What to do if the bank to block the card

Tips / / December 19, 2019

What is card lock

Blocking a debit card - a ban on the performance of any of its operations. You will not be able to pay her anywhere, neither in a supermarket or in a cafe or in the online store. Card stops working and becomes a useless piece of plastic.

It can block the owner of the bank or payment system.

Why can block the card

Due to the non-standard card transactions

The Bank may block your card if suspects that her attempt to steal money.

For example, the map want to pay the bill in a foreign cafes, make an expensive purchase (or in the normal online store) or to withdraw cash abroad. Tracking algorithm sees all transactions unusual transactions and thinks it's crooks.

In this case, the bank is associated with the owner of the card and asks you to confirm suspicious transactions. If you do not get called up, the card is blocked, and you receive a SMS notification.

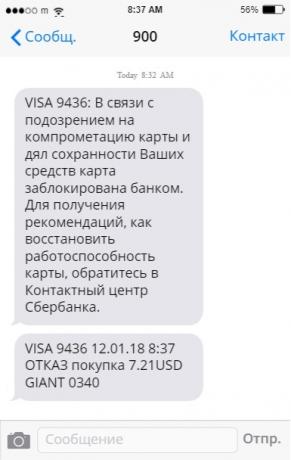

Due to the fraudsters card copy (compromise)

Card can block, even if it did not make non-standard operations. It's enough to suspect that her fraudsters copied (using skimmingovyh devices ATMs, shops, cafes, gas stations).

This is followed by Visa and Mastercard payment systems. If you suspect that the card has been copied, they ask the bank to block her. Most often compromised cards occur in the countries of beach holidays, although they may happen in Russia.

Three times in a row have entered the wrong PIN

This is also a reason for blocking the card. The Bank believes that the scammers are trying to pick a PIN, and limits the operation of the map. It will work automatically after 24 hours.

Ended validity period

A month expired, the period of the card expires and you have forgotten. The bank is waiting for you a new card room. The former is no longer working.

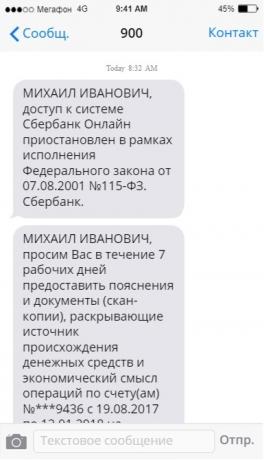

If the bank suggests that with your card cashing money

Regular transfers of large sums at stake and then cashing the money - is reason to believe that you or through you cash out the money, and involved in illegal activities. The Bank monitors these operations and can block the card (yes, it legally).

By the tribunal's decision

Card and a bank account can be blocked by a court decision, if you have debts. So bailiffs seeking the return of funds.

What if the card is locked

Call the bank. The number is on the back side of the card, on your site or app. The employee will ask the passport data and the codeword (each in its own bank identifies the client) and find out the reason for blocking.

Some banks in the tone set has an extra button to lock / unlock the card. So you immediately connect with an operator, bypassing the telephone queue. If you are roaming internationally, you will save a lot of money.

If the card is locked bank, you confirm your purchase, the card is unlocked. If the card is locked on the initiative of the payment system, will not work to unlock it - just reissued.

If the bank to block the card due to the suspicion of cashing the money, you will be asked to the documents confirming the legality of the funds received. After checking the documents of and the lock will be removed.

How to get the money from the blocked card

If after a call to the bank card has not been unlocked, you will still have access to money.

- Transfer money to another card (his, friend, relative). This can be done through a mobile application or internet banking. This is the usual translation, no new skills and knowledge is not necessary.

- Remove money from the account. You can do it in a bank.

- Arrange with the bank. If the money is needed urgently, and the other cards you have not, ask a bank employee about the time you unlock the card. To do this on the phone, explain the situation to the operator. An employee for a few minutes removes the prohibition, and you remove the desired amount. After the card is once again locked to the scammers do not have time to steal the money.

If the bank suggests that using your credit card cash out the money, you still have access to them, you can remove them from your account in a bank.

If the bank to block the card and the account by the court or the Federal Financial Monitoring Service, you do not have access to money. You can get them only if the court overturned the decision.

How to avoid card lock

Most often, the card is blocked because of irregular transactions (payments abroad) and compromised by fraudsters Card. Be in this situation and everyone can, but the blocking probability can be reduced.

Tell about the trip

If you're going abroad, Notifying the Bank: write in a chat on the mobile app, the Internet bank or call. If you're in a number of countries, specify the city and time, not to be without a map at the most inopportune moment.

Apply for an additional card

To make the main bank more: so you will have two cards on one account. If one card is blocked, it will be the second. They have different rooms, so in case of compromise will block only the one which had been used in a suspicious ATM.

pay cash

If you are not sure about the honesty of the seller or the waiter, paid the money. If a cash No, do not let take your card and do not miss the sight of her - all transactions must perform before your eyes.

Withdraw cash in the bank

Fraudsters equip ATMs skimmingovymi devices and copy the card. To avoid this, remove the cash in bank branches. Bypassing the ATMs on the street, do not remove the money in poorly lit places. Cover your hand keyboard when you type a PIN code.

Leave the current phone number

The Bank may call and specify, whether you pay by card. Not taken up, or are not available - the card is blocked, so that it is not stolen with the money. If you will take the tube, then immediately solve the problem, the card will remain operational.

see also

- What to do if the ATM does not give your card →

- How to protect a bank card from fraud →

- What to do if the ATM jammed money →