How to legally work with foreign customers, if you are a freelancer

Get Rich / / December 20, 2019

Knowledge of foreign languages, which today does not surprise any freelancer, you can start working with foreign customers almost from the first days of free flight. What to say about those who work and travel. However, processing of paper and documents, and you can forget that you are, in fact, the developer. To deal with the banks, and not lose any money or time, it is possible if to fulfill two conditions: to legalize the business and find a bank that works by modern standards.

register SP

Working as an individual, perhaps more familiar. Opening SP implies fuss with documents, annual tax statements and payment of mandatory social contributions. But if you are working with foreign partners, the account opened to natural persons, may bring more difficulties than the expense of an individual entrepreneur.

First, the bank will always see money come into your account from abroad. Regular contributions from organizations may attract attention, and you may fall under suspicion of illegal business.

Secondly, if you spend much time abroad, your income tax could grow from 13% of revenues to 35% - in the event that you recognize a non-resident of the Russian Federation. In FE that question does not arise, and according to the simplified system of taxation of income will have to pay only 6%.

Third, legalization would help and work with customers in the country. The contractual relationship with IP can be easier as the customer will not act as a tax agent. And the reputation of the freelancer, working formally, will be more reliable.

Open an account in a Russian bank

For operations with currency need to open two accounts for IP in a Russian bank. Why not in a foreign? Because foreign exchange transactions with foreign accounts PIs can be carried out only to a limited extent. By the way, individuals too. And any transactions with foreign companies - a currency transaction (yes, in rubles, too). And even then, you got the account in a foreign bank can only be used if you, for example, opened its representative office abroad.

When choosing a bank pay attention to the cost of service for the convenience of online banking and the ability to submit documents in electronic form. After you have decided to become a freelancer is not to stand in line for processing operator.

What else to consider when choosing a bank? of his work time. Very many of the processes associated with the transfer of money, depending on the exact date of receipt of funds to the account. And it is important to make sure that your work time coincides with the time of the bank. If you love travel, look for organizations that perform transfers around the clock.

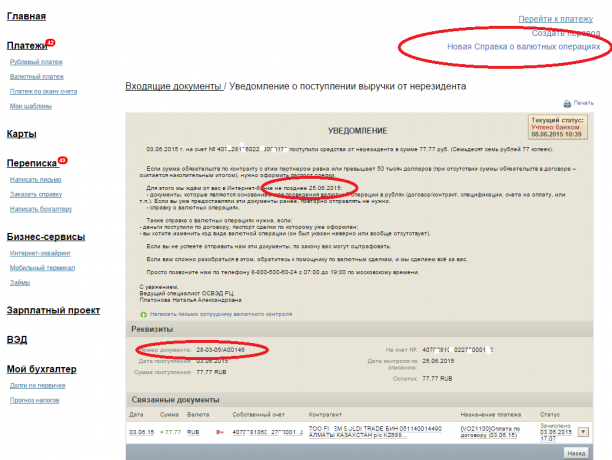

When you open a foreign currency account are automatically created and the current transit account. Transit account is necessary for the Bank to determine the source of the funds. All that pays foreign customer for your work, it will come back. In this case, to use earned you need a current account.

Note: currency and IP are not compatible according to the current legislation. That is, if you have the IP, the packs of dollars you can not be. All calculations in the currency will be non-cash, and to the credit of the existing operations of cash is better to use your account of the individual, and then transfer the currency to your account, SP.

Transfer money to the current account

To transfer money from the transit account to the current need to know a few subtleties. You have to monitor the completion of the account (or use an adequate service notifications in the Internet bank to be notified about it). And then your task - to study of money and its conclusion. Despite the fact that the money is yours, for the delay in the provision of securities can, again, be fined. In order not to lose hard-earned, it is necessary to submit to the bank the following documents:

- Contract or agreement. This includes the offer (if you're developing for the App Store, for example).

- Score.

- Certificate of Completion (although in many countries there is no practice of signing acts and customers do not know what this document).

- Order the cancellation of the currency from the transit account.

- Help on currency transactions.

- The transaction passport (if the transfer amount is more than 50 thousand dollars). This responsibility falls squarely on your shoulders, and although you can sort out the papers, it is better to keep an eye on the bank, which will make you a passport for such a sum.

Difficulty № 1: all of the above must be translated into the Russian language, regardless of the number of pages in the papers.

Difficulty № 2: Documents are available for 15 days after the transfer of money for transit account. What happens if you do not? Of course, fine.

Difficulty № 3: Bank of all these documents are actually read. And if under the terms of the contract you had to get the money at a certain time after the signing of the act, but not received, it is waiting for you... you guessed it, that fine?

When the documents are submitted, the money transferred, the exchange rate is provided, you can use your salary.

Choosing a convenient bank

If, after reading this article you will have a strong desire to hire an accountant and a lawyer, but would not see these bank papers, do not rush. Another expert - is an additional link in the chain "you - the bank - the customer", which increases the chances of failure and error.

There are already banks that restructure the work and abandoned the approach "collect 20 pieces of paper and get a penalty for 21 th." Analytical agency Markswebb Rank & Report was rating Quality of Service Business Internet Banking Rank 2015 small businesses. On the leaderboard example, banking services for entrepreneurs "Dot"(Branch" Business Online "Khanty-Mansiysk Bank" Opening "), you can see that entrepreneurs and freelancers understand by quality of the bank.

IN "point"I understand that sometimes it's easier to do everything yourself, than to explain to the client, where he forgot a comma. This does not mean that will not tell you if you ask. But definitely help if you do not have time to understand the intricacies of the law on their own.

For example, the bank employees themselves know foreign languages and do not require translation of documents. In particular, they have long been familiar with multi-put options - through "point"Many freelancers work.

«Dot"Accepts electronic documents, works round the clock and does not transmit the client's responsibility to do all the technical documents independently. That is, the certificate of currency transaction, the order of transfer of funds, transaction passport - it is the duty of the bank, you only need authentication of documents.

You can also arrange to have a bank account and issued a certificate of completion prepared in a form that is understandable to a foreign customer.

Because the "Dot"Do not like to mess with fines, you will always receive timely notifications and reminders about what needs to be done here and now.

As a result, you are lawfully engaged in the business without thinking about the cons of legalization and not turning into a banking specialist. Compare and operate quietly.