How to protect your credit card from fraud

A Life / / January 06, 2021

Why a credit card needs to be protected especially carefully

There are many fraudulent schemes, and cybercriminals do not care which card they steal from - credit or debit. But for you, the difference will be fundamental.

Your money is stored on a debit card. If the criminals get to them, you will only lose your own funds. Is it a shame? And how. But it is much more offensive if they steal money from your credit account. First, because of the high credit limits it can be a truly mind-boggling amount. Secondly, in the vast majority of cases, you will have to return the money to the bank.

It would seem that you are a victim in this situation. However, there is a nuance. If the money was stolen completely without your knowledge and participation, then you can fight for debt cancellation (or a refund in the case of a debit card). There are precedents when the court got upDecision No. 2-2877 / 2015 2-2877 / 2015 ~ M-2287/2015 M-2287/2015 dated September 18, 2015 in case No. 2-2877 / 2015 on the side of the consumer.

In cases where you yourself helped the criminals, you cannot hope for a successful ending.Is the bank obliged to return the money in the event of an unauthorized operation with a bank card or through the Internet bank?. The bank is also a victim in these circumstances. Let's say you told the scammers the codes and passwords. But under an agreement with the bank, you agree not to transfer this information to third parties. Her input equals to a handwritten signature. So, technically, you personally approved all the operations.

How money is stolen from credit cards

Credit cards are mainly used to pay for goods and services. Actually, they are for this and are intended. So there are few popular ways to steal money, but they are very effective.

Social engineering

The most common mechanism is calls allegedly from the security service. There are amateurs who simply call users around the database and call the bank at random. Contact lists are actively being bought and sold on the darknet. It is easy to suspect a catch here, especially if you never had a card of the named bank.

The pros are more skillful. They often have your details right down to the latest transactions. They threaten with monstrous consequences, rush, do not allow collecting thoughts. Here are some common scenarios.

- The caller asks: "Do you confirm the transfer of money in the amount of N rubles?" At this moment you are not translating anything anywhere, so you say “No”. But you start to panicthat someone is trying to lay a hand on your money. Then the scammer skillfully warms up anxiety and suggests that you solve this problem, for example, block the transfer. All you need is to say the code from the SMS. After that, the attackers will connect to your mobile bank and gut your credit card.

- You are initially told that the criminals got to your account and right now, in front of the surprised employees, they are withdrawing money. The bank cannot do anything about this, so it offers to transfer all the money to a certain master account. The latter, most likely, will be in the name of some incomprehensible person. Now, when you calmly read the text, it sounds as strange as possible. Why does the bank see fraudulent activities, but does not stop them? What does “withdraw all money from a credit card” mean? Why can't the bank issue a master account in your name? However, in a stressful situation, there is a risk of acting faster than thinking.

- There is also a scheme very similar to the previous one, only the victim is “driven” to the ATM. There, for example, she must withdraw all the money from the credit card, and then send it to the same master account.

Fake links

This type of fraud became especially frequent in 2020, when, during the period of self-isolation, people began to look for used game consoles, sports simulators etc.

The scheme is as follows: the criminal offers to order delivery on the website of a popular service and pay through it. He throws a link where you can do this. The victim goes to a website that looks exactly the same as the official one and enters the card details. The money goes to the scammers, the goods, of course, will never be delivered.

At best, everything will end there. At worst, the attackers managed to remove the cost of the pseudo-product several times. According to this scheme, the seller writes that the payment did not go through, and suggests contacting the site support service - still fraudulent. The "employee" in the chat says that an error has occurred. To get your money back, you need to follow the link. But if you click on it, the money will be debited again. And further.

How to resist scammers

Don't tell anyone passwords and codes from SMS

Do not rush to roll your eyes with the thought: “As long as possible, I did not grow up in the forest and I know all this! Who could possibly be the subject of this divorce? " Unfortunately, anyone, including people who read a lot and even write about financial literacy. And you can too. Much depends on the situation in which the fraudster will come to you and whether he will get into your pain point. And also on his level of preparedness and pressure.

Cybercriminals fake phone numbers to match bank ones. They themselves recommend that you call the bank back and make sure that they are not scammers (most victims, of course, will not do this). Often they offer to voice all the codes to the robot - again, supposedly to protect you. Criminals are constantly improving their methods.

In general, never tell anyone anything: neither SMS codes, nor passwords, nor information from the card. If someone wants to know this, he swindler. If they call you from the bank and rush or say something that you do not fully understand, hang up and call back at the number indicated on the card.

Nobody needs to tell the code word either. It is used to identify you when you call the bank - not the other way around.

Do not go to the ATM with a credit card thoughtlessly

Withdrawing cash is a non-core credit card option. Moreover, most banks offer unfavorable conditions for this operation. They take a percentage of the amount withdrawn plus a flat fee. Therefore, withdrawing cash from a credit card is a bad idea anyway. This step should always be deliberate. And the bank itself will certainly not ask you about it.

Don't pay on suspicious sites

This should be brought to automatism: before entering card data on any website, check the following.

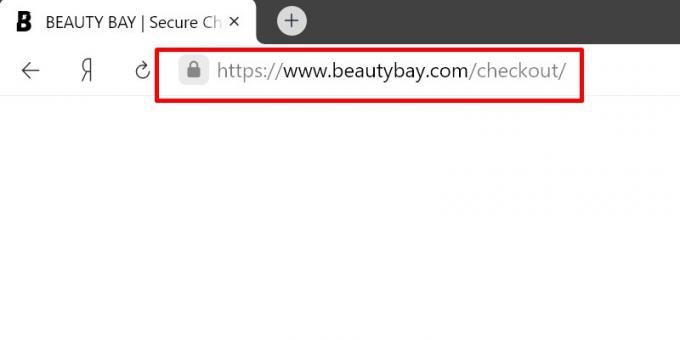

- That there is a prefix in front of the site address HTTPS - an extension to the HTTP protocol that makes the connection more secure using encryption.

- That the lock in the address bar is closed - this also indicates a secure connection.

- That the address bar contains the correct address of the desired site.

Don't chase big limits

Banks often present high limits as one of the advantages of their loan products. Some offer clients to borrow hundreds of thousands of rubles - up to a million. It sounds tempting, but it actually creates more risks than opportunities.

Let's face it: it is better to borrow a large amount from the same bank in a different form, with lower interest rates. For example, in the form target loan. The card is needed to take small amounts and return them without interest during the grace period. Therefore, it is better to choose a smaller limit and set additional restrictions on the maximum transaction amount. If the fraudsters get hold of the credit card details, at least you owe them less.

What to do if money is stolen from a credit card

- Call the bank urgently and ask to block the card, cancel access to the mobile bank, and stop all further steps of the fraudsters.

- Go to the office of the institution as soon as possible to write a statement against the unauthorized transaction and fraudulent activities. But, as already mentioned, the debt can only be canceled if the criminals acted without your participation.

- Report to the police.

- You won't like this point, but alas: all that remains is to pay off the debt and hope that the attacker will be caught. Perhaps then you can get your money from it. If we ignore the debt, it will not melt, but will only increase.

Read also🧐

- 8 well-known tricks of street fraud manipulators

- How to protect a bank card from fraudsters

- "The administration is not responsible." Who is to blame if things were stolen in the wardrobe