How to make a credit card

Get Rich / / December 20, 2019

Credit cards are issued not only to those who need cash to buy a third of the TV, but also people who want to earn extra income. Especially for Layfhakera service bank selection services and insurance companies "Sravni.ru" describes a simple scheme, with which you can further earn up to 30 000 rubles per year.

How not to give the bank money on your credit card

Banks make money from their clients who are drawing up credit cards, an average of five times. For the first time - when the issue card and charge for its services from 1 to 3 thousand rubles a year. The second time - when the customer withdraws cash from a credit card through an ATM, surcharge of 300-500 rubles. The third - when the borrower uses the money for a long time and pay interest on the loan. Fourth - the monthly fee for SMS-notifications on the movement of funds in the account. And for the fifth time - if the card holder passes the required monthly payments, and it is awarded for penalties.

At the same time, the bank client has two loopholes and a great bonus:

1. Free use of bank credit during the grace period (average 55 days).

2. Minimize maintenance costs: for example, to find a card with a small price to pay for the service (in some cases it is free) as well as disable the SMS-information.

Bonus - use a credit card with cashback or reference to the loyalty program.

Bank money can be used for free during the grace period, if you do not skip a monthly payment (5-10% of the outstanding amount).

Driving income

Credit Card - a tool for daily expenses. For example, for the purchase of food, clothing, equipment, fuel for cars, various tickets and other things that can be paid for the card.

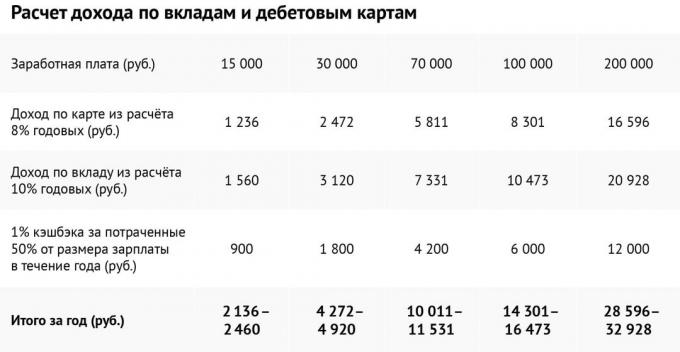

To obtain additional revenue it will need to issue debit card with an option for calculating percent residue or contribution with replenishment or partial withdrawal without loss of interest. Yield good debit cards is 8-10% per annum. Earn on deposit can 10-12,75% per annum.

Never remove the cash from credit cards - this is taken for a large commission.

Each time receiving a salary, you need to leave 3-5 thousand rubles, which are necessary for current spending in those areas where not accept cards. The remaining part must be placed on the account debit card or deposit. Current payments made by credit card. At the end of the month the loan is repaid on the map by means of the following salaries, the card where the money is repaid, or from the deposit account. If done correctly, for the year under this scheme you can earn from 1 236 to 20 928 rubles.

The card is not simple, and gold

Now consider the options when the additional income brings a credit card. The choice offered to customers with charge cards cashback for purchases (12% of all payments and 5-10% in some categories) and credit card with charge points that can be spent on air and railway tickets, as well as the purchase of certain stores.

Suppose that framed Card with Cash Back accrued at a rate of 1% on everyday purchases, which spent 50% of salary. Then, even if wages in the amount of 15 000 rubles for the year will return 900 rubles. If you earn 100,000 rubles a month, the additional income will reach 6000 rubles.

Thus, the total income from the two cards or the contribution amount for the year from 2 136 to 32 928 rubles. This is without taking into account the accumulated miles to buy tickets or additional points that can be spent in certain shops.

Tips

1. Find the card with free service accrued cashback, miles and other bonuses, you can use a calculator credit and debit kart. Pick up a profitable deposit easily through deposit calculator.

2. Instead, SMS-information is used to monitor the account online banking or mobile banking.

3. Never remove the credit card cash - for this will be charged a large commission.

4. The higher the status of the card, the higher the corresponding yield, cashback and interest on the remainder. Relate your benefits to the cost of service. Look for these options when for the services of the bank to pay the minimum amount.

5. Open replenish deposits with high rate to unused for a month to shift funds on deposit with the highest yield. At the same time, do not place in one bank more than 1.4 million rubles - this amount is protected by the deposit insurance system.