How to make the property tax deduction and get 260,000 rubles from the state

Get Rich Right / / December 20, 2019

Vadim Muratov

He knows how to get money from the state. Instagram profile: vadim_rafi.

Social policy of Russia in recent years is depressing. Since July 1, housing prices rose by 4%, all gasoline becomes more expensive, and now even the retirement age and VAT are going to increase. To pay for all of this will we, the ordinary citizens.

But is it possible to get something from the state? Yes, and it's tax deductible. If you buy an apartment, house, land for construction or other property, you can receive compensation of paid taxes - the same 13% income tax.

In late May, I collected the documents for the property deduction for the apartment and handed them safely to the tax. Now I am waiting for the money. This article will tell you what documents are needed to arrange everything right the first time, where to get the data to applications and information and what to do in the tax to less than standing in line. This instruction for those who submits a declaration on property deduction for the first time in my life.

How it works

Property deductions - state compensation for citizens who buy the property. State benefits in the form of returns of the income taxes that we paid. Since 2014 in the deduction is the upper limit 2 million rubles for the cost of real estate and 3 million rubles on the interest paid for the mortgage.

This does not mean that you get 2 or 3 million rubles, no. The state will pay only 13% - less than 260,000 rubles per apartment and not more than 390 000 for interest on the loan for the purchase of housing. That is just 13% of the 2 and 3 million, respectively.

If you took a mortgage before 2014, you can return 13% of any amount of interest paid without any restrictions. Does not necessarily apply immediately to deduct and for the cost of housing, and interest paid.

If the time of purchase of property you are married, it is considered common property. Since 2014, each spouse can receive a deduction for this apartment. It is important to be aware of the limitations of 2 million per person. If the apartment is worth 4 million rubles or more, then it's simple: each spouse as it invests 2 million of their money, so it can get the full deduction.

If the apartment is cheaper cost 4 million, then each spouse paid less than 2 million. Here it does not matter who is in a family working and getting better. This is a general property. Therefore it is necessary to distribute the share of the couple that there was no situation in which each spouse submits the maximum deduction, although actually spent on housing less than 2 million.

Example. Ivan da Marya married and a year later bought an apartment for $ 3 million. The family council, they decided that the share of Maria is 2 million, and Ivan - 1 million rubles. Mary receives the full amount of the deduction - 260,000 rubles, and the husband - 130 000 rubles. The next time you buy real estate Ivan could again apply for a deduction from his or her remaining 1 million and get another 130 000 rubles.

What documents are needed

- Help 2 PIT: written in it, how much you have earned and paid taxes for each month of the year. Ask in the accounting department at the place of work. If labor in several organizations, or changed a few employers - take it all.

- The tax return 3-PIT. Her we will build on their own in a program, I will show below.

- A document confirming the right to housing:

- certificate of state registration (if you buy an apartment until July 15, 2016);

- agreement on joint participation with the act of acceptance-transfer (if you buy an apartment on the contract of the equity);

- sales contract with an extract from the Unified State Register of real estate (if purchased after July 15, 2016 and the equity). Extract can be ordered at any time online Rosreestra described ways.

- Document confirming the payment: paper, which confirms that you have spent the money to buy an apartment, such as a receipt, bank statement, receipt, and the like.

- Application for deduction: download the form hereHow to fill - show below.

- Passport and TIN. They are not in the list of mandatory documents, but it is better to take the originals and copies (in the passport - pages 2-3 and page with registration).

If you have a mortgage, you need to take it further from the bank, where it was made out:

- document confirming the payment of interest on the loan;

- a copy of the credit agreement;

- a certificate of the amount of interest paid.

If you are married / single and apartment costs at least 4 million rubles, it is necessary to:

- copy of marriage certificate;

- a statement about the distribution of property between spouses deduction. example application watch here.

If the apartment is worth more than 4 million rubles, these documents are not necessary.

Council: better distribution share so that a large proportion was the spouse who pays more taxes. Then the total deduction will get faster.

How to fill in the blanks

Declaration 3-PIT

Slowly but surely, for state institutions are written program for completing the forms. 3-PIT is a special - "Declaration." download here, Install and run. For each year, a swing version. Below the pictures show that much to write and where to get the data. The example uses the version of 2017.

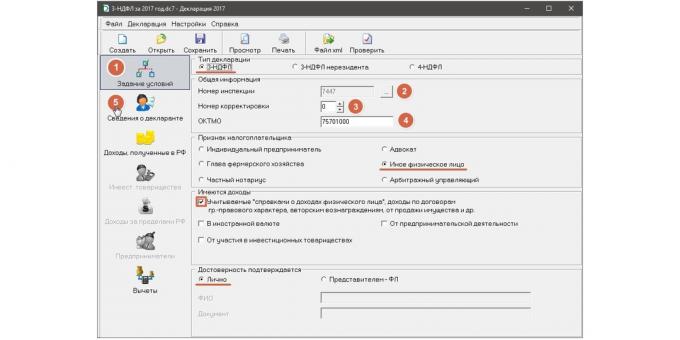

- Tab "Setting the Conditions." Select the type in the declaration - the 3-PIT.

- "Inspection number" - click on the ellipsis button, select the tax office of the district, which will apply. The first two digits - the area code.

- correct number - 0, as We submit a declaration for the first time and there is no patch.

- OKTMO - take here. Enter your region and locality, click "Find."

- We turn to the tab "About the declarant. ' Here your passport information and TIN.

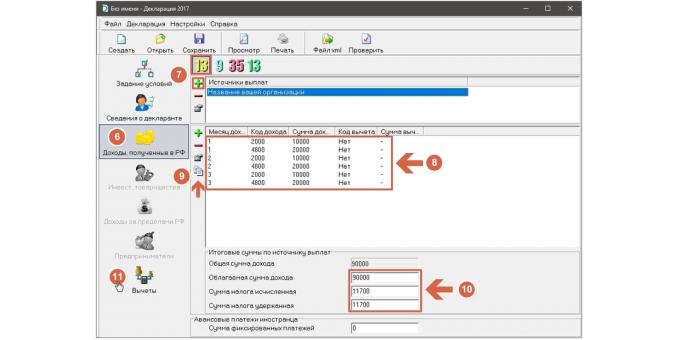

- Next tab "Income received in the Russian Federation." Choose yellow 13.

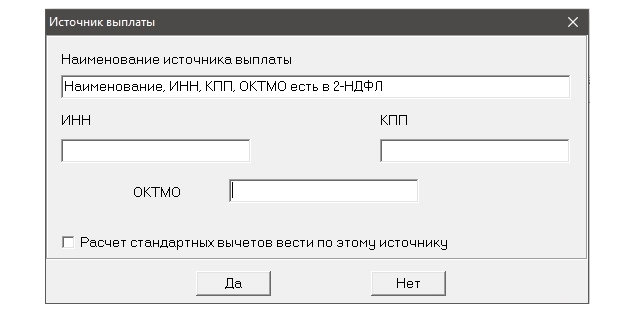

- The block "the source of payment" make data on the employer. All data is available in the reference 2-PIT. Click on the plus enter data. If employers had a few, all make. Checkbox at the bottom or place.

- Block below - your monthly income. Highlight block "the source of payment" of the employer and fill the revenue they will apply it to the employer. All data is in the 2-PIT. Click on the plus in revenue block, enter the code, the amount per month. Just type it from the keyboard, and not squander the list to select the code faster.

- If the codes and amounts of income are repeated, it is easier not to drive every time the numbers and highlight the revenue line and press the "Repeat income". correct if necessary.

- The taxable amount of income = total income. The amount of tax calculated and withheld - 2-PIT, these amounts are, normally 13% of total revenue. Taxes are driven without cents, rounding principle: from 1 to 49 cents - penny dropped, from 50 to 99 cents - is rounded up to the amount of the ruble in a big way. If you get 12 500.37 - write 12,500; If 12 500.76 - write 12,501.

- After making all the revenue go to the tab "Deductions" data. Uncheck "Provide standard deduction" and click on the "Property". Put a tick "Provide property tax deduction." The remaining tabs similar checkboxes be should not!

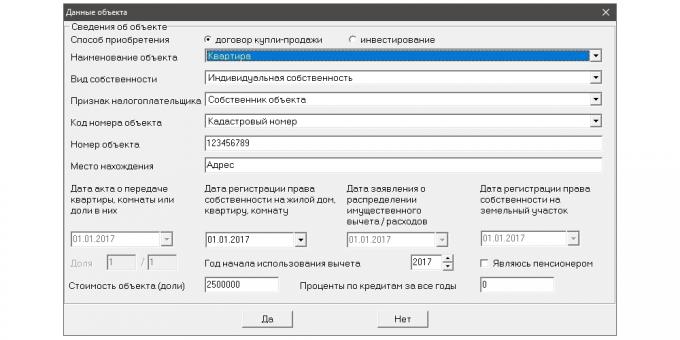

- Click on the plus and drive in their data.

- If you have participated in the joint construction, choose to invest in other cases - a contract of sale.

- Cadastral number of the object, or look in the certificate of state registration or in the contract of sale, or in the statement of USRRE.

- Date of registration take documents proving ownership.

- Year begin using deduction. If asked for a deduction in the past, then specify the year, when asked for the first time. If you previously did not request - the place in 2017.

- Project cost (shares): the price of the apartment sale and purchase of the contract. The interest that you pay the bank for a mortgage, here not included.

- Interest on loans over the years - for those who have a mortgage.

- Click "Yes", go back to the main window. "The deduction from the tax agent ..." - do not write it for the case when you get a deduction by the employer (this option is not considered here). The "Deduction of previous years' inactive since the beginning of the year, the use of deduction in this case, 2017 th.

The declaration is ready. Save it just in case. Mode "View" document can be printed or saved to PDF. Be sure to save the declaration, they will be useful in the future.

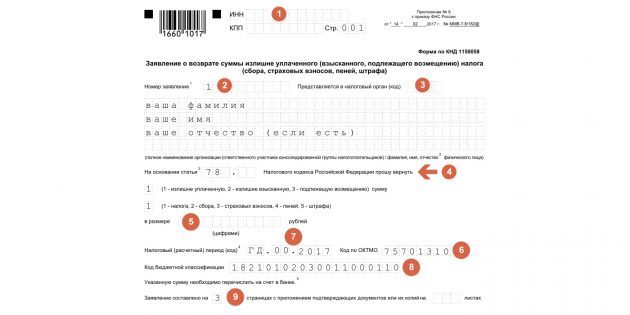

Application for property deduction

As there are only three pages, difficulties arise when filling only the first of her talk.

- At the top write your TIN. PPC leave blank, this is for organizations.

- application number — 1. If you are filing multiple applications for different years, then every year you need your statement. For example, if you get a deduction for 2016 and 2017, the request for 2016 write 1, 2017-th - 2. In our case - 1.

- It submitted to the tax authority - enter the code of the tax inspection, the same as in the Declaration of 3-PIT. Or see. P. 6 below.

- On the basis of Article: 78. After the point is not type anything. Below in place both fields 1.

- At the rate of: Type in the amount of taxes that paid in 2017. See it in reference 3-PIT in the 050 section 1 and in the 130 section 2. Fold, so get the deduction.

- Code OKTMO: This is not the code of the 3-PIT, is the code of your tax. take here here. Enter your address, the system will OKTMO code. Here is the code and tax office.

- Taxable period: Drive in GD.00.2017 if get a deduction for the entire 2017. If not for the whole year, on the last page of the form there are notes, which figures to write.

- Budget classification code: Enter 1821 0102 0100 1100 0110 without spaces. This tax code, which you pay to the budget, and it will return to you.

- The statement drawn up in3 pages. But copies of the documents consider themselves - how many sheets you get. It is better to fill as gather all of the documents that for sure. You can write by hand.

- Drive in the rest, as in the picture. Bottom left write the date when you go to the tax take documents. Do not forget to put a signature.

On the second page, specify the bank details. Tax can transfer money directly to a bank card. Details for the Savings Bank and "Alfa Bank" can be viewed in their mobile applications. At the bottom enter the nameplate data. If the field "Issued" is not enough space, it is reasonable to prune, do not write word for word.

re-enter the nameplate data on the third page.

All the application is ready. Now all you have to come to the tax, and to hand over documents.

How to apply

If you are going to tax, order card online. There are a number of advantages:

- You do not have to enter their data in the terminal compartment: Terminal screens capricious and do not allow the text to drive the first time.

- You will know exactly the date and hour of recording, quietly arrive at the appointed time.

- If coupons do not, you will learn about it in the office and at home / at work - will not be in vain to wander.

- Terminals sometimes buggy and do not give out the coupons: in front of me and it happened, people could not join the queue, and I just print out your ticket and went into the hall. Like a boss.

To order the card, go on linkAgree to the terms. On the next page, select the "natural person", type in the name and the name. If you specify the mail, you will receive a letter with the recording data. Next, select the region, department, where'll go surrender documents. Hauling - "Admission and tax accounting reports (incl.. 3-PIT) "Sub Services -" Acceptance of declarations 3-PIT ".

In the menu "Show days recording" choose a convenient time. Get out the window, type in the numbers from the picture and get a form with a PIN code. It is necessary to enter the terminal in the tax to get the card to the correct specialist. Next, we can only wait for their turn - the reception is in the range from 15 minutes of the card. This is normal.

Somehow, anywhere on the Internet do not write that, in addition to all of those securities that have brought with them, will have to fill out another one - an inventory of submitted documents. You can download application examples in the free form, but it is better to take a form in the office, because he was predzapolnen, you will only have to enter the number of pages of each document and its data. In addition, at the top right to appeal to the head of the department (about the same as you write in the application for leave to his head), and the name you hardly know. So it's easier to take the form to the tax, ask the name of the employee and the chief quietly fill in all fields. For each set of documents for a certain year - a separate list. Without it, the documents will not be accepted, so come on 10 minutes earlier admission coupons and fill in the blanks, it is short-lived.

Employee tax cursory check documents put visa and passport checks. Three months in the paper checked cameral department, and if everything is in order, for the fourth month the money will come into the account. If there are errors, called and asked to make changes.

Important to know

- Property deduction in the amount of 260 thousand rubles, the state provides only once.

- If you get paid in an envelope and do not pay taxes - the compensation will not be.

- If you bought an apartment until 2014, then you get a deduction under the law until 2014. Until 2014 the deduction tied to real estate and get it could only once, regardless of the price of housing. That is, if in 2013 you received a deduction for an apartment worth 1 million rubles (you back 130,000 rubles), then more to get the deduction, you can not. And getting to the next purchase up to 260 000 will not work. You plan to buy a new home? Then do not take a deduction from the old apartment, if it cost less than 2 million.

- After 2014 the deduction is tied to a person. So now you can several times to request a deduction from the different houses until you get your 260 000 rubles.

- Tax return for the last three years. That is, if an apartment bought in 2015, you can back taxes for 2018, 2017 and 2016. During 2015, the first tax return is not. If the amount of taxes does not reach up to 260 000 rubles for three years, then in the next year again to submit the declaration, and the state will return the taxes paid.

Example. At a salary of 30 thousand rubles a year, you pay the tax 30 000 × 12 × 0.13 = 46,800 rubles. It is less than 260 000 rubles, so will receive a deduction for nearly six years. Every year, you need to submit the declaration, and every year the tax will be returned to you on 46 800 rubles, or other amount - depending on how much tax you have paid in a particular year.

Do not be afraid zamorochitsya papers - compensation for it is more than pleasant. I hope this article was helpful. If you have questions, please write in the comments: everything I know on the subject - will tell. Good luck with residues, friends!

see also

- How to make a tax deduction and return 13% of the value of purchases →

- How to pay taxes: the answers to 12 key questions →

- What to check before you buy an apartment in the secondary market →