How to calculate the business income

His Work / / December 26, 2019

Sergey Ivchenkov

Consult a financial advisor in the Bureau "not dull finances».

Many entrepreneurs believe business profit at the box office money. For them, profit - is the difference between how much was received, and how much is gone. In most cases, to do so properly.

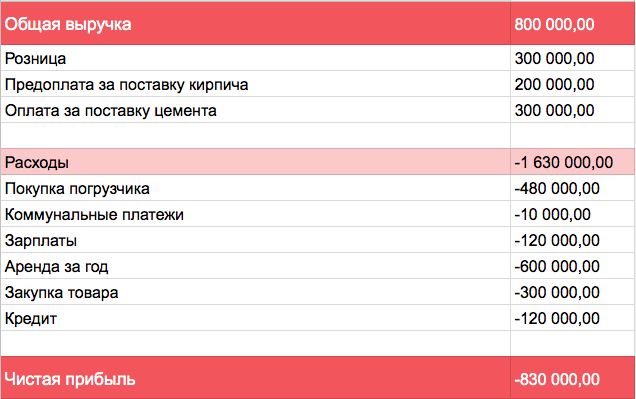

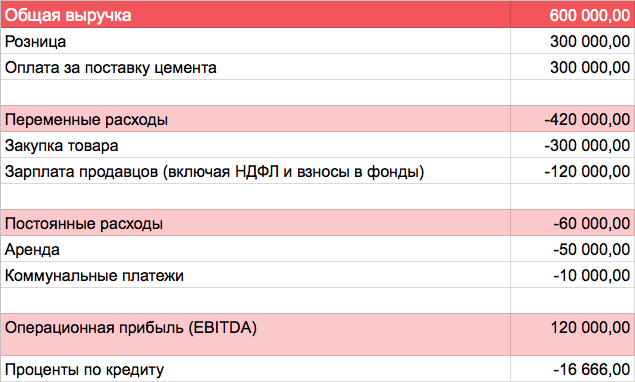

Consider the following example. Store "Daisy" sells building products in the retail and wholesale. The owner considered income for the month:

It turned out 830 thousand rubles loss - though the business is closed. In fact, the situation is normal, the owner simply made a mistake in the calculations. Let's understand, how to calculate profit correctly.

How to calculate the net income

The formula for the calculation of profit is as follows:

Net profit = revenue - operating expenses - interest on loans - Depreciation - Taxes.

It looks simple, but there are nuances.

revenue

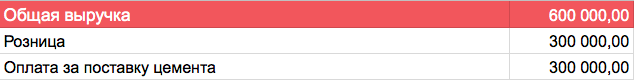

The owner of the shop "Daisy" was originally recorded three sources of revenue: the money from retail customers, payment for the supply of cement and pre-payment for the supply of bricks.

Money to pay for retail and cement - it really is revenue. Clients paid the store gave the product. But the advance payment for the brick - it is not revenue. It it will be only when the store will give the buyer a brick.

Entrepreneurs often do not realize that such revenue. They think that it is all the money that lay on their accounts. But this is only the money for closing. Prepayment can be revenue, because you have not fulfilled the obligation to the client. So far, it's just his money in your account.

Operating expenses

Called operating costs of providing the daily work of the company: rent, utilities, stationery, salaries, purchase of goods.

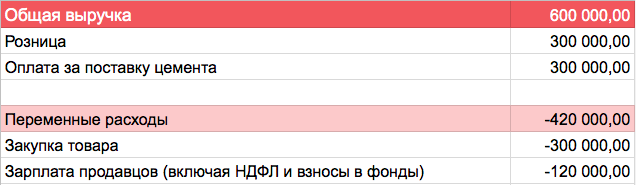

The store owner has combined all costs, but it is more convenient to divide into fixed and variable. The variables are dependent on revenue, constants do not depend.

For variable costs in the "Daisy" includes purchase of goods and sellers of salary, which sit on a percentage of monthly revenue. Inscribe these two articles in the variable costs.

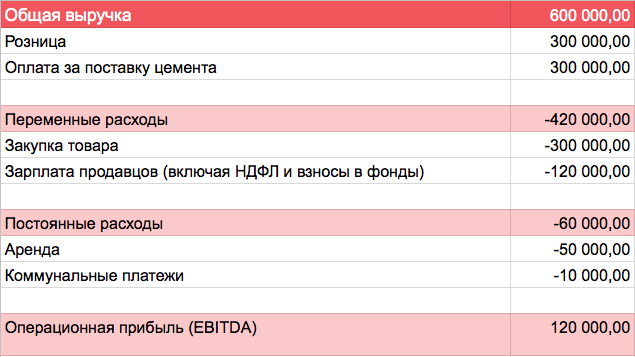

Fixed costs - is to rent and communal. No matter how many earned shop, they will not change.

Payment of rent due to incorrect counting was 600 thousand and became 50 thousand. Because it is impossible to record an annual payment for one month, because the room is rented for the entire year. Evenly distribute the payment for the duration.

EBITDA - is the operating profit. It shows whether the business can, in principle, to make money. Positive EBITDA does not mean that the business has a net profit. You subtract credits, depreciation and taxes.

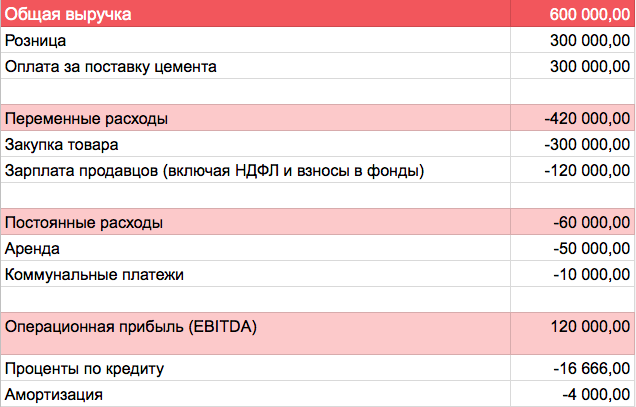

Interest on loans

Credit It consists of loan principal and interest. Store "Daisy" took a million under the 20% per annum for one year. As a result, it will have to pay 1.2 million: 200 000 will go to interest.

body of the loan - this is not the profit and loss. You took the money, you get them back - all, the story is over. But the interest - it's a loss. You pay them for the use of credit. Therefore, when calculating the profit taken into account only the interest on the loan: 200 thousand rubles per year, or 16,666 rubles per month.

Depreciation

Purchase of equipment - an investment. You spend money on a thing, which for some time will bring you profit. These costs also need to allocate for the duration.

The owner of "Daisies" bought the truck to the warehouse for 480,000 rubles. Assume that the truck will last 10 years. So, it will cost the owner in 4000 rubles per month. This flow is called depreciation.

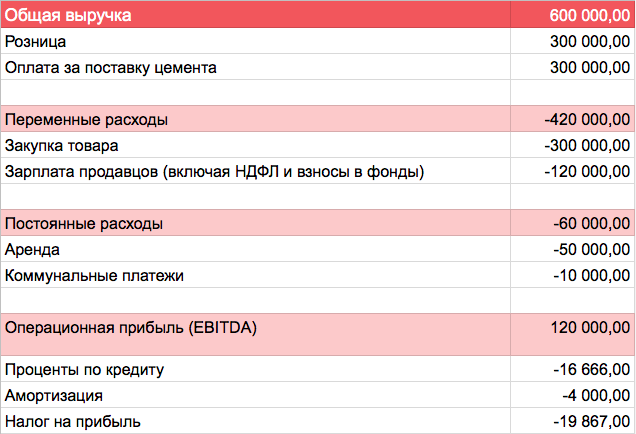

taxes

Separately, we must take into account the income tax, which depends on the tax system. The rest of the taxes paid by business, are already considered: the personal income tax and sotsvznosy - in wages, transport tax - in the price of the truck. VAT does not take into account: the money that customers pay the state transit through you.

Store "Daisy" uses a common system of taxation and pays 20% of the profits. This month profit amounted to 99 334 rubles. Tax - 19 867 rubles.

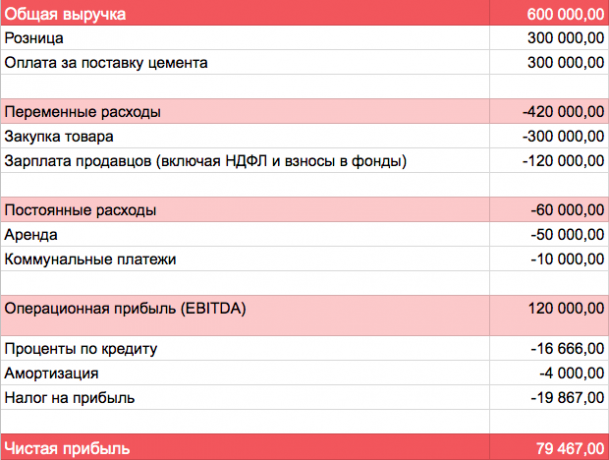

Net profit

We got clean profit and find out how much business really earned. When properly considered, was a loss of 830 thousand. In fact, a profitable business and this month brought 79,000.

However, the owner of "Daisies" this fact is not much rejoice: he will still have somewhere to take 830 thousand, which he left in a minus. Knowing their real profit, he realizes that the business is profitable.

To be considered a profit, make a profit and loss statement.

Template OPiU report →

To ensure that the necessary accounts of money for the business, drive cash flow statement.

Template DDS report →

see also

- Why cash gap occurs and how to prevent it →

- Why entrepreneurs to conduct financial accounting →

- How to succeed and make a fortune if you have virtually nothing →