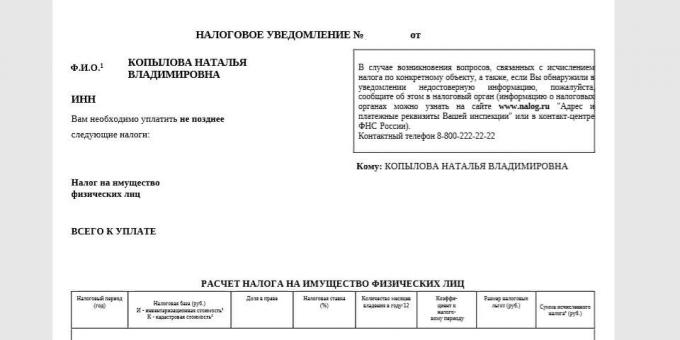

Every year, the Federal Tax Service sends tax notice, accrued in the previous year - by mail or in electronic form in the personal account on the site. The document shows how much, for what, and in what time you need to pay.

You will be notified if you have a house property, an apartment, a room (or a share therein), garage or parking space, under construction object car.

Why in the tax notice to make corrections

Errors in tax notifications are fairly common. For example, a resident of Lipetsk-invoiced annual vehicle tax for the sold"Shelves" of suffering five years ago the car. The fact that this is not a rare phenomenon, and indicated on the websiteIf you are charged the transportation tax on car sold FTS itself.

No matter how short-changed inspectors - have added more taxes or less - you is still unprofitable. Underpaid in any case will have to deliver. Perhaps, this time with penalties and fines.

You can enter once owned facility or select one of the available, to extend the term of tenure or fail to notice that you sold

carAnd count the tax for the whole year, not to take into account the benefits - lots of options. So ensure that the correct information is specified in the notification, it is necessary.How and where to correct errors in notifications

Previously, to make corrections, you had to go to the tax, to direct circulation by mail, register the personal account on the site FNS.

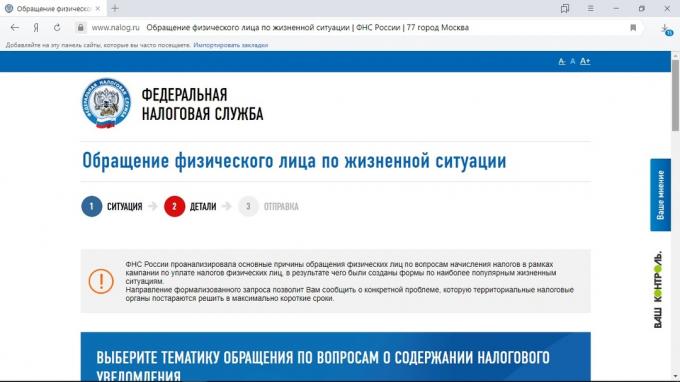

Now works serviceWhich allows you to quickly point out errors in the tax notice, with no registration and SMS.

You will be able to correct the shortcomings not only their data, but also to help older relatives who do not cope with this task, including remotely. It requires only the data of the tax notice and the internet.

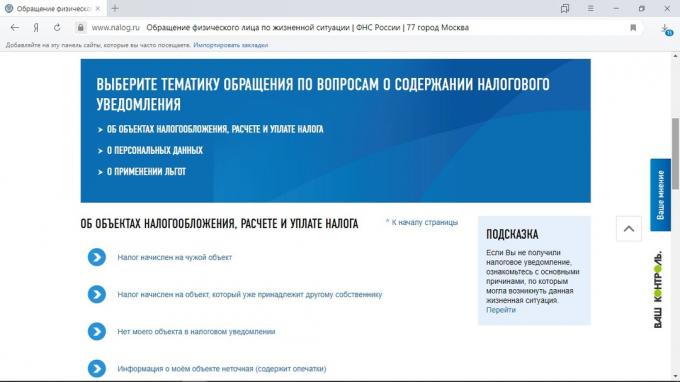

On the site you need to choose from a list, with what kind of problem you are facing. And if you do not find it in the list, use traditional form treatment. A choice of three types of situations:

- Incorrect information about the object of taxation;

- incorrectly referred to the personal data;

- problems, taking into account the benefits.

If your problem has got into the list of common and there are in the list, will have to fill in only a few fields.

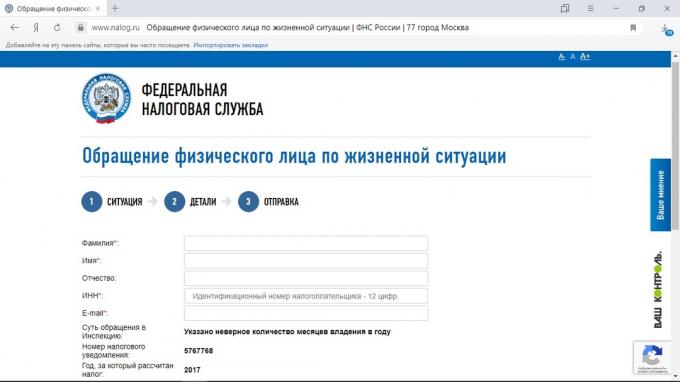

For example, in April of last year you sold the apartment, but the tax you have counted for all 12 months. Choose the category of "Indicated the wrong number of months in a year of ownership," and proceed to the filling.

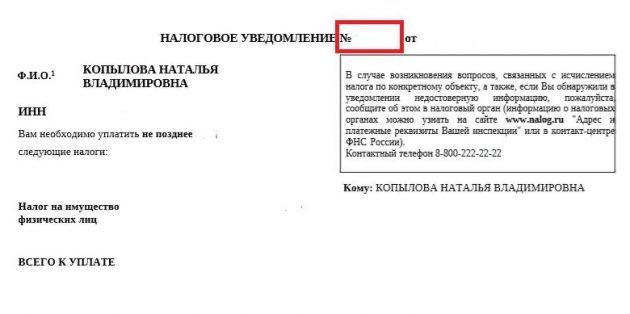

Specify how many months you actually owned the object. Other data from the write off of a tax notice.

On the next page, enter the name, VAT number and e-mail address (indicated his if to make corrections in the tax notice grandmother).

It remains to wait for an answer that comes to email. Usually the treatment takes less than 30FZ "On the order of consideration of applications of citizens of the Russian Federation" days. In practice, the answer often comes much faster.

see also🧐

- How to pay taxes: the answers to 12 key questions

- Tax deductions: what is it and how to save them

- How to find tax arrears