How credit history to find out the cause of failure in the credit

Right Purchases / / December 19, 2019

Let's say you have been denied in the fourth pot, and you request a credit history to find out the reasons. Our guide will help you understand why you are considered unreliable borrower.

Roman Shards

editor service mycreditinfo.ru.

Credit histories are stored in the credit bureau (CRB). In Russia, 13 CHB, and although each has its own display format for credit history, only external differences: the structure and the same content.

Once a year you can get a credit history in any Office for free.

Discover🏦

- How to check the credit history

In this article we will dismantle the credit report of the largest credit bureau - NBCH. Other reports can be read by analogy.

1. Enjoying summary

Credit history is made up of four parts. The first part is called title. It contains a summary of your loans.

Late payments

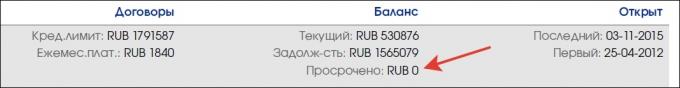

In the column "Balance" find the line "Past Due." Here you specify the total amount of overdue loan payments. If there is zero then, at the time of check you regularly pay for

loans. Any number other than zero means the delay. In this case, the new loan will be denied. Need a loan - close delay.

negative credit

In the column "Account" look at the line "Negative." Negative are called loans for which the delay has passed for three months or has reached the judicial foreclosure. It can be active or closed loans. The more negative the score, the less likely to get a loan.

To reduce the impact of negative credit, improve credit history of small loans, but not in the MFI. use credit card or take on credit, such as a refrigerator. This will help restore the reputation of a reliable borrower.

Note the number of loan applications:

Banks have a negative attitude to the following indicators:

- Many applications in a short period of time, for example more than three per month. This demonstrates that you are in urgent need of money and you are not very picky in choosing a lender.

- Reject applications at times more than approved. For example, you have filed 58 applications for loans, and you have approved a total of 8. Bank sees all the previous failures and will be automatically denied.

Do not try to take credit unceremoniously. Like, do not give a loan at one bank and go to another, and then the third and so on. All faults are displayed in the credit history and reduce the chances of loan approval.

2. Check personal data

The personal data fall into the credit history of the loan applications. You are filled with such claims, when they tried to get a bank loan. Personal data should be checked for authenticity and "constancy".

reliability

It happens that your credit history is written incorrectly the name, date of birth or address. I could be mistaken himself borrower in completing the application, and the bank employee, which transfer data from paper to the computer. For example, in the passport you Ivanov, and credit history - "Yvonne". In considering the application the lender compares data from documents with your credit history. If there are discrepancies, refused a loan.

Check credit history for errors in the personal data. If you find, write an application to the Bureau, which received a credit history. Terms of credit history fix at the three major bureaus is available at:

- NBCH;

- BCI "Equifax";

- United Credit Bureau.

consistency

Personal information is updated in credit history as it updates in the applications. And the more I have this information, so much the worse. Banks appreciate persistence. If you change every year address or phone number, banks can consider your credit cheater and refuse to credit.

To convince the bank that you are not a crook, come to the office and tell us about the causes of frequent relocations: looking for a job in different regions or live with relatives.

3. Parse individual loans

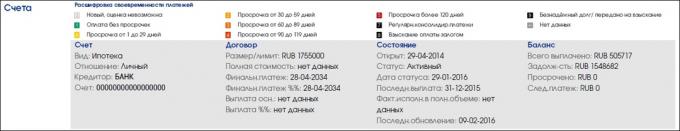

Information on individual loans is in the section "Accounts". This section is easy to find on the colored squares:

active loans

Find active loans and look at the payment schedules. Active loans - those that you pay today.

One square - one month. Green squares - everything is in order, you pay no delinquencies. Gray squares indicate that in some months, the bank did not give details on payments.

Poor, if in the green and gray squares meet squares of other colors. They talk about delay.

Closed loans overdue

Banks pay attention to them, if there are no active delinquency. Important delinquency depth and the loan closing date. If you shut down six months ago, credit overdue for more than three months, the new loan is likely to be denied. Over time, the chances of the loan will increase.

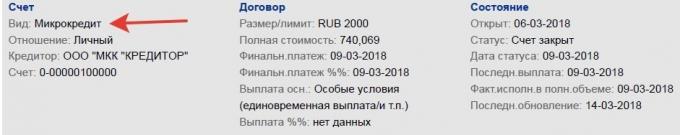

microloans

Check the number of microloans. Banks do not trust borrowers, who regularly "intercept to paycheck." If you take a micro loan every six months - this is normal. Often - bad.

Also keep in mind that banks are more loyal to the active borrowers. If you have exemplary credit history, but the last five years, you did not use loans, the bank can refuse. Therefore, refill the credit history of new information from time to time.

4. We study the reasons for the refusal

After the partition of the "Accounts" section, you will find "information part". It displays your applications for loans and their status - approved or rejected. In the event the application the lender indicates the reason:

There are five reasons for the refusal:

- Credit policy of the lender - the vague wording. It means that at the moment banks are not lending borrowers with your options. This may be the age, education, income, residence and so on.

- Excessive debt burden. Bank Compare your income with payments on loans and saw its excess credit load. The permissible level - when the loan payments (including the planned credit) does not exceed 35% of revenues.

- Credit history of the borrower. Bank examined your credit history and considered it her insufficient positive.

- Inconsistency information about the borrower, the borrower specified in the application, the information available to the lender (creditor). What to do with this reason, we have told above - see "Check your personal information."

- Others. The lender could not choose one of four reasons.

According to my observations, the most common cause of failure - the credit policy of the lender. Probably because it is the "spacious" and peremptory. Alas, this reason does not give specific direction for the analysis, therefore, the borrower will have to go through all the possible options for the refusal.

Check list

If you do not give credit, get credit history and check:

- The title of the - delay size, negative account, the number of approved and rejected applications for loans.

- In the personal information - the accuracy and "constancy" (change of address and phone numbers).

- In the "Account" - payment schedules and the number of microloans.

- In the "information part" - the reasons for refusal in credit history.

what to do not necessary:

- Throw banks for loans. It will spoil the credit history.

- "Correct" credit history microloans.

- Search specialists who "will call where to" and immediately fix credit history. Plucked to fraudsters.

see also💰

- What are credits and that they can buy

- Can I take out a loan if you are officially unemployed

- Things to know about the percentage of the loan, not to remain in debt to the bank