs.

We assess the bank itself

Suppose, in different financial institutions you have already found 4-5 tariff that suits you. On what to stop? To choose the best, you need to evaluate other conditions cooperation with the bank.

1. reliability bank

Against the background of periodic closings of banks in the country would like to be sure that you address in a safe. However, all ratings are subjective reliability of financial institutions. To see this, let's look at two versions of the famous sites, "the Banki.ru"and Forbes.

As you can see, in the first place was different banks. This is because in the preparation of different reliability criteria used ratings.

In addition to these lists includes all banks, including those that do not work with the business or offer unfavorable rates.

What to do

Representatives of small and micro businesses just look Reliability rating of banks for business - for review. You can also check whether the selected part of the establishment of state participation in the program - it is an additional plus, but not a hundred percent guarantee. Trying to analyze the deeper it is not necessary, you just get confused. This is done by analysts for the business and a multimillion-dollar multi-billion turnover.

If you still want to play it safe, open the two calculated bill in different banks. If a problem occurs in one of them the money will quickly translate to another.

2. Ease of opening an account

All banks have the opportunity to open an account in one visit to the office. But if you do not have time, choose the option to exit the service manager. A meeting with a specialist can be assigned anywhere: it will arrive in the agreed time and will bring the documents to be signed. After the meeting, you can immediately use the account.

3. Integration with accounting services and accounts management for micro free

If the accounting is conducted in the third-party service, such as "Elba", "Finguru" or "My business", make sure that the bank has with him integration.

Entrepreneurs to the USN 6% non-wage earners should check whether the institution offers free Internet accounts. This is not a personal accountant, and built-in mobile and online banking function calculation taxes and contributions, as well as a calendar of payment.

4. Corporate cards

Cards are available all banks, but some - for an extra fee. If the release is free, make sure that you can get a card without additional costs after the conclusion of the contract. In some banks have a condition free issue cards only on the day of opening the account.

5. shares

Not all stocks are equally beneficial. For example, it is not necessary to choose the tariff only because the bank offers a free service to the first two months. So you save only 1 000-2 000. A good action which should be taken into account when choosing a tariff - the terminal as a gift. The device costs 10 000-20 000, and you get free.

Check list

- Do not limit the rates of one bank, examine all available.

- Always check the interest rates, limits and other conditions for a specific tariff.

- Make sure that the bank does not charge for admission to the account on a free rate - it is unprofitable.

- If you plan to receive interest on the balance on the account, check, bank charges interest on any amounts.

- Think of how much cash will be removed from your account, now and in the future, when profits rise.

- Select the type of acquiring that connect and check commission on it.

- If necessary, find out the commission for the replenishment of the account, transfers to legal entities, entrepreneurs and natural persons.

- Find out whether the bank offers outbound service manager.

- Check whether there is integration with the service accounts that you are using. If you have IP on the USN 6% non-wage earners, choose a bank with a free built-in online accounting.

- Make sure the financial institution to issue corporate map free (if you need it).

- When choosing a bank, consider only the profitable stocks, such as the terminal for free.

see also🧐

- What you need to know to get a loan from any bank

- How to fix credit history

- How to recognize hidden in the installment loan