How to improve financial management in the company

His Work Web Services / / December 24, 2019

If the business is stagnant or causes damage, check whether the effective management accounting in your company. Layfhaker together with the service Seeneco It made recommendations that will help to clean up the finances of your business.

Seeneco - is a cloud service for the management, analysis and financial planning. With it, the entrepreneur can get answers to very important questions. How much money in bank accounts and in hand? How much cash the company spent for the current month? What are its main items of expenditure? How much money will need to pay to counterparties in the next quarter? whether the business is profitable?

Here's what we recommend to do to answer the last question was always positive.

1. Keep regular accounting operations

Success in business depends largely on the discipline. Without meticulous accounting of all transactions the company quickly into chaos. It is important not only to fix the operation, but also to group them.

Most often, this is done in Excel. But the more transactions, the more cumbersome the table, the more time it takes to process them. In Seeneco can collect transactions from all accounts in all banks, as well as all the booths, including cash, by different employees and departments. All this greatly simplifies accounting.

Loading cash transactions can be carried out manually (see "Money" → subsection "Accounts» → «Add cash") or via download existing ones you have Excel-tables. As a result, a list of all operations will be shown in the section "Money" in the relevant box office.

Download operation, which took place through the bank, you can use the statement in the format of "1C" or by connecting direct integration with the bank. Now it is available to clients "Alfa-Bank", "Modulbanka", "Tinkoff Bank" and the bank "Point".

After loading of non-cash and cash transactions can be spread over the managerial category. In this case, you can use the standard directory service or create your own, entirely consistent with the tasks of management accounting of your company.

Distribute category can be manually (there are several ways), but it is more convenient to set up automatic distribution. To do this, you need to create your own payment processing regulations in the relevant section of the portal.

For those who are constantly on business trips or business leads "from the field", there is a mobile application. It allows you to record income and expenses on the go.

2. Analyze your cash flow

Just fix the revenue and expenditure is not enough. Money in the business as on the dashboard in the car: is not the figures, but the fact of what they suggest.

For the analysis of key business indicators Seeneco a special section. Opening the page "Summary" section in the "Analysis", you will find general information on revenue, expenses, financial results.

The entire page is clickable. So, moving between cells in the table "Key performance indicators", on the right you will see the graphs and charts that reveal the details of each digit. If you click on a particular segment of any diagram, opened detailed schedule.

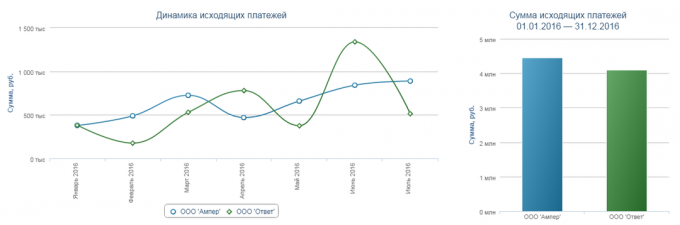

You can trace the dynamics of each of the items of expenditure and income as well as to compare them with each other. By analogy we can compare revenues from customers and payments to contractors, to quickly find answers to any of them profitable to work with and who not. You can also keep track of finances for projects to evaluate the profitability of each project and to adjust its development plan.

This is especially convenient service for entrepreneurs who have multiple legal entities. In Seeneco can get a cut like one of the companies, and all at once, to see the whole picture.

3. Plan Finance companies

It is important not only to analyze the current financial situation, but also to plan finances. How much we will earn next month? When funds can end? How dividends can afford without compromising the business? Seeneco It helps to answer these questions and build a realistic financial plan of the company.

See "Budgeting" allows you to create budgets for the articles and projects and monitor their implementation. Thus Seeneco indicates risk areas and provides recommendations for the compilation of the financial plan.

Very convenient financial calendar service. It is located in the "Planning" and allows you to make a plan for future expenditures and revenues. For example, the 15th day of each month to your account should do the payment from the counterparty in the amount of 100 000 rubles, and the 30th you need to pay the rent 70 thousand. Make this event to your calendar, and schedule displays right at the top, as the impact of these operations on account balances and at the box office.

If somewhere in the cash gap may occur, the system will show a red dot is on the graph. This is a signal that you want to redirect cash flows and adjust the income and expense items.

Summary

Seeneco - a great solution for small and medium-sized businesses. Service will appreciate the business leaders, owners and business managers, project managers, assistant accountants. After all, they, too, can enjoy Seeneco to solve their problems: the system can start anytime the number of users and very flexible configuration of the right to view and edit financial operations.

Service allows you to track and classify all the cash flows of the business, and a powerful analytics and intuitive graphical information - promptly take the necessary management decisions.

After trying Seeneco, you do not want to go back to the Excel-tables. Never.

The first 14 days, you can use options Seeneco free, including consulting services on financial management. Two weeks is enough to evaluate the features and benefits of the service and choose a suitable tariff plan:

- Start - 990 rubles per month. The rate includes accounting of money in the accounts and at the box office and all the analytical functions of the system.

- Standard - 2590 rubles per month. The same options, plus planning and plan-fact analysis, forecast the cash balance and the financial calendar.

Larger companies Seeneco service provides the ability to keep finances on an accrual basis, do budgeting large projects and manage applications for payment.

Get demodostup in Seeneco