How to fill out and submit a 3-NDFL tax return

Right Educational Program / / January 05, 2021

What is a 3 ‑ NDFL income tax return

3-NDFL - a declaration form with which those who pay tax are accountable to the FTSRF Tax Code Article 229. Tax return on the income of individuals. It must be served in two cases.

1. You have income that has not been taxed

If you are self-employed, your employer reports your income. He also calculates and pays taxes on them. In this case, nothing needs to be done. The declaration is filled out if you have additional income. This may be the case if you:

- You are not working under an employment contract and your employer has not taken on the role of your tax agent. In this case, you will have to resolve issues with the state yourself.

- Sold an apartment that you owned for less than three years (or less than five if you own several properties).

- They sold a car that they owned for less than three years.

- Handed over something (apartment, land, etc.) for rent and received income.

- Received as a gift from someone who is not your close relative, real estate, a car, or securities.

- Won in the lottery up to 15 thousand rubles - if more, the organizer deals with tax issues.

- Received income abroad.

- You work as an individual entrepreneur on a common taxation system.

Keep in mind that not all money that falls into your hands is subject to personal income tax. This means that you do not need to declare them. These are, for example, pensions and scholarships, debt repayments, government benefits.

In some cases, you do not need to pay tax, but you will have to file a tax return. For example, if you sold an apartment a year after the purchase, but received less for it than you spent (how it works - in a special material Lifehacker).

2. Do you want a tax deduction

The state gives you the opportunity to return part of the taxes paid if you bought a house, received medical treatment or studied for a fee, donated to charity, and so on. To issue it, you must submit a 3 ‑ personal income tax return.

When to submit a 3 ‑ personal income tax return

If you want to tell the tax office about your income, you must do so by April 30 of the year following the year in which you received the money. The deadline may shift slightly towards May if this date falls on a weekend. The accrued tax must be paid by July 15th.

In the case of deductions, you decide for yourself when it is convenient for you to file a return.

Reading now🔥

- 10 things that are still not taught in schools, but in vain

Where to file a 3-NDFL tax return

The declaration is submitted to the tax office at the place of permanent registration Federal Tax Service of the Russian Federation dated 02.06.2006 N ГИ-6-04 / 566 @ "On the direction of information" "href =" http://www.consultant.ru/document/cons_doc_LAW_60810/c1b8be8ab11626a8435ecb996e2ab6a3cfce8001/» target = "_ blank" rel = "noopener noreferrer">

You can clarify which inspection is yours at website FTS.

How to fill out and submit a 3-NDFL declaration

There are several ways to submit documents to an inspector.

Electronic

Through your personal account on the FTS website

This is the simplest option with minimal labor costs.

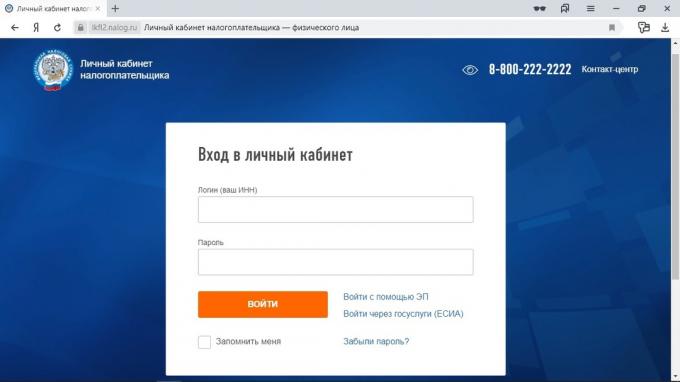

1. Log in to the site. There are three ways to do this:

- Using the login and password from "Gosuslug".

- Using the login and password from the personal account, which were issued by the tax office. To get them, you need to come to the department with a passport.

- Using a qualified electronic signature (ES).

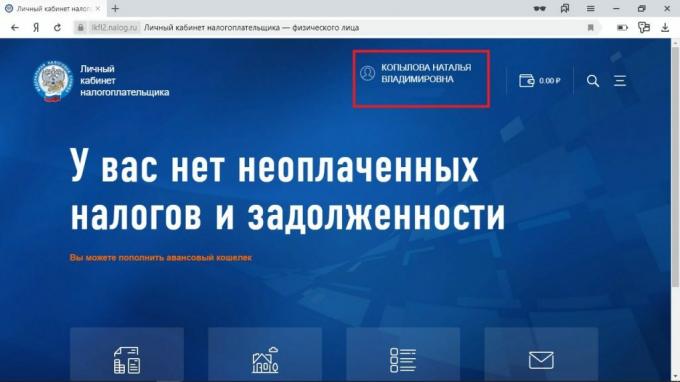

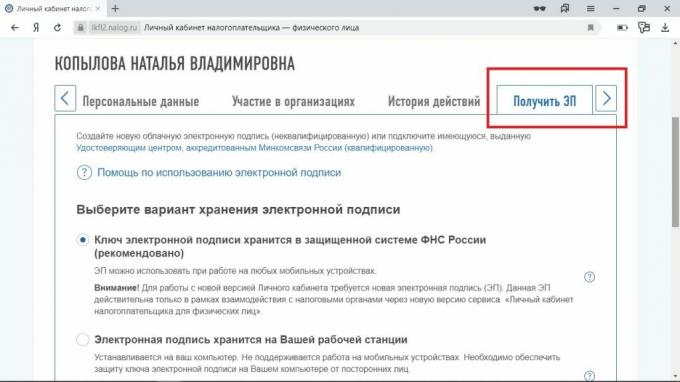

2. Issue a reinforced unqualified electronic signature, if you have not already done so. Click on your last name, first name and patronymic to go to your profile page. Select "Receive EDS". Decide where you will store the electronic signature key: on your computer or in the secure system of the Federal Tax Service of Russia. Create a password and submit a request.

The signature will be registered in a few days.

If you have a qualified electronic signature, just register it on the site. This will be more than enough to fill out the declaration.

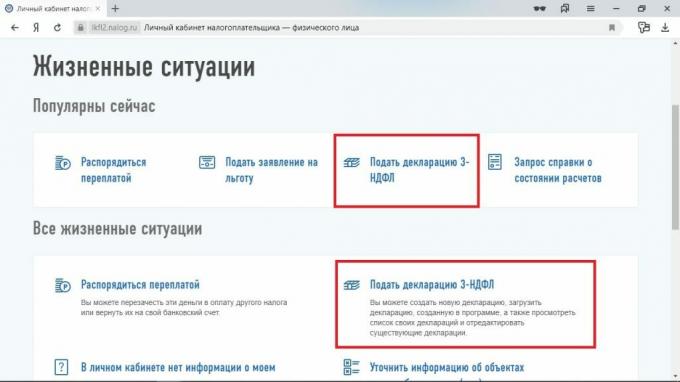

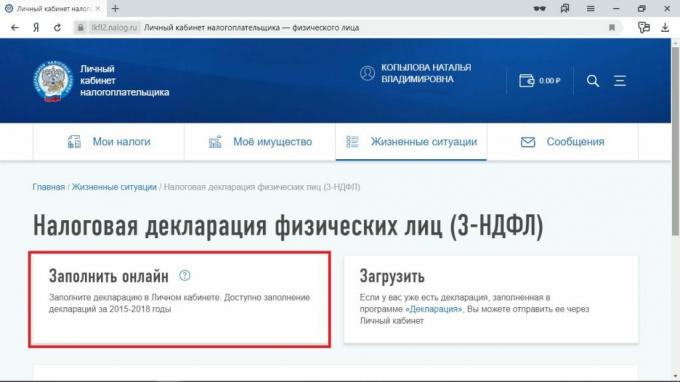

3. Select the items "Life situations" → "Submit a 3 ‑ personal income tax" → "Fill in online".

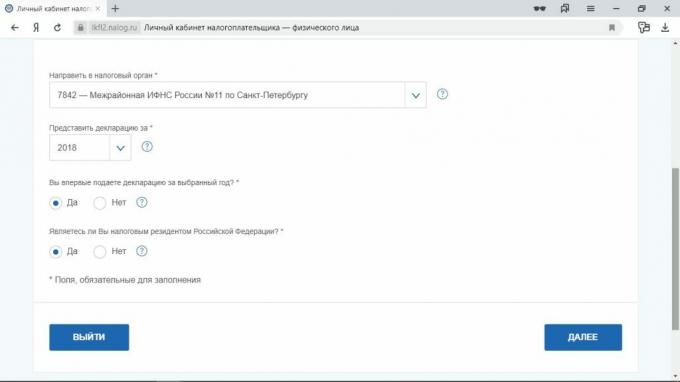

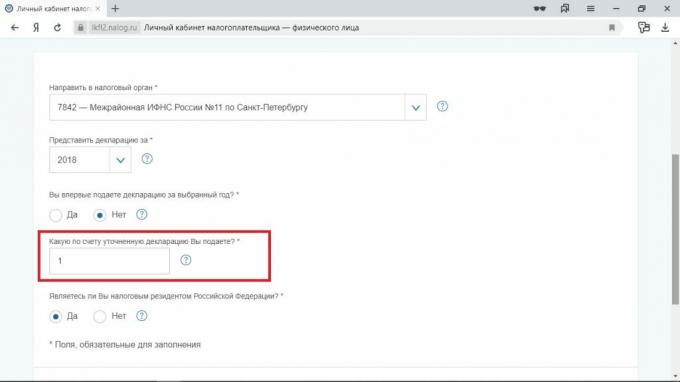

4. Enter your personal information. Indicate the inspection where you are sending the documents. Usually the system offers the correct option, but it won't be superfluous to double-check. Mark the year for which you are filing the return (usually the previous one). Exceptions are possible if you are applying for a tax deduction. Please write down if this is your first declaration this year or if you are submitting a document with corrections.

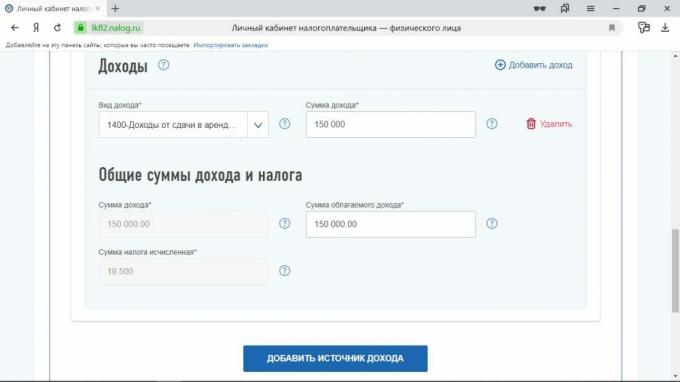

5. Report income. Click on the "Add source of income" button and enter the details. Feel free to hover your cursor over the question mark icon: there are very clever hints from the tax office.

Information about income, taxes on which the employer pays, will appear in your personal account after March 1. If it is not there, you will have to take a 2 ‑ NDFL certificate from the accounting department and add this source of income manually.

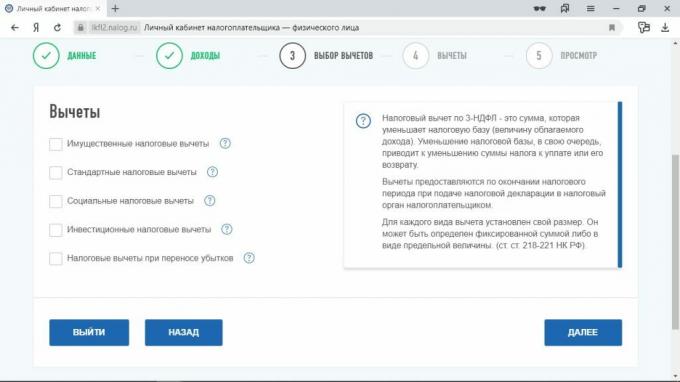

6. Choose a deduction. You can read more about them in a separate material Life hacker.

If you are reporting your income rather than claiming a tax deduction, proceed to the next step.

Fill in the details of the circumstances that qualify you for the deduction. Attach documents confirming this. You will have this opportunity before submitting the declaration.

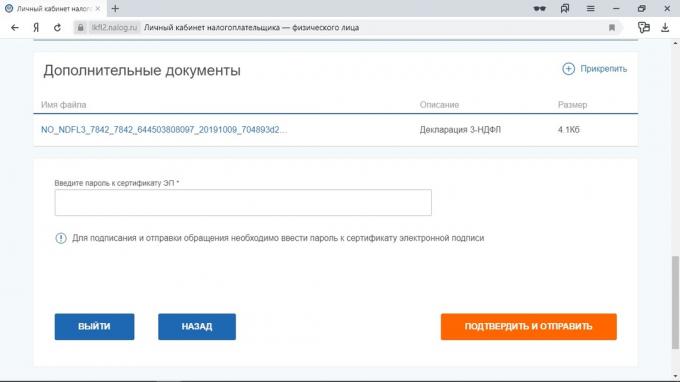

7. Prepare your declaration for shipping. Make sure that you have specified everything correctly, enter the password for the ES certificate and send the document.

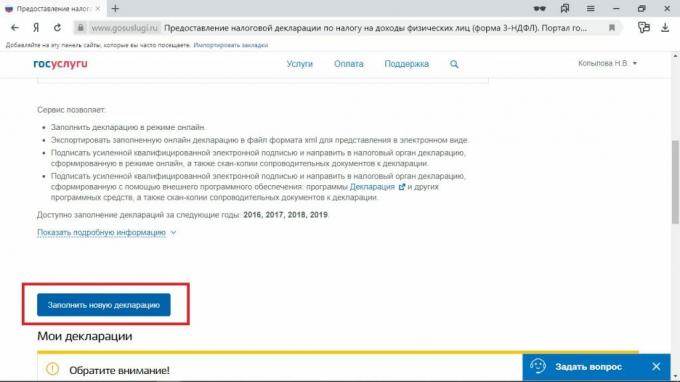

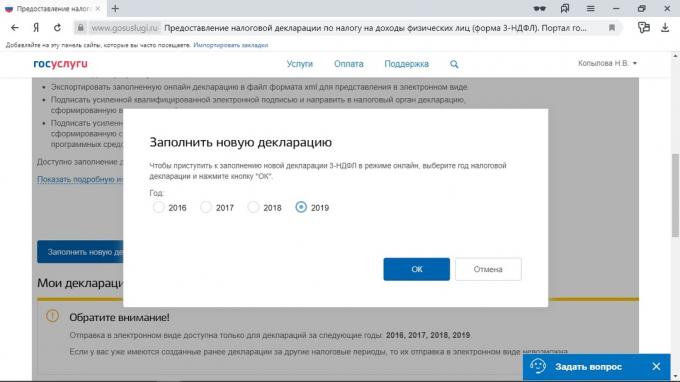

Through "Gosuslugi"

You will need the same information as when sending through the FTS. The algorithm is similar, so when filling out, be guided by the previous instruction.

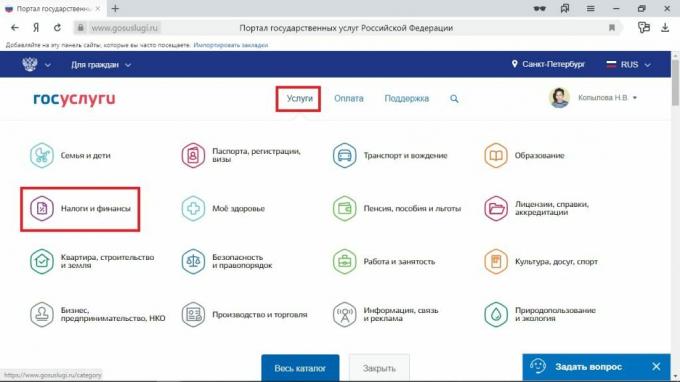

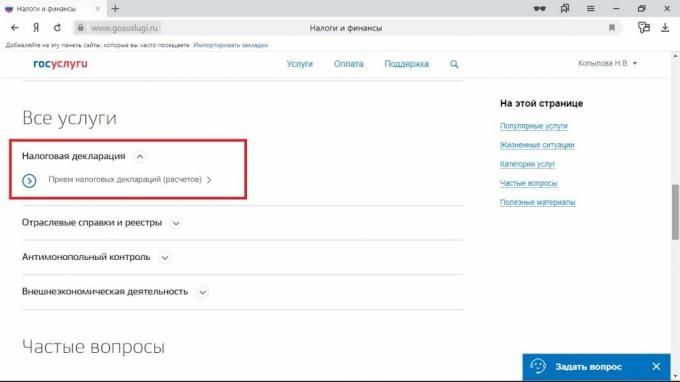

1. Log in to the site. Select “Services” → “Tax and Finance” → “Receiving tax returns (calculations)” → “Receiving tax returns from individuals” (3-NDFL) → “Get a service” → “Fill out a new declaration”.

2. Select the year for which you are filing the return.

3. Fill out the declaration.

In paper form

The declaration is ready to be accepted directly at the tax and multifunctional centers. The documents are filled out in the same way, but this must be done through the "Declaration" program. You can download it at website tax. But even there they advise not to suffer and submit documents in electronic form.

What will happen if you do not submit a 3 ‑ personal income tax return

You will be fined 5%RF Tax Code Article 119. Failure to submit a tax return from the unpaid tax amount for each month of delay. At the same time, the sanctions cannot exceed 30% of the debt and be less than 1,000 rubles. And you still have to pay the tax.

If you do not have undeclared income, you just did not apply for a deduction, you, of course, will not be fined. But you won't get money either.

What to remember

- The 3 ‑ NDFL declaration must be filed if you have undeclared income from which you need to pay taxes, or you want to receive a tax deduction.

- The easiest way to fill out the declaration is on the FTS website.

- If you do not file a return, and the tax office finds out about it, you will be fined.

Read also📄📌💸

- What do you actually earn with a black salary

- 7 bonuses from the state to help pay off your mortgage

- How to pay less taxes

- 12 types of income from which you do not need to pay personal income tax

- How much taxes do you actually pay