How to earn on everyday purchases

Get Rich / / December 20, 2019

Earn on everyday purchases? And that, can you?

Of course. All of us every day we go to the supermarket for food and various household trifles. Perhaps you even have a discount card favorite store, by means of which it turns out to save a little. How about to return some of the money back for every purchase?

You've heard about the bank card keshbekom. With these cards you can earn at least for a purchase of airline tickets, even for everyday purchases. The "Bank Home Credit" is a debit card "Space"Loyalty program" Benefit ".

Paying with this card, you return at least 1% of the value of each purchase:

- Keshbeka 1% for all purchases.

- 3% back in categories with higher accrual. In "Home Credit Bank" is one of the most popular categories: petrol stations, travel (hotels and their services, tickets, including public transport and car hire, cafes and restaurants).

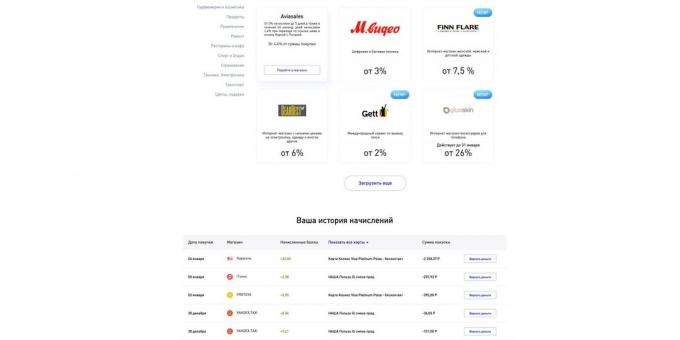

- 5-10% on average keshbek the partners of the program "Benefit».

Limitations on the amount that you have to spend to get keshbeka, the "Cosmos" is not - keshbek always returned and for all purchases and charged as shopping, rather than one-time fee at the end of months. Keshbek for purchases at partner arrives on the account during the period specified in the partner cards in your account.

The resulting keshbek can immediately translate into cash and use: pay subsequent acquisition, to remove the card by cash or leave the account. By the way, if you have a card contains the sum of 10 000 rubles, you get up to 7% per annum for the remainder. For more details, we'll talk about that later.

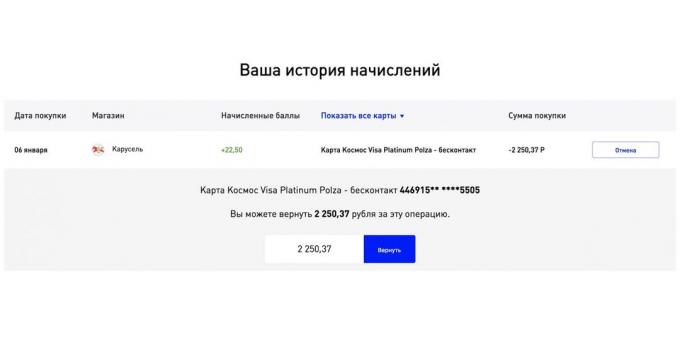

Keshbek comes in points, 1 point = 1 Ruble. Information about how much keshbeka you received, available in a private office of the program "Benefit».

There you will see how many points accrued for a particular purchase as well as total number of points come back to you.

In a private office points can be exchanged for money.

The cool thing with keshbekom you still will receive discounts and bonuses for shopping discount card.

Gambling people should bear in mind that under the law keshbek not charged in the categories related to rates, betting and other similar payments.

I do not spend so much every day. On what have the money?

That small daily expenses account for a significant part of the cost: a trip to the office, lunch in the cafe, buy food in the evening. Let's say every day you spend 300 rubles for lunch at work and 500 rubles for buying food for dinner, and different things. Once more when it is less, but on average, something like this.

As a result of monthly accumulates about 6 000 rubles for lunch in the cafe (the number of working days, we rounded up to 20) and 15 000 for food (here we take 30 days). Just count up how much you can earn:

- 6000 rubles spent on lunch, bring you 3% keshbeka - cafes are categorized with keshbekom increased 3%. For a month you get 180 rubles.

- From 15 000 rubles you back 1% - to 150 rubles.

Add to this expenses for transportation, clothing and entertainment - at least unwise to miss the opportunity to get the benefit.

Minimum keshbek with card "Space"1% - it is assumed you for any purchase paid card. For expenses in categories with high keshbekom (gas stations, travel, cafes and restaurants) "Space" will return three times more.

If, however, you will gain something from partner companies, you will get more on average 5-10% keshbeka. And so, in the case of base keshbek partners (1% for any purchases and 3% in special categories) does not disappear.

With daily shopping clear. How about large purchases and trips?

They also can earn. To get the maximum benefit, regularly inspect the list of partners, "Bank Home Credit" loyalty program "Benefit"- there often are new shares. If you are planning a major purchase, take it from the bank partners, so it will be much more profitable.

The "Bank Credit Home" is as permanent partners, as well as those that provide increased keshbek as part of special offers. In addition, part of the shares offered in person, that is selected for you. Be sure to watch out for special offers, not to miss anything interesting. For some shares can be returned for the purchase of up to 20 or 30%.

Partners, and there are more than 60, offer promotions and discounts for all tastes.

There is a popular services Ticket and booking hotels, suggestions for mothers and children, pharmacies, clothing, footwear, entertainment, repair of household goods, sports and leisure, electronics, and more more.

If you frequently make purchases from online stores, the card is simply irreplaceable. Here are a few examples: 7% keshbeka for buying on AliExpress, 6% for the purchase of machinery and electronics GearBest, from 4.4% at the order for Aviasales tickets. Spend with the "Space" and receive a small gift in the form of the purchase price back to the account.

Partners accrue keshbek differently: some interest returns for purchases in offline stores, and some - only for online purchase. This information is listed in the partner cards in a personal study program "Benefit".

When shopping online it is important not to forget to switch on the partner site through a personal account. The program puts a special mark to the right to charge you keshbek.

To earn more and more quickly, get additional cards for family members - bonus points for purchases will arrive on one account.

And if the card I need to just keep the money?

"Space" helps to earn, even if you prefer to pay in cash, and use the map as a kind of piggy bank. To receive a percentage, enough to keep on the map 10 000 rubles.

If you store between 10 000 to 500 000, on the balance accrued up to 7% per annum. If the remainder is more, in excess of 500 000 rubles, you will get 3% per annum. Interest is calculated every day, but are paid once a month. Date of payment depends on what day of the month you opened the card.

You can be translated into "Space" salary: so you will regularly drop interest on the balance, and if you are at least occasionally pay card purchase, you will get more and keshbek. Money on debit cards are protected by the Deposit Insurance Agency - amount to 1.4 million rubles, which is stored in the same bank on the cards or deposits, when the insured event will be returned in full volume.

Transfer money to the card is easiest through the Internet bank. You can instantly and without Commission to send the funds to the card payment systems Visa, MasterCard and "MIR", issued by any bank. One-time limit is now 150 000, and in just one month can be transferred from one card to up to 300 000 rubles.

Withdraw cash from the card can be no fees at ATMs of "Home Credit Bank". The first five are free cash withdrawals per month at ATMs or cash desks of other banks. Five withdrawals per month is usually enough because the card are accepted almost everywhere. In addition, paying cards, you earn.

To make it very convenient to configure your internet bank or mobile bank Regular payments: payment of a loan or mobile phone and the Internet - for these operations you will also come keshbek. In the mobile banking convenient means to control their spending by a distribution chart and search for the nearest ATM or bank branch.

Well, how much money you can earn with the "space" for the year?

Let's count. Suppose a conditional card holder Layfhaker reads and knows that it is necessary to have the accumulation of a minimum of three monthly salaries. The average balance on the card it is 93 000 rubles. Every month he makes the purchase of 20 000 rubles, paying cards, with 10 000 rubles spent on the categories with increased keshbekom.

In this case, the size of annual income will be 11 310 rubles. This amount is our conditional person receives a gift from the bank simply what is in the cards "Space». Magic? No good.

If you actively use the card, you can earn good money. That is the way keshbek: spend more - more gain for the year is possible to return more than 60 000 rubles.

By categories, in which 1% is charged, you can get up to 2000 rubles per month, by category with an increased accrual of 3% - up to 3000 rubles per month. keshbeka accrual of the partners in this amount is not included, so you can buy from them indefinitely and receive keshbek for all purchases.

Sounds interesting. Perhaps a card costing a pretty penny?

Service nothing will cost you if you follow one of the simple conditions: keep monthly balance on the card at least 10 000 or pay off "space" in the amount of 5000 rubles per month. For the funded card, focused on the purchase, both conditions are met by themselves. Otherwise, the card service costs 99 rubles a month.

Card "Cosmos", you can connect a paid SMS package with information about the transactions and balances on the account, the cost of services - 59 rubles per month. However, if you pay with an active card, keshbek cover these costs. Enough, for example, once to refuel at the gas station to fill up or travel in the subway.

Well, how to decorate the card?

Press the big red button - it will lead you to the registration page requests. To submit your application, sufficient to indicate their name, date of birth and mobile number. Then you will contact a specialist bank and to clarify how and when you can get a card.

Tangible benefits from every purchase - is a real story, if you choose the right card.

Make a map of the "Cosmos"