Why invest only in rubles is strange

Miscellaneous / / July 31, 2021

You can earn more by looking at other currencies and countries.

Because exchange rates fluctuate

Currencies are different: some are stable, others are not. The former usually include reserve currencies - those that are often calculated in the world economy and which buy central banks of different countries: dollar, euro, yen, pound sterling, Swiss franc and yuan. By contrast, currencies in poor and underdeveloped countries are unstable.

For example, the value of currencies is affected by inflation - the general rise in prices for goods or services.

The Venezuelan bolívar lost almost 3000% of its value in 2020, and the dollar - 1.36%.

If an investor were to buy shares in a Venezuelan company for bolivars, he would be at a loss because of inflation alone.

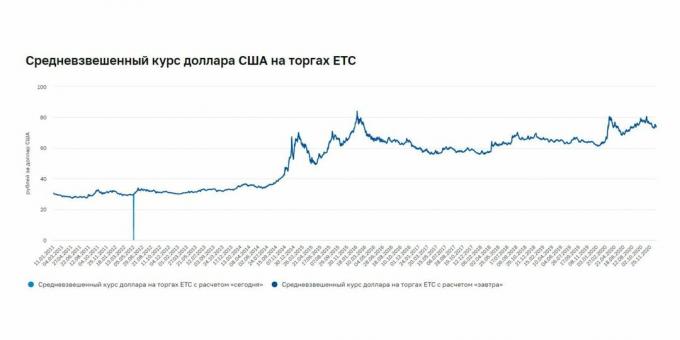

The ruble is closer to the dollar in terms of inflation than the bolivar - the Russian currency lost 4.9% over the year. But the ruble is not very stableDynamics of the US dollar and euro against the ruble and exchange trading indicators / Bank of Russia

for other reasons: due to sanctions in 2018, its exchange rate fell by 13%. And in the last ten years, it has fluctuated like this almost constantly.

Suppose an investor deposits the same amount for a rainy day in rubles and dollars every month. He does not invest this money anywhere, but simply hoarding. That's what inflation will do to them.

| Currency in 2011 | Currency in 2021 |

| 100 dollars | US $ 119.67 |

| 100 rubles | 185.55 rubles |

Both currencies fell in price, but their purchasing power remained different. It shows how many goods and services can be purchased for a certain amount. Let's say that in 2011, one hundred rubles would be enough for almost three kilograms of buckwheat, in 2021 - for less than two.

But even the US dollar loses more value than some other currencies. The annual inflation of the Japanese yen, for example, is only 0.56%, and the Swiss franc - minus 0.21%, that is, it has also risen in price.

The downside of currency stability is low profitability. Everyone has a riskWhat Risks Lurk in Each Asset Class? / Morningstar asset, and the higher the potential profit, the higher the probability of loss. Conversely, a low profit usually means that the risk of losing money is also small.

Investors don't like taking too much risk, but they also don't like making a penny. So they came up with currency diversificationWhat's in Your Portfolio? The Role of Various Asset Classes / Charles Schwab: investors choose several different currencies in which they will invest money and protect themselves from exchange rate fluctuations.

This makes sense because exchange rates are constantly affected byCurrency ETFs / Charles Schwab many factors:

- change in interest rates;

- intervention of central banks in the economy;

- economic events such as material shortages due to increased demand;

- the course of international trade when a container ship obstructs the Suez Canal and supply chains are disrupted;

- political decisions;

- international conflicts;

- natural disasters.

If investor is invested in only one currency, then he will not be able to protect himself from these risks. How many currencies to pick depends on the strategy, but J. P. Morgan, an investment bank, advisesWhy is currency diversification important? / J. P. Morgan private bank at least two or three. And along with them - investments in different countries and industries.

Because different countries have different strong sectors of the economy

The Russian stock market is not the largest and most diverse. In fact, it consists of three sectors of the economy: energy, mining and financial - they account forBroad Market Index, March 2021 / Moscow Exchange 78% of the value of companies. This means that if an investor buys an ETF with Russian shares, he invests in specific sectors.

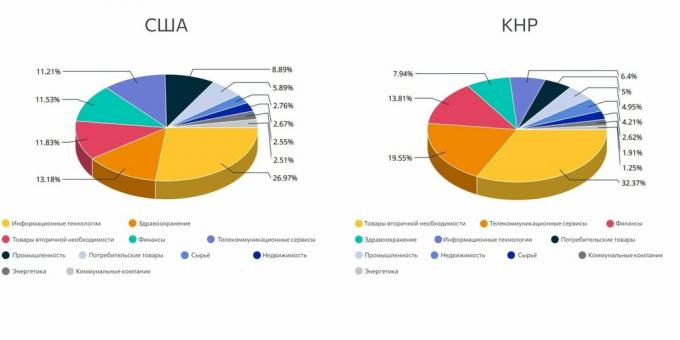

Russia is not unique - the economies of almost all countries are skewed in different directions. For example, even in a diversified US economy, more than half of the stock market accounts forMSCI USA Index / MSCI into three sectors: information technology, health care and secondary goods (cars, clothing, household appliances). Almost the same in China, only few sectorsMSCI China Index others: secondary goods, telecommunications companies, and finance.

Here, the same principle remains as with ETF: when an investor buys a fund with American or by Chinese companies for rubles, it acquires a non-ruble asset: corporations are settled in dollars or yuan.

Investments in the leading sectors of the stock market are essentially investments in the country's economy as a whole, including the national currency. For example, the oil and gas sector is gradually losingOil and gas after COVID-19: The day of reckoning or a new age of opportunity? / McKinsey & Company investors and profits. Accordingly, countries whose economies depend on oil and gas lose budget revenues and currencies weaken.Loss of the ruble in the coronavirus year. What's next / RBC Investments.

On the contrary, the information technology sector is rapidly2021 technology industry outlook / Deloitte growing: companies make a lot of money, attract new customers and investments. The states in which this sector is strong collect more taxes from companies, the currency is strengthening.

This does not mean that an investor should choose one of the most promising industries. On the contrary, it would be less risky to decomposeBeginners' Guide to Asset Allocation, Diversification, and Rebalancing / U.S. Securities and Exchange Commission money for different assets that are not very related to each other. Because of this, one unsuccessful investment is offset by a second, profitable one.

It is difficult to guess which company or type of asset will be more profitable than others. You can earn tens of percent per year or lose the same amount. But a diversified portfolio is likely to remain a solid mid-range.

Because not all investments are available in one currency

Some attractive assets simply cannot be bought for rubles or on Russian stock exchanges. There are many reasons for this: the stock market is still young; the regulator divides investors into qualified and unqualified - only the former can buy shares of any foreign companies, and the latter have access to several hundred foreign securities. And some financial corporations find it unprofitable to obtain a license for the sake of Russian investors.

Therefore, they are not available in the ruble zone.Federal Law of April 22, 1996 (as amended on June 11, 2021) No. 39-FZ "On the Securities Market", Article 51.1:

- Foreign stocks that are not included in the S&P 500. For example, more than six thousand companies are traded on the two largest American stock exchanges, the NYSE and NASDAQ. On the Moscow and St. Petersburg stock exchanges there are about one and a half thousand Russian firms and a little less than five hundred foreign ones.

- ETF from foreign asset management companies. A Russian investor can buy about 30 exchange-traded funds - portfolios of investment assets formed by professionals. Thousands of such funds are available in foreign markets: an investor can flexibly select a portfolio by profitability, industry, geography or currencies.

- Eurobonds of other states and foreign companies. Domestic issuers issue such securities, but the Danish energy company Ørsted will not be able to buy Eurobonds, for example, - and an investor could make moneyØrsted issues green bonds / Ørsted on them 4.875% per annum in euros. This is approximately one and a half times higher than the rates on Russian Eurobonds.

- Units of hedge funds or venture funds. These companies tend to have good returns. AverageThese Were the Best-Performing Hedge Fund Strategies in 2020 / Institutional Investor 17.49% per annum in dollars is slightly higher than the usual stock index.

- Participation in the IPO of foreign companies. If a firm decides to go public and place its shares on a foreign exchange, then an investor without access to this exchange will not be able to buy anything. And, for example, will not invest in 2012 Facebook shares at a price of $ 38. In June 2021, they cost $ 336: that's a 784% profit.

However, all these investment options are not available to everyone: it makes sense to open an account with a foreign broker with a capital of $ 10,000, otherwise all profitability will be eaten by commissions.Broker Commission Pricing Structure / Interactive Brokers. In addition, investments abroad are not exempt from taxes, which will have to be calculated and paid by yourself.

On the other hand, international industry leaders are better developed and more expensiveJ. R. Kim. Industry Leader Premium / European Journal of Multidisciplinary Studies stand. For example, American tech companies Microsoft, Facebook or Salesforce have grown by hundreds of percent and have brought in a lot of money for their investors. Even the world's unknown Chinese automaker Chongqing has risen in priceChongqing Sokon Industry Group Stock Price, $ 601,127 / TradingView by 650% in a year.

Companies from different countries and industries are not as strongly interconnected as within one country and even more so in the industry. If an investor wants to distribute risks and earn money, he needsA. Ilmanen. Expected Returns: An Investor's Guide to Harvesting Market Rewards various attachments.

A possible alternative to foreign assets is global depositary receipts, which are available on Russian stock exchanges. These are certificates that confirm the ownership of securities traded abroad.

Here's how to diversify your investments by currency

An ordinary Russian investor has several options:

- Buy currency from a bank or on the stock exchange - almost all financial institutions give clients such an opportunity. The obvious disadvantage: money will be pulled out of the economy, and there will be no more money. Most likely, the investor will even lose a little in their value due to inflation.

- Buy an ETF that contains shares of foreign companies.

- Invest in foreign firms from the S&P 500 list. They are available on the Moscow and St. Petersburg stock exchanges.

- Invest in shares of Russian exporting companies. They are registered and traded on Russian stock exchanges, but they earn in foreign currencies and are not so susceptible to fluctuations in the ruble exchange rate.

What is worth remembering

- Inflation and exchange rate fluctuations affect currencies in different ways. The ruble has lost half its value in ten years, the dollar has lost a few percent.

- Large countries have specialization in certain sectors of the economy. An investor who invests in market leaders in different currencies earns more than an investor who supports only one country.

- A diversified investment portfolio avoids the problems of a specific currency, company or country.

- Some profitable investment options are not available in rubles and in Russia. Such options are provided by foreign brokers, but start-up capital is needed.

Read also🧐

- 12 best free services and online courses to teach you how to invest

- What are ESG investments and why they are important

- What are mutual funds and how to make money on them