This article will talk about how to file a tax return quickly and correctly, without leaving your computer.

Nearing the deadline to the tax office. This year, entrepreneurs and everyone who receives additional income in excess of the official salary, are obliged to submit a declaration to the May 4th.

Sometimes the delivery of the tax reporting turns into a nightmare. You need to collect a lot of inquiries, fill in the appropriate form and submit the resulting impressive set of documents to the tax office. The hardest part - to fill in the declaration is true. In case of error you get her back, so most taxpayers trying to make it through special agencies and accounting firms. Fortunately, now you can return how to fill and submit directly through the Internet. We chose three of the most, in our opinion, the way to do this. About them today and we'll talk.

Service "taxes"

service "taxes"Was created to fill a 3-PIT, which must be submitted to the tax office. At this point you can create a return for 2013, 2014 and 2015 reportable years. Provided for this purpose

programWhich is available on a separate page of the site (registration required). This service is designed for individuals.

Site creators did everything to make it easier for users. In addition to short training videos and step by step instructions on how to fill, there is plenty of background information on all matters relating to the filling of tax returns and tax deductions. Everything is very simple and clear, it is written in accessible language.

After filling the form provides a received fax document is sent to the e-mail or print. And therein lies the rub: free can only make a declaration to obtain a tax deduction for tuition or medical treatment. Declaration created for other purposes, too, can be sent to a printer or email, but they will be provided with the inscription "Sample" across the entire sheet. To get rid of it, need to pay 500 rubles. Although there is always the option to download the form and have learned to fill in yourself.

But in each case, which can only lead a person to fill in a tax return, there is a separate online handy calculator that allows you to calculate the amount of tax payable or the amount of the potential return on the state.

Filling instrument returns "tax" only works in Internet Explorer, Mozilla Firefox, Google Chrome. Contract offer advance warning that there are other restrictions, such as: application functionality may be insufficient, can not work with non-residents of the Russian Federation, can not work with more than 15 sources of income, the service can not be used for agricultural and farmers.

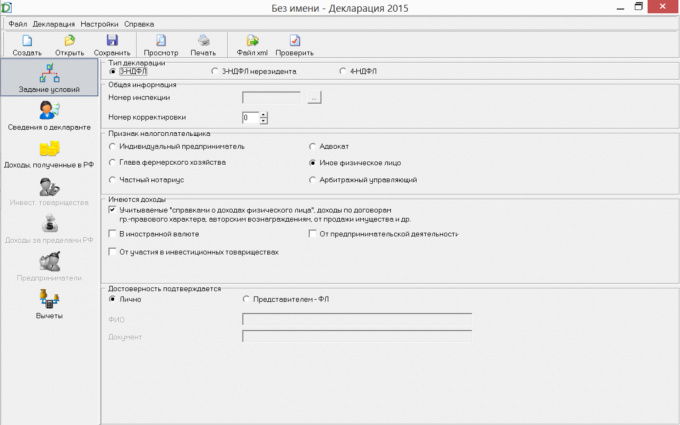

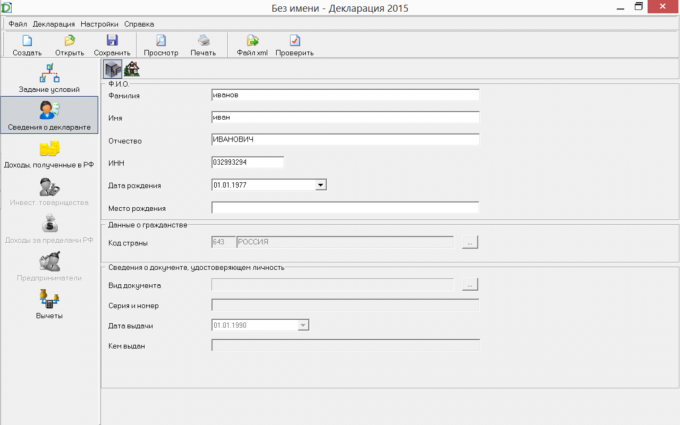

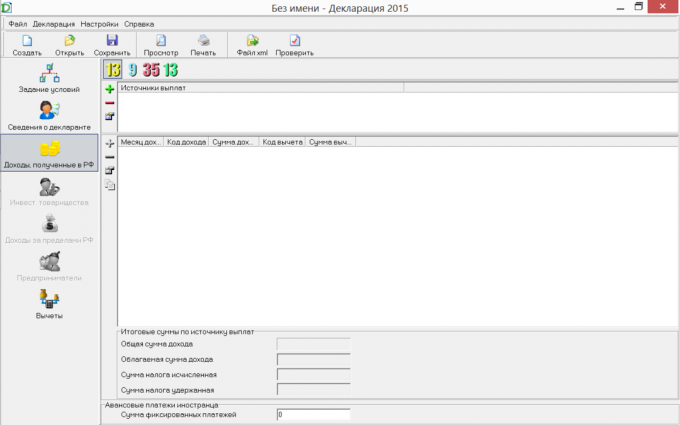

A desktop program FTS "Declaration"

The program is under the straightforward title "Declaration" can be filled and automatically generate tax returns of individuals on a 3-and 4-PIT PIT. Is a function of automatic verification of input data correctness.

To the program, affordable link, there is compendium and reference brochure (For individuals). Today it is the cheapest (free) way to create the necessary documents. Only need to print the received document - and you can go to the tax or send a registered letter.

Online service Tax Service

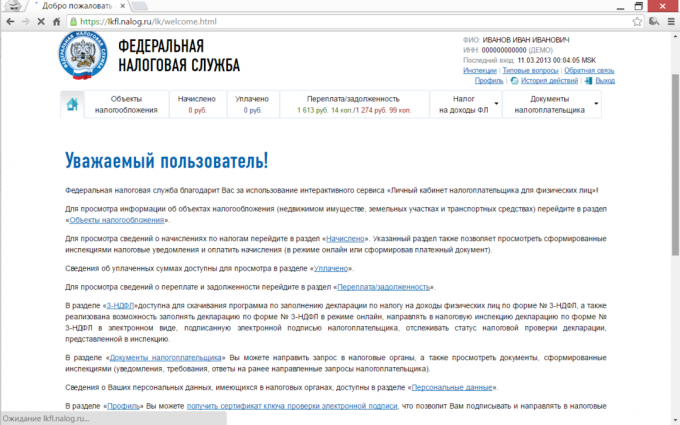

For the full digitization of the processes associated with taxes, federal tax service has created a multi-service "Personal account of the taxpayer for individuals». It can help you:

- receive information on the amount of accrued and paid tax payments, overpayments and arrears;

- receive and print notices and receipts, to pay taxes online;

- apply to the inspection on issues of interest;

- fill in the form 3-PIT and send it in electronic form (only in the presence of the electronic signature of the taxpayer), to monitor its status.

In general, the web service - a good and easy option as the preparation and e-filing. That's only access to the "My Account taxpayer" not so easy. There are three ways. The first - the middle complexity. He is the need to go personally to the tax and get registration card.

The second is for mere mortals much more difficult. Or need to have a qualified electronic signature, or to obtain universal electronic cardissued Certification AuthorityAccredited by the Ministry of Communications of Russia. Also need cryptographic software to create a secure connection.

The latter method is the most simple, accessible and does not require any additional gestures. If there is an account in Unified system of identification and authentication (ESIA) you can use it to access the tax reporting. But with a caveat. Suitable only for users who accessed to obtain the access details in person at one of the places ESIA presence of operators, such as the post office. Perhaps you are already a user ESIA system, if you have previously applied to public services website.

If necessary?

The described methods will save a lot of time and money. The cost of drawing up the help on a 3-PIT in specialized accounting services from 400 to 2000 rubles, depending on the area and complexity. In the presence of an electronic signature or an account on a portal of the problem of public services at all turns into a slight evening entertainment go somewhere or go without needed.