Why entrepreneurs to conduct financial accounting

His Work / / December 26, 2019

Alexander Afanasyev

Business finance specialist at Consult-bureau "not dull finances».

Many entrepreneurs do not keep financial accounting. They have a maximum plate, where they drive in income and expenditure. Some even write down everything in a notebook. But the good of this little - information is missing, the business eventually becomes unprofitable.

Why not keep a record made in small businesses

It so happened that a small business is no culture of doing financial accounting. First of all entrepreneurs are studying marketing and sales. But without knowledge of the basics of financial accounting business unreal to grow to medium-sized or even larger.

according to statistics,Business lives three years., Small businesses rarely lives longer than three years. There is a feeling that it is just ignorance framework for management and finance. Finance - is not just a collection of numbers at the plate and the information to help make decisions, plan actions and achieve goals. Business is understandable and manageable, and not just as something moves somewhere.

Why is it important to keep records

Represent Simon, whose plumbing shop. While the heat, people are actively engaged in repair, changing toilets, bathtubs, mixers. Orders from Semen much money fall in box office and accumulate on the company's account.

Simon wanted a new iPhone and MacBook. Withdrew 200 thousand from settlement account the store and bought it.

The businessman gave the employees salary and pay the rent. But then phoned the supplier and reminded that tomorrow is the day of payment for the goods delivered. Simon turned on his computer, went online bank, and there is not enough 300 thousand. I had to take in debt.

Semen is not recorded that 30 days after the shipment has to pay to the vendor. He still did not understand that if we take a reprieve from the supplier, how to keep his money at home, and they in any case can not be spent.

And this is just one of the possible situations. Some entrepreneurs work in plus, but do not see the money, because they are buried in stocks. Others give too long a delay and live on bread and water until the customer finally pays.

What is the financial accounting

Financial accounting - a system of reporting, which allows businesses to keep finances under control. It consists of three reports - of cash flows, the income statement and balance sheet. Taken together, these reports provide answers to important questions: whether the company is growing, why there cash gaps, effective management is working on how to increase profits, why profit is, and no money. Without this information, the head is difficult to run a business.

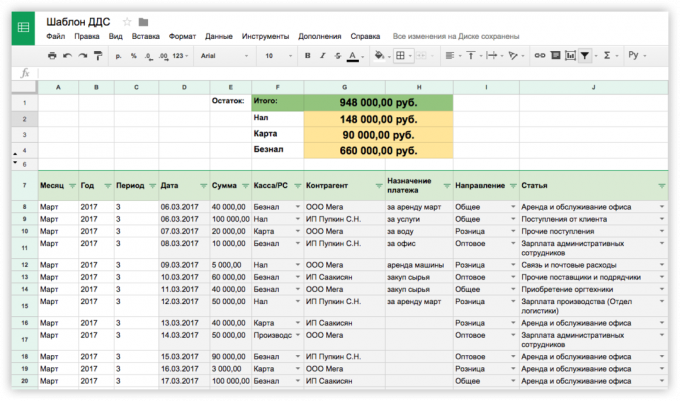

STATEMENTS OF CASH FLOWS (DDS)

that takes into account

How much money comes and goes from the accounts.

why do we need

On the report of the head he sees the money will be enough business to fulfill its obligations: payment of rent and salaries, purchase of goods. Without VAT it will not control the money in the accounts, and eventually fall into the cash gap - the situation where the business has no money for the bills of work and pay.

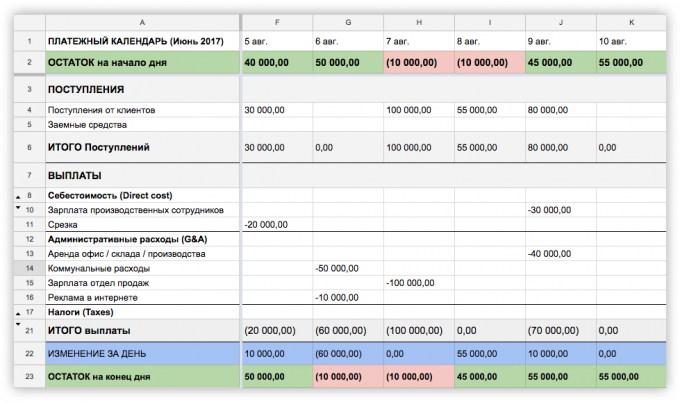

Together with the statement of cash flows should be conducted of payments calendar. It is necessary to make the planned future earnings and write-off of money. This way you can anticipate the cash gaps and take action in advance.

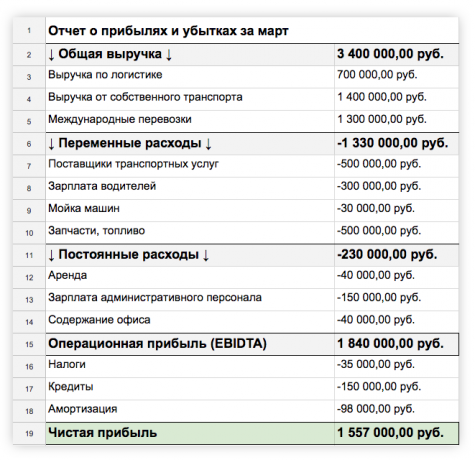

Profit and loss account (OPiU)

that takes into account

Revenue and business expenses on closed acts or overhead.

why do we need

On the report of the head of said net business profit.

Profit - is not money at the box office. In a loss-making business can be a full cash box office, while profitable - empty. Consider this with two examples.

- Full Service, unprofitable business. Kirill before the new year decided to earn some money on Christmas decorations. Orders were many. Kirill has purchased raw materials for production, premiums paid, launched targeted advertising. The new year has come, the order finished. Kirill pay taxes, rent, and wages to all employees is not enough. It turned out, business has been unprofitable. Cyril had to raise the price of toys. And he did not know - he was on hand as a lot of money.

- Empty cash register, profitable business. Nastya produces cosmetics. All it admire, write reviews, She has a lot of orders. But there is no money - it took relatives on production. And business has been profitable. Simply income was in the form of stocks in the warehouse, as well as accounts receivable - delays to wholesale buyers.

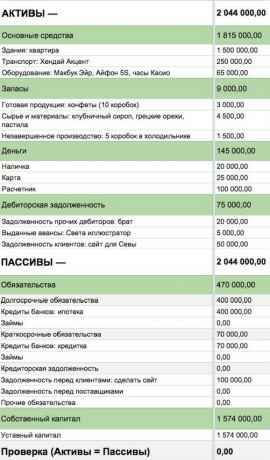

Balance

that takes into account

The assets and liabilities of the business. Assets - that is all what the company owns real estate, equipment, inventory. Liabilities - is money that bought the assets of the business.

why do we need

Head knows whether the business and whose money develops growing. Also on the balance he sees, what is the profitability of the business.

Imagine an entrepreneur conducts three reports. According to the SDS, he sees that there is no money. Looks OPiU - profit there. Then checks the balance and realizes profit - complete storage of goods and new equipment.

Situation, due to which the Company has a financial problem

Wrong handle money

The owner thinks that all the money the company - it is his property. This is wrong, because the business - a separate body, which can not just climb up and collect 100,000 for a new smartphone.

Moreover, the money spends the owner may not even belong to the company. For example, if you were given an advance payment for the project, and you are his work has not yet passed, the money - not the property of the company and the customer, which are simply stored on your account.

More entrepreneur can not understand how you can take yourself without harming business. To know this, you need to consider the profit properly plan for future expenses and development, and only then to receive dividends.

They think earn

Often, the company said profit in cash or money in the accounts: deduct from the income and expenses and earns a certain amount. But this is wrong. Profit - is a virtual figure, which can not be touched or expressed in figures on the current account.

The problem of wrong calculation of the profit that head making on the basis of his conclusion, the company is working effectively or not. But the amount of money has nothing to do with the efficiency and performance gains.

They do not plan properly and set goals

If the manager sets goals properly or at all does not do this, the company does not develop. Most often, people think this way: "The more you earn, the better." In such order no specifics, no plan, no digitizing. Because of this business marking time in one place, rests on the ceiling, and the businessman jumps to a new project.

Planning and execution of the plan - a basic part of company management., Create a financial model to plan come true 80-90%, you need to put the profit target and develop a different scenarios, calculate budgets, deadlines, and assign responsibility and regularly monitor the implementation of plan. Without this, small businesses and will be closed in the first three years.

Think that if you increase sales, increase profits and

The logic seems to be simple: the more sales, the more income. But it is necessary to take into account that with the growing sales and the cost of hiring new employees, Purchase of raw materials and products, organizing additional sales volume delivery. Costs are often relegated to the background, and takes into account only the amount of money from future sales.

If you do not plan an increase in sales, you can instead earn profit loss. It is necessary to clearly understand how to increase revenue, what costs it will entail for themselves, how it affects the working capital, there will be enough money to this company. If not initially digitize an increase in sales, you either lucky or not. If accounting is carried out properly and the company is actually losing, the loss will only increase.

Where to begin to conduct financial accounting

Financial Accounting need to conduct business on the basis of numbers, rather than intuition. Start guide him to report VAT. This is the easiest way. Make every day income and expenditure for all wallets, compare them with the actual amount of money in the accounts.

SDS template →

Together with a report of payments DDS lead Calendar: Determines the amount of money at the beginning of the month, add the projected income and expenditure. So you see if you have enough money to pay off all.

Template payment calendar →

When you are versed in accounting, you do not need complicated software. Will be sufficient in the tablet Excel. It is important to learn how to group income and expenses into categories and to conduct regular reporting.

see also

- How to be an entrepreneur and not die →

- 5 tips for those who want to start a business →

- 33 things you should know every aspiring entrepreneur →