John D. Rockefeller learned: how to become a billionaire from scratch

His Work / / December 26, 2019

Ruslan Tsarev

Editor-in-Office Consult "not dull finances».

John D. Rockefeller - the world's first dollar billionaire. The start-up capital of its first business Rockefeller has made 2000 dollars. Of these, 1 200 dollars borrowed from his father. And in 1937, when Rockefeller was gone, its capital is estimated at $ 1.4 billion. At today's prices it is 318 billion. For comparison: the state of the richest man in the world - Amazon founder Jeff Bezos - is estimated at 149.8 billion.

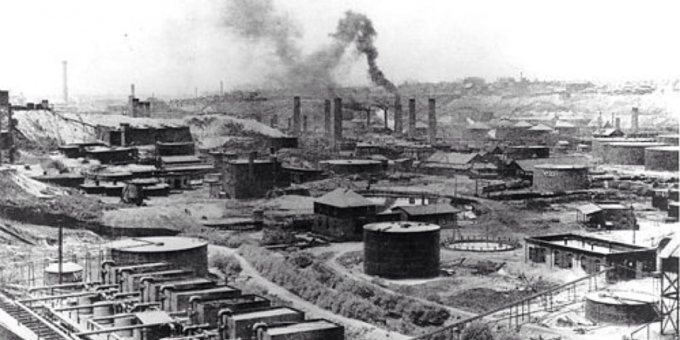

Way in the oil business, where Rockefeller made a fixed capital, he began with a small firm, was selling kerosene in bulk. And when at age 55 Rockefeller withdrew, he owned Standard Oil Company controlled 95% of the US oil industry, 70% of proven oil deposits in the world and the entire production chain - from production to delivery of kerosene to retail customers - almost around the world.

We will understand that Rockefeller helped put together the billions.

Lesson 1. Monitor the movement of money

In seven years, Rockefeller earned the first money on the farm of his neighbor, who helped collect and grow potatoes rabbits. Then, on his mother's advice, he made his first entry in the ledger, which reflects the last penny, how much and for which he received and what to spend. These analogs of modern cash flow statement (SDS), one of the tools that are used to

accounting Finance business, he led until his death, and lived for 97 years.Rockefeller biographers like to mention that he grew up in a poor family. For information how to earn his father, could not be found. I know for sure: the future billionaire dad was a traveling salesman, traveled around the country. In the meantime, the head of the family was away, my mother had to save Rockefeller. Hence the habit to count every penny, she planted and children.

John childhood saw the account of the money helps them multiply. His parents wanted him to go to university but chose to Rockefeller commercial college courses and accountants. And when, after studying settled assistant accountant, his love of numbers quickly noticed and appreciated authority. None of the Rockefeller colleagues did not like to bother with taking into account of completed periods and projects. And he had on such tasks eyes burned.

Rockefeller starting salary - $ 17 per month. From the second month - for 25 dollars. A year later he was the manager with a salary of $ 800 a year.

Tradition from an early age to take into account every cent Rockefeller descendants hold to this day. Rockefeller taught the children of their own, they - their own and so on.

I also have home version of the SDS, But in the form of electronic plate. He began to lead to more than 40, as a child had no one to tell. But better late than never. This is routine, but actually helps to manage money wisely.

Lesson 2. Do not be afraid to borrow

Entrepreneurs are borrowing money as evil, from whom better to stay away. EXAMPLE Rockefeller shows - in vain.

Do not take the Rockefeller missing to enter the amount of business from his father - most likely, and would have worked all my life for hire.

Borrowings were a constant feature of the Rockefeller business. He preferred to sell shares to the next investor, even when missing and equity. Also invested their money, but kept as a reserve. And if investors are, take the next funding the project entirely on himself.

Rockefeller first business was a small logistics company. Rockefeller in the first year won orders for 0.5 million dollars. Money on their software was not enough soon. Already a lot of money due to his father, who gave not just a loan, but under 10% per annum, Rockefeller held the missing amount, where he could. It was not easy, but he managed.

It's believed that credits not afraid only financially illiterate people. And then - to the first call from the collectors. The difference between them and Rockefeller that he took credit wisely.

Lesson 3. to fulfill obligations

Rockefeller was always careful in the performance of the obligations, including financial ones. No matter how difficult, and in the first years of doing business these difficulties were constant, the required amount to the desired date is always found.

In his memoirs "As I have made 500 million dollars"Rockefeller remembers how his father would come to his office for the next payment on the loan at the wrong time, and insisted - the money is needed now. Rockefeller himself could not say by chance it turned or father specially arrive just from educational considerations. In any case, each lender, including his own father, received from him as it should and when it should be.

Over time, one word at Rockefeller bankers fearlessly rowed for him all the contents of safe deposit boxes. His reputation in financial matters was the best guarantee.

Lesson 4. To know the price of every management decision

Fearlessly borrow and regularly fulfill obligations Rockefeller succeeded because he did not act at random. Every decision scrupulously counted in advance. If the borrowed money, then in view of when and how much will have to pay due to what they will return and how much he will earn on borrowed funds. If you are investing their own money, counting, when and how they multiply.

In its enterprise Rockefeller invested millions of dollars. If the investment showed an increase in production volumes and / or cost reductions, which was converted into profit growth, Rockefeller did not skimp.

The first in the US Rockefeller ceased to carry oil in wooden barrels on horseback and began to transport in tanks by rail, driving across the country the whole train. First stopped to save on security of oil refineries when estimated the damage brought constant fires. And the first US oil refineries were literally sheds. Oilers thought: oil - it is profitable, but soon it all deflate. And why did not make sense to invest in infrastructure.

When Rockefeller began sending oil exports, needed a device for its fast pumping of the tanks in tankers. Rockefeller at his own expense has equipped their desired w / station. At first glance - the railroad presented. But this, in addition to the volume of traffic, it has become an argument for tariff reduction and allowed Rockefeller to carry oil by rail is three times cheaper than the competition.

Rockefeller and owned several iron ore mines. When he realized that ships carrying ore to the blast furnace and the ports cheaper than trains, built from scratch its own fleet.

Partners Rockefeller thought he was the next innovation too risky and did not want to invest in them. He is in such cases, he said: "Okay! I will put the money alone, but all profits will be mine. " Thereafter partners immediately became compliant. Everyone knew - once Rockefeller ready to invest one will profits accurately.

Lesson 5. attract professionals

In life and business, Rockefeller helped that he liked to tinker with the numbers. But you can not love - do not worry. It is enough to bring to the team or to outsource human who loves.

British millionaire Richard Branson loved what today is called HYIP, and hated figures. But he had a business partner in the youth who loved to tinker with the numbers. By the time the business has grown enough to Branson, the owner is aware of the importance of management accounting, remembered the former partner and that he instructed to take the figures themselves.

Founder of the empire McDonald's Ray Kroc lifetime sells and understood only in them. This allowed him to be seen in a small roadhouse promising product in the form of franchise and make this product a symbol of America. But members of his team, who fumbled in finance, saw and told him one more promising direction: not to sell bare the franchise, but first rent and then buy back land from the premises of the restaurant and take their franchisees rent. This solution simultaneously at times to increase revenues, profits and capitalization of McDonald's. In 1974, Kroc himself in a meeting with the students said: "My business - it's not burgers. My business - it's real estate. "

Rockefeller himself preferred not to delve into what does not understand, and listen to the professionals. Sometimes this approach to fail. So it was with the shares of the iron mines, which he bought in early 1890: experts promised bonanza, and the mines were unprofitable and were on the verge of bankruptcy.

To find out what is going wrong, Rockefeller found a specialist who is knowledgeable in finance. His name was Frederick Gets. He gets submitted statements, due to which Rockefeller realized what was happening and how to save the situation. he Getsu and instructed to restore order in the mines, and they began to make a profit soon. He gets later became Rockefeller's right hand.

When Rockefeller decided to build its own fleet, he turned for help to the owner of shipping company. He carried the ore itself and was not interested in helping a competitor. It Rockefeller went like this: "I understand you. But I will only carry the ore on their ships. I still build them, you do not earn the transportation of my ore. But I suggest that you earn on a commission for what the court for me to build under your control. I turned to you, because you are a professional and honest person. And I do not poskuplyus commission. " Rockefeller went home owner with a contract for $ 3 million.

Lesson 6. Do not be afraid of negative reports in

When Rockefeller was still working as an accountant, he once walked into the office of a business partner of his boss. But that just brought a huge bill from the provider with a variety of positions. Boss Partner longingly looked at the columns of numbers and doomed accountant threw the paper: "Pay".

"And I would say the accountant:" Check and tell me if everything is correct, and then pay for it, ' "- decided to Rockefeller.

In his memoirs, Rockefeller surprised that American businessmenPeople are not stupid and sober, were afraid to look once again at reporting. Especially panic before it experienced entrepreneurs, when business had problems. Rockefeller also considered: namely, when the business is something wrong statements should be studied more closely.

Lesson 7. Do not be greedy

Rockefeller did not spare the money not only on the investment. His company, Standard Oil four times a year paid dividends. Their total amount was $ 40 million - just 40% of the share capital of the company. Rockefeller money getting any of these 3 million.

The owners of oil companies that bought Rockefeller offered to pay the shares in part or completely. With the consent of the workers gave their shares salary. Shares of the company received all investors. Stable and high returns to its shareholders was guaranteed.

Here's a set of rules to follow that Rockefeller succeeded. As is easily seen, there is nothing extraordinary in them.

see also

- How to increase the accumulation of 10 strategies with different risk levels →

- 8 These stories inspire you to feats of business →

- How not to spoil the children and raise them rich and successful: 4 Secrets of the Rockefeller family →

- 7 secrets of success of Jeff Bezos - the richest man in the history →

- 10 books that will become rich →