bitter experience

Recently I decided to buy a refrigerator in installments. I came into a large hardware store and choose your favorite model at the price of 39,490 rubles. The seller sent me in the lending department. There I explained that the store directly by installments does not, do the banks-partners. After I informed your personal data, send an inquiry to the manager a number of banks. Approval came from three out of six. I have chosen the bank with the most appropriate conditions.

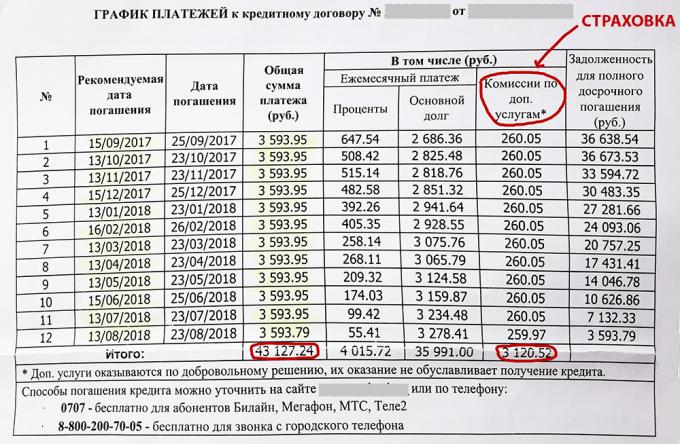

The payment schedule attached to the agreement, were given the interest payments and the total amount after payment of interest. The agreement was also a column with insurance payments (without which the bank would not approve of installments). The total amount - 43 127.24 rubles. Together with the insurance overpayment was 3 120.52 rubles. Of course, from the insurance can be dispensed with, but in this case, the bank may not approve credit.

Each time you make a payment through an ATM of the bank charges a fee of 100 rubles. To pay the money can also be through the online account of another bank, where the Commission, as a rule, less, or free in the mail 10 days before the date of the monthly payment. If you contribute to an ATM with the Commission, the overpayment can make more 1200 rubles per year, for a total of 4 320.52 rubles.

The total amount of payments by installments in terms of the interest of approximately 10% per annum.

Even if it is not 20% of the ordinary consumer credit, but still not the installments. In order not to fall for these tricks and not to overpay, it is important to clearly understand the difference between installments and credit.

Installment and credit: what is the difference

Installment - a way to purchase goods or services, in which the buyer pays the purchase within a certain period is not the sum total, and by parts. By law, this type of loan, but in reality for the buyer is a fundamental difference.

Bank credit - way to purchase goods or services, in which the buyer pays the purchase within a certain time in installments with interest payments for the use of funds.

Many major stores offer customers products like loans and installments. Of course, the installment - the most profitable option for the customer, but for the seller to be more appropriate to offer credit, because then the money gives the bank, which assumes all the risks. In both cases, the product or service provided to the client immediately after the transaction.

Additional types can be distinguished classical installments, or simple, in which the value of the purchased goods is divided into parts and should paid by the buyer within a specified period, and installment loan from a bank: the store does offer the bank in the amount of interest credit agreement.

Instead installment loan you do not have imposed on unfavorable terms, you need to carefully read the contract, and then to sign it. Let's see what you need to pay attention.

The contract installments

Between buyer and seller sign a contract installments. In some cases, for installment enough to present a passport, others may require a certificate of employment or bank. Seller has the right to determine the terms of the contract alone. However, the buyer must keep track of all the details.

Pay attention to the following points:

- timing and availability of interest for funds;

- voluntary insurance services;

- sanctions for non-payment of debt;

- conditions return defective goods.

As long as the buyer does not pay the full amount, it is the user, not the owner of the goods. If a timeline debt is not repaid, the seller may withdraw the goods. However, it is in theory. In practice, it is unlikely to want to take back, for example, worn shoes or badly soiled with cooking plate.

Contract installment loan may be a contract between the buyer and the bank where the payment amount indicated interest. In this case, the store makes a discount on the product in the amount of interest on the loan. The total amount paid to the buyer shall be equal to the value of the goods on the price tag.

Output

Shops often issue for installment loan (albeit not so high percentage as when lending). Such use can be deferred, and is generally more profitable, but it is necessary:

- make sure that the final amount is not much higher than the price of the goods;

- to verify the absence of additional services that you do not need;

- to make payments in advance by mail (it's free) or transfer through mobile bank with a smaller commission.