"My checks online": why tax data on purchases

Miscellaneous / / July 31, 2021

The new service collects information about your spending on the Internet and not only.

What information is stored by the tax authority and how it receives the data

In February 2021, the Federal Tax Service launched a service "My Checks Online" for storing electronic checks of citizens. This is a third-party resource, it is not tied to a personal account on the website of the tax authorities or to "State services".

By promiseFTS is developing a service for storing electronic checks / FTS FTS, information comes to their repository on a voluntary basis only. The data will be recorded in the service only if you gave the seller a phone number or email. You can also scan the QR-code on a paper check with the Federal Tax Service "Check Check" application - links to it will be below.

At the same time, the service promises that you can always refuse to process data. It is enough to get a paper check instead of an electronic one. In this case, the information about the purchase will go to the tax office, but it will not be tied to you in any way, even if you pay for the goods by card.

Another thing is that the connection of purchases with a specific taxpayer gives the inspectors some food for thought. For example, why does a person monthly spend amounts with many zeros, although he has no official income. Therefore, the position of the Federal Tax Service may change at any time.

However, if the tax authorities want to collect data on our purchases, they will start doing this and will not even tell us.

Why did you create the service "My Checks Online"

The Federal Tax Service explains this exclusively by concern. The agency promises that the service will allow citizens to keep checks in one place and get easy access to them. And electronic documents, unlike paper ones, will not fade and will not be lost.

But there are goals that are even more global: concern for health and the environment. Checks are printed on thermal paper using special chemicals. One of them, bisphenol A, is quite toxic.Update on Bisphenol A for Use in Food Contact Applications: January 2010 / FDA. And in general, printing documents that are likely to end up in the trash can in a minute does not look very reasonable.

Some stores are already offering customers to replace paper checks with electronic ones, including Azbuka"Azbuka Vkusa" proposes to abandon printed receipts / "Azbuka Vkusa" taste "," Pyaterochka "In "Pyaterochka" there is an opportunity to refuse paper checks / Retail.ru, "VkusVill"VkusVill will help replace paper checks with electronic ones / "Vkusville". For retailers, this is not only a way to express an environmental stance, but also savings. Printing of one check, according to the tax authorities, costs 10–20FTS is developing a service for storing electronic checks / FTS kopecks.

How the service "My Checks Online" works

The site is extremely straightforward. To log in, you need to enter your phone number and then enter the code that will come to you via SMS.

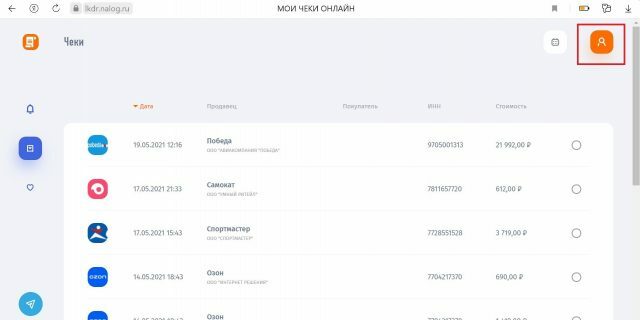

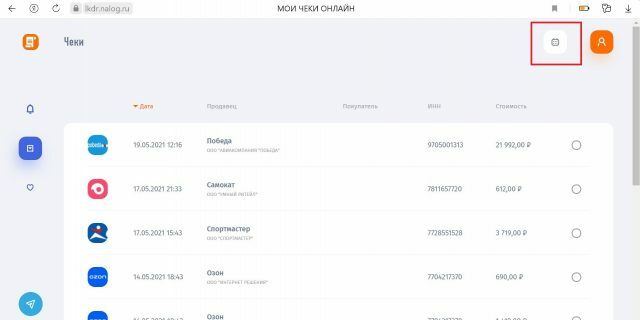

And you will have access to electronic receipts, data about which is in the system. Includes purchases made since June 2018. Basically, you will see in the list of purchases that paid for online. But if you asked for an electronic check in an offline store, the document will also be reflected in the service.

If you click on a specific line, you can see the details.

By default, the list will contain receipts linked to a phone number. But there will be more of them if you add email to your profile.

The service allows you to group receipts by date.

There is also a tab with notifications and partners. The latter are still few in number, but in the future the FTS promises bonuses and cashback.

The service also exists in the form of mobile applications.

FSUE GNIVTS FTS of Russia

Price: Free

Download

Price: Free

FTS of Russia

Price: Free

Download

Price: Free

What things will the "My Checks Online" service help with?

One of the first emotions that a new service evokes is alertness. Many expect a trick from government developments, and it is difficult to reproach such people for being too vigilant. But data on a significant part of online purchases are already stored in one way or another with the tax office. So let's try to find the pluses. And they are.

Store receipts in an orderly way and quickly find the one you need

Checks are important documents that confirm the fact of payment for the goods. Now in electronic form, they come at random. Some stores send them by mail, others send QR codes by which you can go to the document itself, and still others send SMS with links.

So the problem of storing receipts is not far-fetched, especially for those who make a lot of purchases on the Internet. You need to create a separate folder in the email or come up with another way to collect them together. If this is not done, the search for a specific document can turn into a difficult quest.

Skeptics say the same information can be found in the mobile banking app. This is not entirely true. The bank statement will tell you where and how much you spent. The check contains a specific list of goods. It happens that a transaction hangs in the same application, for which the memory fails: it does not work out in any way what kind of purchase it is. Checks help out in this case.

Maintain a budget

If you take into account income really scrupulous, you know how long it takes to transfer data from receipts. If you do not do this immediately after purchase, the documents must be stored somewhere. And sometimes the list of purchases is very long and includes products from different categories. So you won't be able to copy the total amount, you need to split the purchases into separate columns. If you have an electronic check, it is enough to learn how to copy and paste.

Solve problems in controversial situations

If you need to return an item, exchange it, repair it under warranty - a document confirming the purchase is required. Paper checks really do fade. Sometimes, after a year, they turn into a white piece of paper without any identification marks.

Electronic checks do not have this drawback. And the service allows you to store in this form and documents that were originally paper. We have already said above that this can be done using the Check Checker application - just scan the QR code.

FSUE GNIVTS FTS of Russia

Price: Free

Download

Price: Free

FTS of Russia

Price: Free

Download

Price: Free

Draw up a tax deduction

As conceivedFTS is developing a service for storing electronic checks / FTS FTS, in the future, the service will automatically calculate the amount of tax deduction when buying drugs. The taxpayer will only need to indicate the account to which the money will be returned.

But in general, checks to confirm payment for tuition, treatment and other expenses to receive tax deductions are needed today. And the service allows you to save them as separate documents.

What to do to prevent tax authorities from keeping your electronic receipts

Now it is enough to shop offline and receive paper receipts as proof of purchase.

You will have to give up online purchases. When making payments on the Internet, the seller mustFederal Tax Service Letter dated September 26, 2017 No. ЕД-4-20 / 19359 @ "On consideration of the appeal" send you an email check. So the data will automatically go to the tax service.

Read also🧾💰🖊

- Where else is the "Gosuslug" account suitable for authorization and how it will make life easier

- How to issue a tax deduction through the FTS website: step-by-step instructions

- How to get an extract from the USRN online and offline: step by step instructions

- How to get cashback for a trip to a children's camp

- How to learn to save in 7 days and reinforce the habit

I am writing for Lifehacker about money, law and rights, things that help to live easier, better and more fun. And, of course, I check the advice for myself: I get tax deductions, I file tax returns online, and I paid off my mortgage ahead of schedule and forced the mail to find my package.