As you know, money love to score. These programs will help you keep a personal or family budget with minimal downtime.

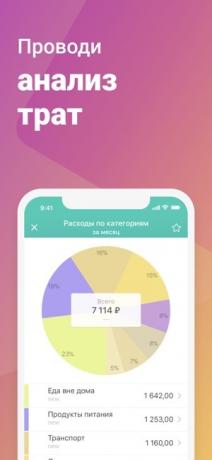

1. CoinKeeper

The main advantage of this program - intuitive and easy to use interface with a lot of informative icons. With simple gestures you can instantly fix their costs. Among other things, CoinKeeper allows you to set financial goals, establish a budget and plan costs. Thanks to the tables and graphs are very easy to control the dynamics of the funds.

Advanced reports, the cloud data synchronization, joint management of the budget and of the other features available only in the paid version of the program or after subscription.

Price: Free

2. Debit & Credit

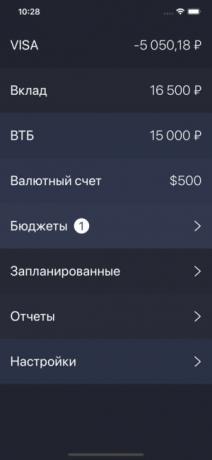

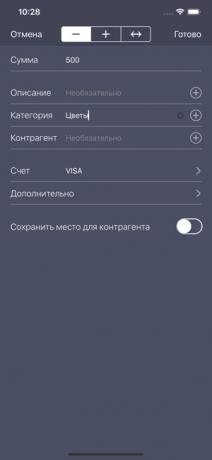

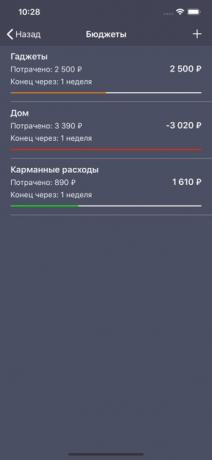

This app follows the principle of minimalism. As there is almost no graphics and all the menus are made up of text lists. But the program is not as simple in terms of functionality, it looks like. You can create accounts and expenditure categories, set budgets, record expenses, as well as to observe the movement of funds by means of graphs.

The developers have paid special attention to the report. Debit & Credit displays detailed information about what and how much money you spend and whether your income grows. The program even predicts your financial condition on the basis of the planned transaction.

Plus Debit & Credit supports the import and export data in CSV format and synchronization via iCloud. To add more than two accounts, and to be able to attach pictures to transactions of checks, it is necessary to buy the paid version of the program.

Price: Free

3. Moneon

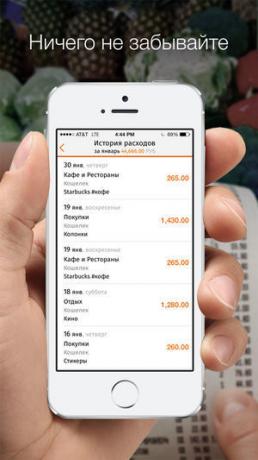

After the first start the application user instructs detail with interactive prompts. Therefore, to understand it will not be difficult. The program is beautifully framed and does not suffer from a lack of features. Moneon allows to fix the costs and compare them with the budget. You can create several purses and to control their financial turnover, independently of each other.

The developers believe that to take into account income not necessarily because it is stable in most people. Therefore, they have focused on tracking spending, but as a paid subscription revenue accounting still present.

In addition, premium users get detailed financial reports, as well as the ability to save photos of checks and monitor debt, joint management of wallets and other additional function.

Price: Free

4. OK money

The "Money OK" also uses icons to visualize the sources of funds and expenditure categories. This is reminiscent of CoinKeeper. But "Money OK" is much more simple and suitable only for the calculation of the difference between earned and spent money without taking into account debt and create financial goals.

The app syncs with other devices and allows you to control the overall finances together with relatives or partners. There are export function to CSV. The paid version has a more detailed report.

Price: Free

5. HomeMoney

And finally, the most simple application in this collection. It is suitable for users who want to follow the story of spending, not bothered over control of the revenue, budgeting and other subtleties. All data entered into the program are synchronized with the cloud. The free version has quite a hard limit on the amount of waste per week. There may be no more than ten.

Price: Free