How to use a credit card

Get Rich / / December 20, 2019

Credit card as a good knife. Chef for a second chop them vegetables and deftly narezhet meat, while a child with this knife only get hurt. So it is with a credit card: financially literate person she will bring money and make life easier, and the unwary newcomer will spoil debts and credit history.

This article - the rules that will "not be cut" by credit card and get benefit from it.

1. Spend as much as you can return

Pay with a credit card as if it were a normal debit card. If you used to spend 50 thousand rubles per month, so, so much waste, do not pay attention to your credit limit.

Sasha earns 60,000 rubles and can postpone a month just 15,000. He wants to buy a new iPhone for 80 000 rubles. This is disadvantageous purchase: Sasha is 5 months to return the debt to the bank and pay more than they would otherwise.

How can I do

Sasha was going to buy tickets next month, but found out that they are now being sold on the stock. Instead of the planned 40 000 rubles, he could spend 35 000 - a bargain. Now Sasha is not the entire amount, but it will be typed exactly two weeks. So he pays the tickets by credit card, and pay day money back on the card.

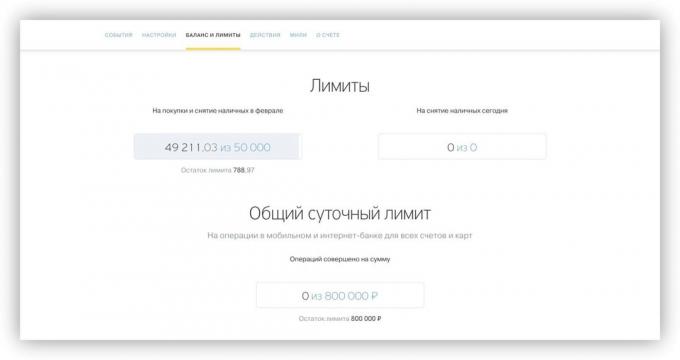

If you are afraid to spend the extra money, set a limit - the amount you're willing to spend per month. This can be done in half a minute in a mobile application or internet banking.

For example, you have a credit card Tinkoff Platinum with a limit of 300 000 rubles. If a month can freely spend 50,000 rubles, and this limit is set. When exceed it, you will not be able to pay off the card.

2. To repay debts in the grace period

Nearly all credit cards have a grace period: a month or two or even three. If within this period return the money spent, the interest is not credited - this is something like the installments from the bank. You want to have your credit card has been profitable - to repay debts on time and use the bank's money without interest.

If you do not remember how much should then look amount of the debt and the date of payment in the Internet bank or mobile app. In credit card Tinkoff Platinum has special calculator free period calculation: you see immediately when the start accrue. By default, free use of bank money as possible within 55 days.

3. To repay debt payments higher than the minimum

In a conventional loan have a date by which the debt must be repaid. The customer pays according to schedule brings a certain amount on a certain day. In the credit card holder of such a plot is not the main thing - to make a minimum payment. It is relaxing, and the payment of the debt is prolonged.

To quickly pay off the debt by credit card, increase the monthly payment. The fact that the debt is the sum of the principal loan and interest amount. Minimum payment is enough to fully pay the interest, but principal repayment remains a small part of the sum.

So to make a credit card as much money as you can: Calculate the bank faster and less overpay.

4. Do not withdraw cash

The credit card is not suitable to shoot with her money. The explanation is simple: the higher the turnover on the map, the more the bank earns on the transactions. To encourage you to use the card, rather than cash, the bank imposes restrictions. First, for cash withdrawals, you pay a commission. Second, you can lose the interest-free period or a reasonable credit rates. All the conditions are in agreement, so be prepared.

The same situation with the transfer of money to another card. This is not a purchase, the bank will not work on it. Therefore, the transfer fee you pay and will pay interest.

For example, Sasha takes off from an ATM with credit card Tinkoff Platinum 10,000 rubles. For this, he will pay a commission of 2.9% and even 290 rubles - for a total of 580 rubles. And I could just buy in the store right things at 10 000, to repay a debt to pay, and not to overpay a penny.

5. Use a credit card in a pair with a debit

If you use a credit card in a pair with a debit card, you can earn in the bank. It works like this. Your salary is on the debit card from the interest on the balance (as a contribution in the bank), and in the shops you pay by credit card. When the free period is over, you extinguish the debt on the credit card. Your benefit - a percentage of the salaries and bonuses by credit card. What kind of bonuses, tell a little further.

If you decide to try, make sure that the debit card is charged interest on the balance. For example, Tinkoff Black card you can earn 6% per annum on the account balance.

6. Get bonuses and exchange them for money

To attract customers, banks are using the loyalty program. For example, for the purchase of bonuses: miles, points, pros. Different cards - different bonus programs.

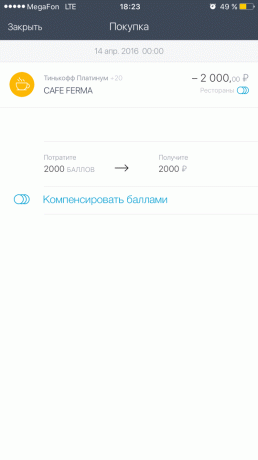

For example, credit card Tinkoff Platinum 1% of all purchases will come back in the form of points. They can compensate for the spending in restaurants and cafes or buying train tickets. One point - one ruble. Write off points and return the money to the account.

In the list, select the purchase costs in the cafe. Pay it points accumulated by credit card: bonuses will be written off, and the money will go to the account.

On some purchases by Tinkoff Platinum card, you can save up to 30% of the cost. Preferential terms offered by the bank partners: popular network and online shopping, online services and tour operators. Buy cosmetics, clothes and shoes, pay for courses Book flights - and some of the costs back to the account in the form of points.

A good credit card can make money.

Get together with Tinkoff Platinum

- Bonuses from 1 to 30% for purchases. You can spend on dinner in the restaurant.

- The interest-free period - up to 55 days. Service - 590 rubles per year.

- Free replenishment. Convenient online banking and mobile application.

- Card can repay the loan with another bank. Then increase the interest-free period up to 120 days, and the transfer does not take a commission.

Readers can Layfhakera issue a card Tinkoff Platinum with unique design and favorable terms. Within three months of return of 20% on purchases in the categories "Books", "Electronics", "Restaurants". And in an exclusive set of stickers Layfhakera!

Make a map