Deposit or investment account: much more profitable to invest money

Tips / / December 19, 2019

Contribution

Bank deposit (or bank deposit) - this is money deposited with a credit institution (bank) to the end of the term to receive interest income.

Types and conditions of many contributions. There are time deposits and demand deposits. In the first case the deposit to be paid for a certain period and can be removed completely without loss of interest only after this period. demand deposits have not returned to the storage time and on demand of the depositor, but it is significantly lower percentages.

Contribution - friendly and relatively safe investment.

Open a contribution. You do not even need to leave the house: many banks allow you to open deposits via a mobile app or a website. Of course, you first need to become a client of the bank.

The main advantage of the contribution as a form of investment of available funds is the insurance coverage Deposit Insurance Agency in the amount of 1.4 million rubles. Within this amount, we can confidently place your contribution in any bank which has a license of the Central Bank of the Russian Federation. If the bank will burst, the state returns the money together with interest at the date of revocation of the license. By the way, to 2014 in Russia were deprived of license more than 300 banks and investors certainly suffered.

Minus the contribution that compared with individual investment score it gives quite modest capabilities to multiply money.

The individual investment account

The individual investment account (IMS) - a kind of brokerage account or the account of an individual asset management, public directly with a broker or if the trust manager (e.g., a bank), in which two types of tax privileges provided on selection and are defined restrictions.

The notion of "individual investment account" has been enshrined in law since January 1, 2015. IMS can open as physical persons - citizens of Russia, as well as people who are not citizens of the Russian Federation, but living in its territory for more than six months of the year.

The maximum amount which can be initially put on IIS is 400 000 rubles. During the year, the account can be replenished in an amount not exceeding 1 million rubles.

The big advantage of IMS is the ability to obtain a tax deduction.

He is paid in the amount of 13% of the investment amount for the year, but not more than 52 000 rubles. That is, 400 000 and 1 million rubles, you can return no more than that amount. This option is right for you, if you have a regular job and the employer pays for your taxes. There is another option - select the tax exemption.

The main disadvantage of IMS is that it, unlike a contribution, no one is immune. However, if you open it in a safe a bank (for a long time works in the market, it is in the top 20 ranking of Russian banks, against him no sanitation) and to choose the right investment strategy, you can earn much more. In addition, to benefit from tax deductions, investment account you need to open at least three years, during which it is impossible to withdraw funds.

How much you can earn on deposit and IMS

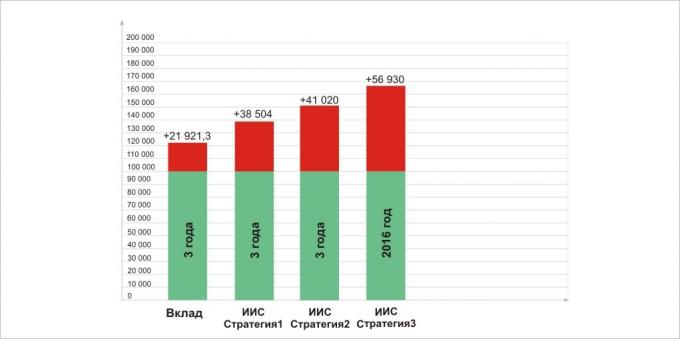

Let's compare how much you can earn, if you make a deposit for 100, 000 and open on the same amount of an individual investment account.

The yield on the deposit

The weighted average interest rate on deposits for a period of one to three years in Russia in September 2017 amounted to 6,83% per annum. If you calculate the income on the basis of this interest rate in a year he will be 106,830 rubles. Reinvest this amount in two years, you get 114 126.5 rubles, and three years later - 121 921.3 rubles. Net income - 21 921.3 rubles.

Yield IMS

Strategy 1: investments in government bonds

Opening the IIS, you can invest in a reliable tool as a federal loan bonds (OFZ bonds) issued by the Russian Federation represented by the Ministry of Finance. Yield to maturity of OFZ 26205 at the end of November 2017 amounted to about 7.3%. Taking into account the tax deduction will amount to 20.3% in the amount of 13% return on investment in the first year. And for three years (the account is opened for a period of not less than three years), the average yield is about 11.6%. The 138,504 rubles you can get a result, for three years. Net income - 38 504 rubles.

Strategy 2: investment in corporate bonds

Another safe and pretty competitive strategy is to invest in corporate bonds, the yield on which is slightly higher than on OFZ bonds.

For example, it may be a bond "Gazprom Capital" and "Rosneft". The average yield on the portfolio of bonds of these companies at the time of writing the material is 7.97%. If put on the IMS 100 000 rubles, and at the end of a tax credit for one year, after three years, we get an average figure of 12.3% per annum. By the end of the third year of the account will be already 141 020 rubles. Net income - 41 020 rubles.

By the way, the coupon yield on the individual bond issues of these issuers will not be taxed since 2018.

Strategy 3: Investments in shares

The largest income can bring investments in shares. However, this is the most risky tool for investment, because even if the shares of any company Over the past period shows growth, it does not mean that this trend will continue continue. Seasoned investors are advised to invest immediately in a few kinds of stocks to drop in shares of companies it could be offset by an increase of shares of another company. This is called diversification of the portfolio.

The most proven investment are shares of "blue chips" - securities of the largest, most liquid and reliable corporations. Among Russian companies These include shares of "Gazprom", Sberbank, "Alrosa" and others.

If at the beginning of 2016 you are equally invested 100 thousand rubles in the ordinary shares of the three largest Russian corporations - "Gazprom" Sberbank and "Lukoil", the average return on equity which amounted to 43.93% at the end of 2016, only one year, you would earn 43,930 rubles. To this amount, add a tax deduction in the amount of 13 000 rubles. It turns out that only one year, you would earn 56 930 rubles. The growth forecast is much more difficult in the three years.

Total

The contribution will approach more conservative and cautious people, probably more than the older generation. Opening of investment accounts - for riskier people. This is not just a fashion trend, but a good opportunity to make money.