How to arrange liability insurance policy tool in the office and on the Internet

Right Educational Program / / December 19, 2019

What is liability insurance policy tool and what to make out of it?

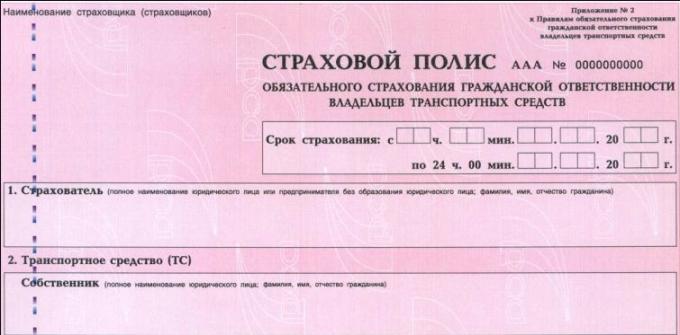

CTP stands for mandatory vehicle liability insurance. Policy - a document that you have signed a contract with the insurance company. The type and content of the policy is strictly uniform. Goznak prints documents. They are distributed by the Russian Union of Insurers (RSA).

This policy CTP slightly larger than a standard A4 has a watermark RSA, red blotches, metal strip and QR-Code. Serial number - convex.

According to the Rules of the road the driver must always be in possession of the right, the documents on the car and insurance. Driving with an expired insurance policy CTP or without punishable by a fine of 500 rubles. If the policy is not all, will have to pay 800 rubles.

When buying a new car you have 10 days to insure it. Prolong the contract is not necessary before one month before the expiry of its term. For example, if the policy is valid until March 1, 2018, it is already February 1, you can go to the insurers.

The standard term of the policy of compulsory motor insurance - 1 year. Minimum - 20 days (when you need to overtake the car to the place of registration or the technical inspection).

What are the policies CTP?

According to the number of persons admitted to driving, compulsory motor insurance policies are:

- Limited (specify the exact data of drivers, a maximum of five).

- Without limitation (to drive anyone can).

According to the term of the most common three-month, six-month and annual policies CTP.

In form they are divided into paper and electronic.

Which is better: an electronic or paper MTPL policy?

Before going to the insurance company or to issue a policy online, weigh the advantages and disadvantages of each method.

If there is a paper policy traffic police less nagging. It can even arrange for a new car and on the driver's novice, data are not yet present in the base of the PCA. But there are also disadvantages:

- The imposition of additional services insurers.

- Red tape and the lack of forms.

- Spending time.

The main advantage of the electronic policy CTP is available. If data about you and your car is in the X-ray system, everything can be done in a few minutes without leaving the couch. The price is the same, and do not have direct contact with employees of the insurance company. But e-CTP is not without drawbacks:

- Difficulties in checking the policy traffic police inspectors.

- Due to technical failures can be overdue insurance.

- There is a risk of running into a site-clone insurer.

- Not available evroprotokol.

- It is impossible to arrange for a new car.

How to arrange liability insurance policy tool in the insurer's office?

To get a policy, you need to file an insurance company office several documents:

- Statement on the conclusion of the contract (sample). Usually filled on the spot.

- Passport and a copy of it.

- The certificate of registration of the vehicle (STS) or vehicle registration document (TCP).

- Copies of driver's licenses of all who will be entered in the policy (for CTP with a limited list).

- Diagnostic Card (simply - MOT) for vehicles older than three years.

- Old MTPL policy (if any).

An employee of the insurance company, on the basis of the data provided, calculate the cost of insurance, will make a corresponding agreement and issue a receipt for the payment.

If you are satisfied, sign, pay and get your hands on a copy of the contract, the policy with the seal and signatures, as well as two forms of notification of an accident.

On January 1, 2018 increased to 14 days, the so-called cooling period. This is the period during which you can cancel the insurance contract.

How to make MTPL policy online?

Electronic compulsory motor insurance policies introduced as early as 2015. January 1, 2017 their registration became mandatory for all insurance companies. But not all have introduced this capability on their sites.

In order not to waste time looking for insurance, which will issue you a liability insurance policy tool, use the service sravni.ru.

There you will be able to immediately calculate the cost of insurance, simply enter your license plate number or brand, year, and so on. Service show you offers popular insurance companies, as well as their rating based on user reviews. Will only choose a company and order policy.

Electronic policy of compulsory motor insurance (e-CTP) has the same force and value as the paper.

Printed on regular printer paper can be replaced by a form of Goznak.

To order e-CTP insurer on the website, you need the following:

- Sign up for the insurer's website. Scroll down to the "My Account" and fill in the required fields. Usually F. requested AND. O., date of birth, series and number of passport, registration address, telephone number. You must enter valid information: insurance company will verify the data through the PCA framework.

- Log. After checking the insurer will send you by mail or phone password to log in to "My Account". It will serve as an analogue of a simple electronic signature of the insured. Also on the websites of some insurance authorization available through the "Public services".

- Calculate the CTP and fill out an application for insurance. This will require information on the previous policy, the insured, the car, the driver admitted to management. These data will also be checked through the automated information system of the Russian Union of Insurers.

- Pay electronic MTPL policy. This can be done with the help of credit card or electronic payment systems. The contract is deemed concluded from the moment of payment.

- Print e-CTP: it will be easier to communicate with the traffic police. Typically, the document is stored in the "My Account" or sent by e-mail.

Which insurance company to apply?

Choose a reliable insurer.

It is recommended to at least check out a license and read reviews on the Internet. The auto insurance market a lot of scams.

Buying insurance in a little-known organization, be sure to check the authenticity of the policy on PCA website.

How is the CTP and what can be saved?

Calculate the cost of the policy, you can use a special CTP calculator. This is at the Russian Union of Insurers, as well as on the websites of almost all insurance companies, and many portals to avtotematikoy.

But before you fill in the fields in the calculator, it is necessary to understand the reasons you can save.

Mandatory auto insurance consists of the base rate and the seven factors. For passenger cars category B and BE calculation formula is as follows.

CTP = TB × KT KMB × × × KO FAC KM × × × CS CN.

- TB - the base rate. Fits CBR varies from 3432 to 4118 rubles. The smaller the rate of use of the insurance company, the CTP would be cheaper.

- CT - coefficient territory. It is determined by the place of registration of car owner. For Moscow area ratio is equal to 2, and for resident, for example, Kurgan region - 0.6. Then you can save only if you are ready to register away from the capital or to issue the car a relative from a remote part of Russia.

- MSC - coefficient bonus malus. This break-even discount for driving the longer driving without an accident, the lower the rate. Learn your MSC on the site of the Russian Union of Insurers.

- KBC - age factor, and time. For experienced drivers is one, and for beginners under 22 years, who behind the wheel less than 3 years - 1.8. This significantly increases the cost of insurance. Experts advise to get the right just after the majority, even if the plans get the car yet.

- KO - coefficient restrictions. Insurance with a limited range of vehicle approved for the management of persons less: the coefficient is equal to one. Coefficient unlimited insurance - 1.8.

- CM - Power Factor. The more powerful engine of the car, the higher vehicle tax and the cost of insurance. Remember this, when will be going buy new car.

- KS - utilization period of. In the standard annual insurance it is equal to one. But if you go by car only in summer, but in winter they are driving it in the garage, why pay more? COP at six months is 0.7.

- KH - coefficient violations. It can be excluded from the calculation, if not prevent gross violations, such as the intentional infliction of life and health, drunk driving, hiding from the accident scene, and so on.

You know more life hacking saving on car insurance? Write them in the comments.

see also

How to start the car, if the battery is mounted →

Should I include automotive air conditioning if the windows is less than zero →

How to charge the car battery →