Making money with state investment

A Life / / December 19, 2019

What is IIS and what to know about it the common man

IMS - a special brokerage account that allows you to get a tax deduction of 13% of the brought funds or exemption from tax on income from investments.

The terms "broker" and "investment" in the financial world far removed from the people associated with something complicated, but in this case is very simple:

- You open the IIS now and make it a certain amount of up to 31 December this year. For example, 10 thousand and 100 thousand rubles. The maximum amount for which you can refill the account during the year is 1 million rubles. The maximum amount of the brought funds, which can be promoted tax deduction of 400 thousand rubles. Funds can be made at the expense of gradually during the year, both in the piggy bank.

- In January next year you fill out a declaration of the taxpayer. If IMS is open in a customer-oriented bank, a set of documents for the tax you will be sent on request to the office is convenient for you.

- Upon receipt of the declaration and conduct a desk audit, during which the tax checks in tax revenues, the state will provide you with a tax deduction of 13% of the brought to the IMS funds over the past year, but not more than the amount paid for the last year taxes. A tax deduction received on any given your current or card account.

Sounds too good. What's the catch?

The trick is not here, but there are a number of limitations:

- One person can have only one IMS.

- Submit to IIS can only rubles.

- If you close the IIS earlier than three years after opening, the tax deduction will have to return to the state received on this account.

How it works in practice

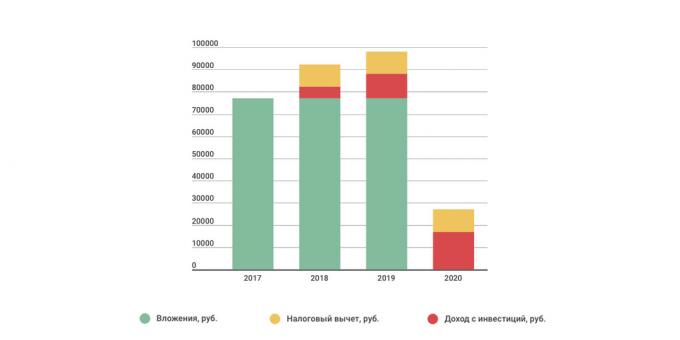

- In 2017, that is, right now, you open the IMS. Let's say your tax payments make up about 10 thousand rubles per year. Accordingly, you need to make to IIS that amount to 13% of it will be about 10 thousand rubles, that is 77 thousand rubles. With this money you buy securities with low risk and predictable returns, such as the federal loan bonds at 7% per annum. So you will earn extra income.

- In 2018 you fill out a declaration and get a tax deduction of 13% of the brought to the IMS funds in 2017, that is 10 thousand rubles, and extra income - 7% per annum on investment. Then make IIS more to 77 thousand rubles, and buy on their federal loan bonds.

- In 2019 you fill out a declaration and get a tax deduction of 13% of the brought to the IMS funds in 2018. It turns out another 10 thousand and additional income of 7% per annum on investment. Then make IIS more to 77 thousand rubles, and buy again on their securities with low risk and fixed income.

- In 2020, you fill in the declaration, and get a tax deduction of 13% of the brought to the IMS funds in 2019. It turns out another 10 thousand and additional income of 7% per annum on investment. When your IIS three years old, you sell all the purchased securities and close the account.

| Year | Attachments rubles. | Tax deduction rubles. | Income from investments, RUR. |

| 2017 | 77 000 | 0 | 0 |

| 2018 | 77 000 | 10 010 | 5 390 |

| 2019 | 77 000 | 10 010 | 11 157 |

| 2020 | 0 | 10 010 | 16 950 |

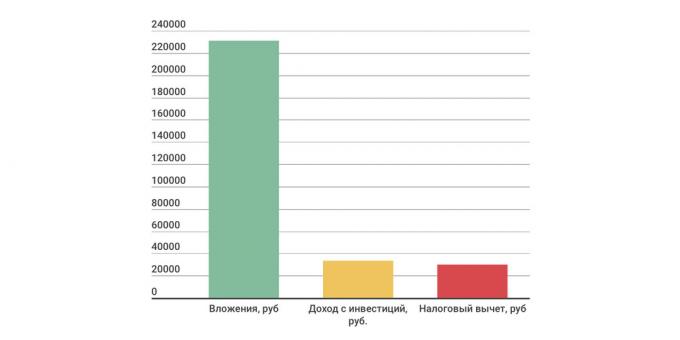

| in total | 231 000 | 30 030 | 33 497 |

| 294 527 |

The total amount of investments in the three years amounted to 231 000 rubles. Income from securities sold amounted to 33.5 thousand rubles. A tax deduction of 30 thousand rubles for three years. Total you have received income of 63.5 thousand rubles.

What you need to know about the benefits of IMS

IMS provides a choice of one of two tax breaks: Type "A" with a tax deduction of contributions and type "B" to the exemption from tax on investment. Owner of IMS itself determines the type of benefits. The above example demonstrates the benefit of type "A".

When choosing the benefits of the "B" of the tax deduction of 13% is maintained outside of the brought funds and from the income received from the investment. This option is suitable for those who have received income tax is greater than the deduction from the premium.

IMS is good because it allows you to select the type of privileges at any time, including before the closing account when investment results are already known. Note that if in any year of the existence of IIS was received deduction for type "A", then the residue of the type "B" will no longer be granted.

How to open your RIS

It all starts with choosing a reliable service provider. For example, "PSB", which has helped us in creating this guide, included in the list of systemically important banks in the Central list It is in the top 10 banks in Russia and is one of the largest brokers in the number of active clients in the stock and foreign exchange markets. These facts allow us to judge the reliability of, well, the benefits of the opening of IMS in the bank, you can judge for yourself:

- Opening a brokerage account and IIS online or at any office of the bank.

- Provision of free software: QUIK, webQUIK and webQUIK Mobile.

- Remote maintenance free account and analytical support.

- Free access to online banking.

- No subscription fee.

open IIS

IMS - an excellent tool for exploring the world of investment and financial literacy, as well as a handy tool for long-term investments.

Classic brokerage accounts are more suitable for short-term and medium-term investment. Unlike IMS, a brokerage account gives you access to all Mosbirzhi markets, has no restrictions on funds contributed to the course of the year and allows you to withdraw money at any time without having to wait three of the year.

Open a brokerage account