How not to swear because of the money in the family and to live so that at all lacking

Get Rich / / December 20, 2019

Quarrel over money - right?

Not to say that is normal, but it happens often.

Sometimes it is not clear who should pay for what and where to go finance. According to statisticsFamily quarrels and violence - a survey, "Levada-Center". , Mostly couples quarrel just because of money: they either do not have enough, or there are disputes on what to spend the savings. Someone wants to leave, but someone - a new car. One wants to set aside and save, the other - to spend and carouse.

Often it endsA divorce 25 years ago and today - press release VTsIOM. divorce more than a quarter of Russians are ready to destroy the family, if not enough money to live on. Moreover, the age of marriage is not so important: people get divorced, and after 5 and after 15 years of marriage.

Statistics sad. And now what i can do?

Sit down and talk.

To destroy the family unit because of money is stupid, especially since an agreement is not so difficult. The main thing - to start the conversation and to bring the rules that will suit both.

For example, the chip in the overall costs, and the remainder of the salary to spend at its discretion. This is the most conflict-free model of the family budget, there is no need to account for every ruble spent: my wife will not make excuses for another new dress, her husband - for the new gadget. Each paid for the purchase of its own "pocket" money, no one has any questions.

But there is a nuance. Most likely, one of the spouses in the family gets bigger than the other. Therefore, allocate costs necessary so that no one is prejudice: let each one resets the general expenses on the basis of their income. You are still a family, not business partners.

Ivan gets 100 thousand rubles, and Masha - 50. Monthly expenses in their family - 70 thousand rubles. If everyone would give 35 thousand that Masha would be a shame: she is still only 15 thousand rubles, and Ivan - 65. It should not be.

How to conduct a joint budget?

Count the joint expenses and to throw off total score.

Every family has mandatory costs: food, apartment, communal, loans, transportation, internet, mugs for children. Great shopping, holidays and savings are not included here. Calculate these costs and decide who pays how much. This will be your family budget, from which all the required expenses are paid.

The amount may vary from month to month. For example, in August, it is necessary to collect the child to school in October and March to change the tires on the car, once a year - to pay for MTPL or CASCO. These costs need to be prepared: schedule them separately and save money.

Why can not you pay each separately?

The total expense of saving money. Yet it is easier, more transparent, and easier.

Thanks to the family budget, you know how much money you need and where they go. This allows you to plan costs and to manage money wisely: do not make impulsive purchases, save, set aside. Practice confirms theory: most Russian millionaires, whose state is more than 100 million rubles upHow to plan a family budget: the experience of Russian millionaires. hard target budget and prescribe all future spending.

In addition, to pay for something individually with personal cards uncomfortable. Someone might forget to make a payment by credit card or to spend too much, and then shift their responsibilities to the spouse.

The total expense to avoid such situations: one throws a certain amount in the joint budget, and from there you pay all required costs.

How to have a joint account?

Open access to the members of the family account.

In any card has an account. Now some banks have expanded capabilities and allow you to connect to an account of a few people. For example, it is possible, the clients "Alfa-Bank".

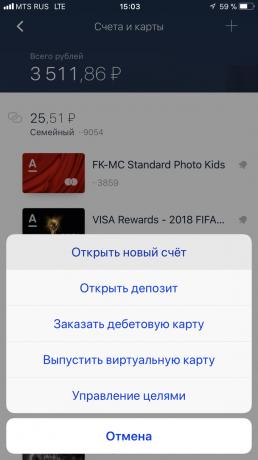

To create "Family" account, Enough mobile apps "Alfa-Mobile". Come, create and give him a name.

Use the total score can be up to four people. For example, a husband, wife and elderly parents, you help money. It can be mounted not only relatives, but also close friends (for example, if you live in a civil marriage).

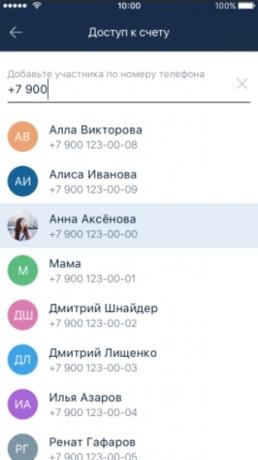

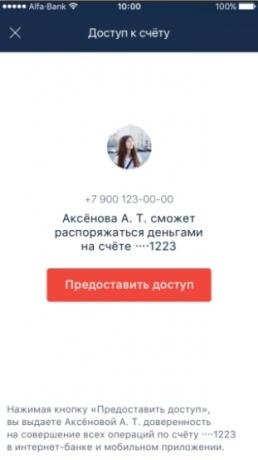

If you want to connect clients "Alfa-Bank", add it to the mobile phone number.

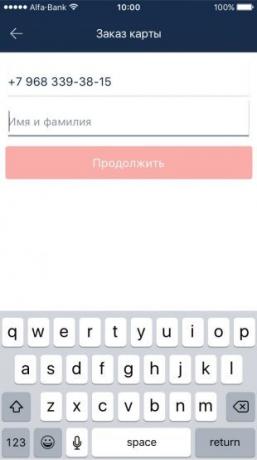

If not - order the map in annex (only need the name and phone number). You do not need to take the card to go to the department: the courier will deliver them to your home.

By "family" account, you can connect your children?

Yes, there is such a possibility.

By "family" account, you can connect children older than six years, and to release them for children's cards. It is more convenient and more effective than giving cash: the child to learn how to manage money and live within our means. Simply install in the application limit for the month, more than he had to spend more than he can.

In advance, discuss the amount and explain to him what's what. It is likely that at first he still will make rash spending and by mid-month stay without money. But then such a way to teach the child to plan their spending and set priorities.

How to use the "family" score?

Just as usual. No difficulty will arise.

- In the appendix, select the account from which the money will be withdrawn when buying the card. Personal purchases you pay with a personal account, and family - with a joint. Everything is simple and convenient.

- Including monthly Autorecharge general account from your personal on the amount agreed to by the family council. This eliminates the need to transfer money each time manually. Let your spouse do the same.

- Adjust avtoplatezhi for all necessary expenses: flat, loans, mobile phones, children's clubs.

- Set limits for each family member. Limit your children monthly allowable amount of expenses (you will see the whole history of their actions).

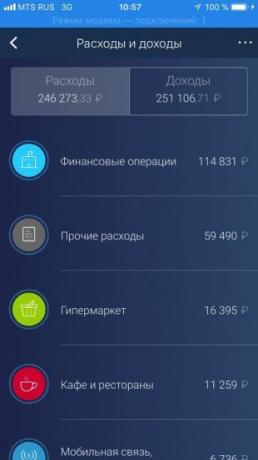

- Configure access to transaction history. Do you want maximum transparency - open access to all. But you can and hide it from the kids and, for example, the mother in law. The main thing is that both family members were aware of what the money goes. The application still clearly visible:

And if I do not have the card, "Alfa-Bank"?

To use the "Family" score "Alfa-Bank", to be his client. To do this, select and order on website Bank debit card. It will make for 2-5 days and will deliver to your home. After that, you download the mobile app, open a family account and connect family members.

And what about the great shopping or vacation?

Here it is necessary to negotiate, too. For example, a family council to discuss major purchases and plans. Let's say you have agreed that within six months you want to have a rest in Europe. Then take a trip budget and start saving money. Save for common goals, too, you can use "Family" account "Alfa-Bank". Open in a new application, called "On Vacation" and connect it to a loved one or friends, if you are going on vacation together.

Careful planning will help to avoid spontaneous spending and give an understanding of how much money you have, how much needs to be postponed, and how much you can spend on their own needs.

Open the "Family" account