How to extinguish the mortgage ahead of schedule: to reduce the time or payment

Get Rich / / December 20, 2019

Layfhaker calculates all the options to find out which loan repayment strategy profitable.

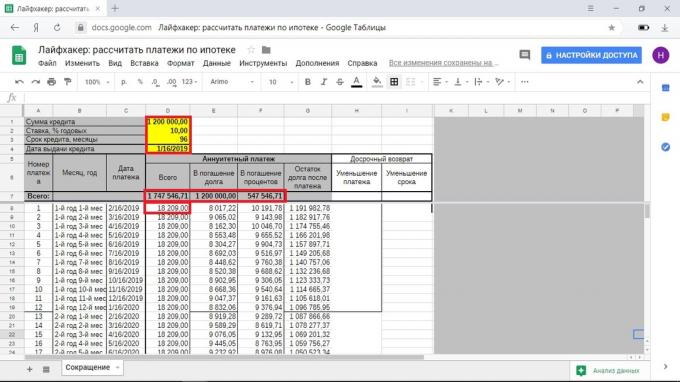

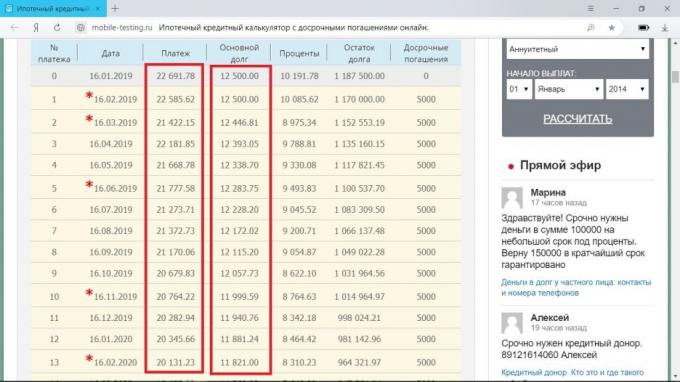

For the calculations take a mortgage loan in the amount of 1.2 million rubles under 10% per annum for a period of 8 years (96 months). Suppose that you have a monthly free 5000 rubles, which you want to send to the early repayment.

Conceptually, these calculations are suitable for your situation, but will have to perform calculations on their own for the exact numbers.

How advantageous to extinguish the mortgage payments under annuity

When the annuity payments on a monthly basis you are giving the bank the same amount on account of repayment loan. At the same payment structure varies in different months. Usually at first at least half is interest - the exact proportions can be viewed in your payment schedule.

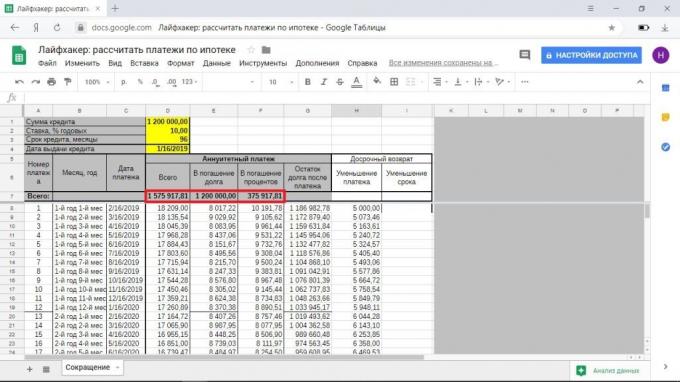

In our example, the monthly payment of 18,209 rubles. Just need to give the bank 1,747,546 rubles to 547,546 rubles overpayment.

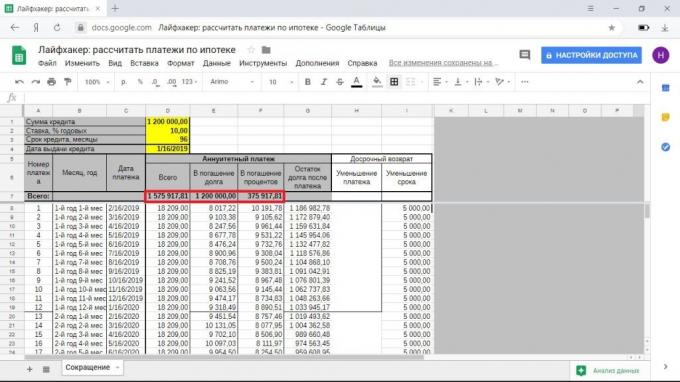

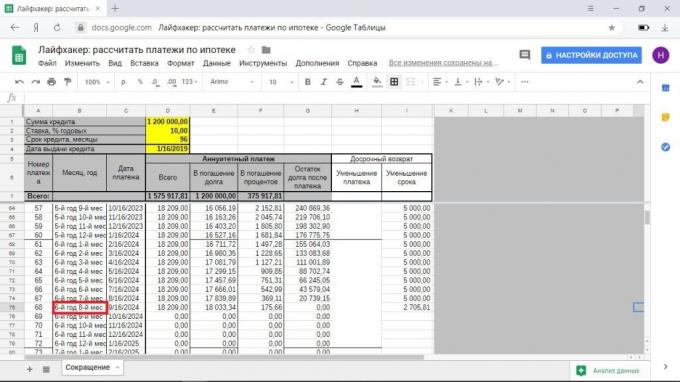

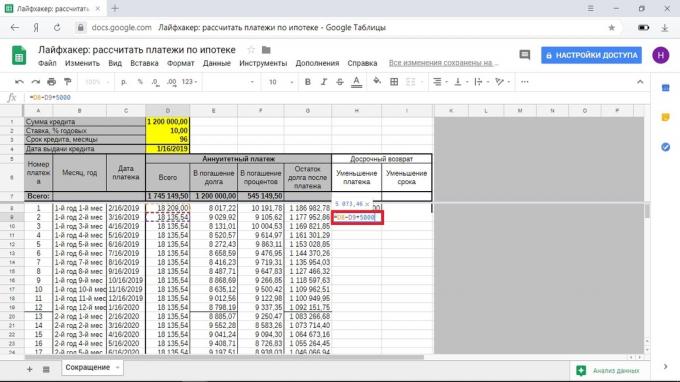

Early repayment of the reduction of

If the monthly pay extra 5 thousand rubles and to reduce the term of the loan, you will save 171,647 rubles to pay interest and to fully pay to the bank for 5 years and 8 months.

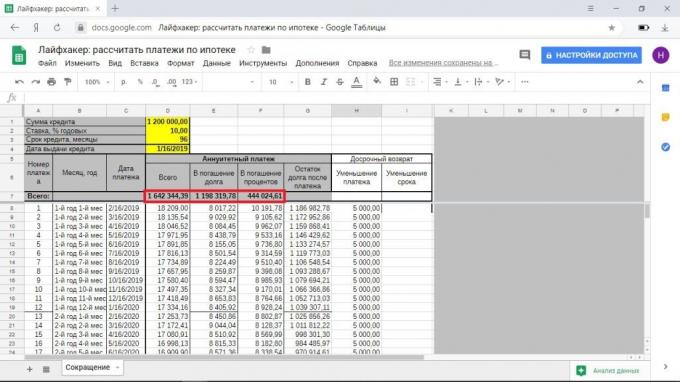

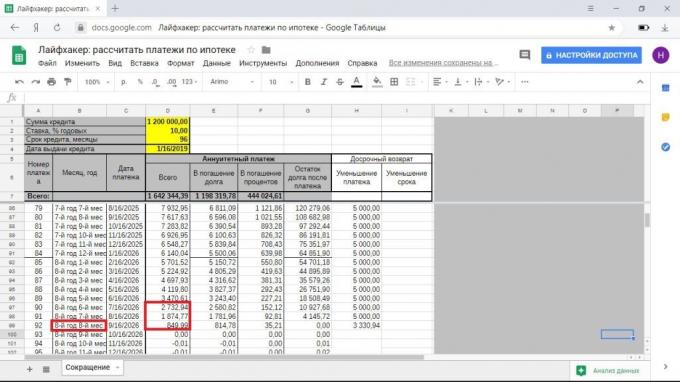

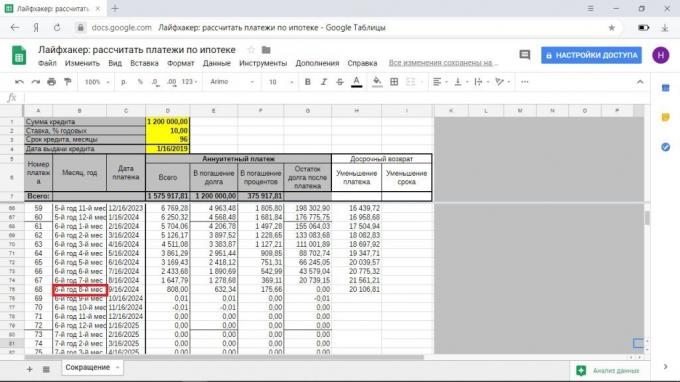

Early repayment of a decrease in payment

If you reduce the payment, you will save 103 540 rubles, the payment mortgage for 7 years and 8 months. In the last months of your payment will be so small (less than 5000 rubles), that you almost do not feel it.

Repayment with a decrease and an increase in the monthly prepayment

Early repayment of the reduction of the mortgage term seems more profitable to save more, are giving the entire bank debt faster. That's only when counting for the strategy of decreasing payment there is one thing: out of focus areas usually receive the difference between the initial monthly payment and reduce.

Payments made with the reduction period, you continue to pay 18,209 rubles + 5000 and parted with 23 209 rubles. With a decrease in the payment you start with the same amount and gradually go to 1874 + 5000 = 6874 rubles.

But you can add on a monthly basis to the amount allocated to the early repayment of the difference between the original and current payments.

In this case, you magically pay the mortgage in the same period and with the same overpayment that for early repayment of the reduction of.

If your financial situation will worsen once, you can always postpone the early repayment and reduce the amount to pay each month. When early repayment of the reduction period, you have no such luxury.

In addition, some banks are allowed to partially repay a mortgage online only with a decrease in payment, and for the reduction of the period would have to go to the office. If full-time meeting with employees of the credit institution is not for you, this repayment option is perfect.

conclusions

- If you are sure that you will always have money on the original principal payment and 5000 for early redemption, there is no for you difference as to repay: the reduction period, or a decrease in the payment of the third embodiment, if you give a monthly one and the same amount.

- If you suspect that your financial situation in a few years may worse, Choose early repayment of a decrease in payment and taking into account the difference between the initial payment and current. There will be problems - will go to the payments on schedule, with a monthly pay will have been significantly less than the mortgage starts. There will be no problems - to pay the mortgage as quickly and with the same benefits as those who prematurely snuffed out her life with the reduction.

- If the mortgage for you and now a heavy burden, but you are willing to somehow carve out 5000 rubles a month, go by reducing the payment. So you will repay the loan the same 8 years, but gradually you will become easier and easier. And save some work.

How advantageous to extinguish the mortgage payments with differentiated

Differentiated payments banks offer rare, but to get a mortgage with such conditions is still possible. In this case, the amount of principal is divided into equal parts, percentages calculated on a monthly debt balance. Therefore, gradually reduced the amount of payment.

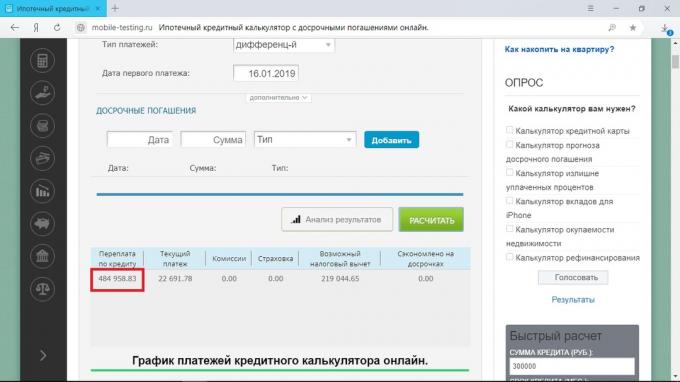

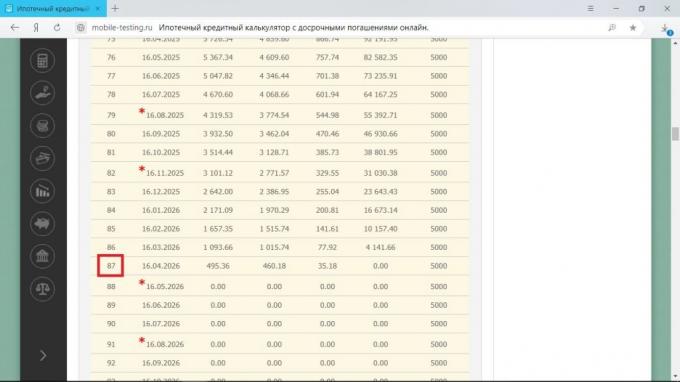

For the mortgage from our example in this situation, the overpayment will be 484 958 rubles, the payment for the first month - 22 500 rubles, the last - 12 604 rubles. To calculate the benefit, use one of the sites with the loan calculator, for example, mobile-testing.ru.

Early repayment of the reduction of

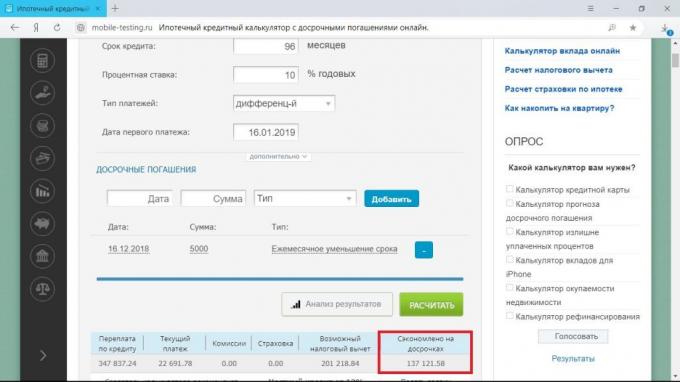

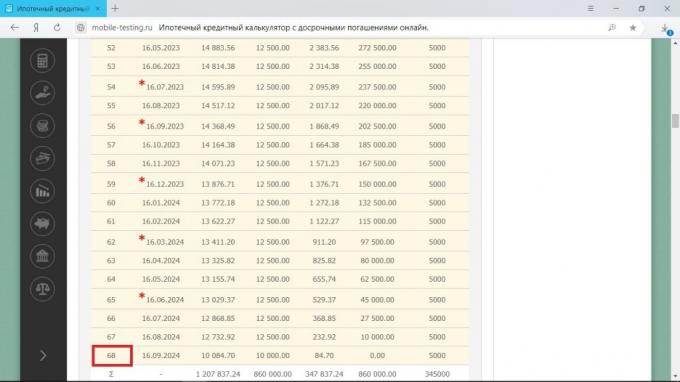

Total for 5000 a month, you reduce the overpayment Interest on 137 121 rubles and to pay the mortgage for 5 years and 8 months. In this month you will be given all the smaller amount due to differentiated payments.

Keep in mind that the calculator does not account for early redemption at the first payment. However, if it were possible, the figures would change slightly.

Early repayment of a decrease in payment

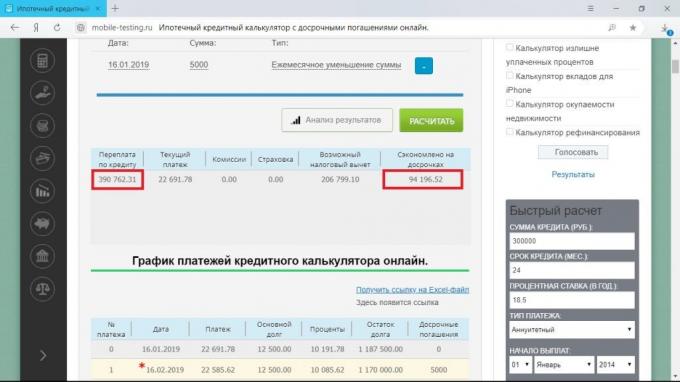

With the reduction of the size of the payment process also goes in the direction of decreasing both options, though not so fast. This is due to reduction of the share, a month going to the expense of repayment of principal.

It turns out that such an approach would be saved 94,196 rubles, a mortgage you apply for 7 years and 1 month.

Repayment with a decrease and an increase in the monthly prepayment

The difference between the original and current delivery is meaningless to calculate: it is formed mainly by reducing the percent. And payment will be reduced and so, depending on the enthusiasm with which you will extinguish the principal debt.

conclusions

- If you are satisfied with the size of the share of the principal debt in the structure of payment, reduce the loan period. monthly payout in any case will decrease faster than initially, by reducing the balance of the principal debt.

- The decrease in payment significantly tightens your relationships with the bank - in this case for 1 year and 7 months. Monthly payment in this case for the first time does not decrease as fast as we would like: compensations without dosrochek after years of mortgage its size will be 21 405 rubles, with early payment of a decrease in payment - 20 345 rubles.

see also🧐

- Rent an apartment or get a mortgage: it is more profitable

- Tax deductions: what is it and how to save them

- Things to know about the percentage of the loan, not to remain in debt to the bank