What is bank card is the most convenient for shopping

Get Rich / / December 20, 2019

We are all accustomed to the ever-growing diversity and quality of all kinds of online services. Beautiful interface, visibility and efficiency of the current data, the simplicity - it's all about them. But the banks have on their background appear to be frank mammoths. Well, seriously, a feeling that the larger and "Capital" financial institution, the more it tries to look like a typical state structure - bureaucratic, living in his own world and in complete disagreement with the real needs and requirements customers.

In general, I need to get there is such a hybrid of modern online service and classic bank that combines the advantages of both the first and second. And I spoiled consumer, so ready to start using such a proposal is not for nothing, but in exchange for any nishtyaki for themselves. Goals and desires are formulated, it remains to find.

In fact, the choice went between "a pair of advanced options" (without the names, not to offend anyone). Both candidates are comfortable application through which you get full control over your finances. The difference between them lies in the "orientation" and the very nishtyak. Above, I forgot to mention that the main requirement was not in a savings card for storage of money, namely the map for everyday use, with the help of which it is convenient to buy and pay for everything. For such cards have their own special requirements and recommendations. For example, they are not recommended to keep a lot of money (and especially when shopping online and app purchases).

comission

And just then proved itself very good Roketbank. Always maintain a small balance on the card - which means it is often translated into a small amount of money. If you do not pay attention to the commission for the transfer of funds for such a card, you can seriously lohanutsya. In Roketbanka Commission for deposit and withdrawal of funds from the card is not present. I'm straight through attachment instantly translate the required amount on your payment card Roketbanka with his other "cumulative" card or an ATM, and do not pay a penny.

Same with withdrawals. In fact, can be translated into cash required amount from any ATM of the world without commission, but only 10 times per month. Then the commission will be, but, in fact, in our time in the cash needs of unexpected pop up less frequently. In addition, if we so much need cash, you can take advantage of the card, which stores the fixed assets. Payment services and personal needs is also convenient.

BUY @ FLY

Do not pay commission - it is certainly good. Perhaps already this fact would be enough to use Roketbankom, but no. I need more bonuses. Here the user pampered miles. Mile - is a unit equivalent to the ruble. When I spend money Roketbanka card for purchases, I get 1.5% of the amount spent in the form of miles. Spend the miles you can purchase tickets at any airlines via any web-sites, as well as buying offline.

Everything is transparent and clear, one mile = one ruble. It will now become cheaper to fly.

without the asterisks

You know, these are now popular advertising slogans in the style of "Everything for everyone * ** *** free." When you see these footnotes, asterisks, it is no longer on its own, and the brain tells the run and out. Roketbank lured simplicity payment of their services. You just pay 290 rubles per month and no longer think anything. This amount includes everything. Many banks have earned on the little things (the same committee, and all that under the asterisks), and then pay abonentku (albeit expensive for the average hospital). In fact, taking into account the very last detail paid, as a result of incidental costs may be higher, even with a very modest fee.

Platinum without credits

Briefly - Debit Platinum Visa, with all the consequences: discounts, concierge, there is no risk to remove some excess amount and fall into the credit network.

about the app

In principle, all the features already described, and the need to look at the application itself. Yes, that's when you can so manage finances right from the app - it's cool. Even cooler is when you just simply the monitor your spending. I recall that during use virtual card QIWI (though now with conventional banks as well) on the phone receiving SMS of unknown content, and they had to decipher. Here all the information goes straight through to the push notification app, moreover, they do not look like a dump of data in the log file, and that's it.

There are times when you want to control spending on articles. Roketbank proposes to use tags like Twitter. Put simply, you are simply added to each transaction # statyaraskhoda. Then to these tags, you can monitor all payments and build statistics. For haters hashtag is the usual statistics on the categories of goods, the same operations and so on. In general, the application also replaces Roketbanka expenses magazine, but only if the majority of them is made with this card.

about support

Typically, the bank refers to the client for "you", and it's so much angry. Supervezhlivost hides the absolute incompetence and bureaucracy, and eventually your problem and not solved, because they all difficult. Roketbank surprised format communication. See screenshot.

And in general, most typical activities here greatly simplified for the user.

sorrow

In use, it revealed a very bad thing. The same point about the absence of commission does not work everywhere.

Firstly, it is impossible to transfer to the card Roketbanka money with Visa, issued by the Savings Bank and UniCredit. These banks are blocking translation on his side, for that large beams them "good." In this case MasterCard from these same banks works fine.

Secondly, the surprise will be when translating from debit cards and Vanguard QIWI. These banks take yourself some additional fees. This is what we have found, and generally check to the alleged use of the card on the "problem" can be on site in Roketbanka special proveryalke.

Important! We do not advise to use credit cards to replenish. For them, the banks put a high percentage for withdrawal.

How to obtain the map Roketbanka

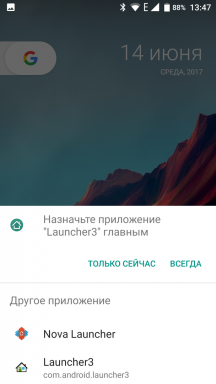

Now about how to get these things payment means at its disposal. There is one feature - a mobile application for iOS only, that is, Android users have a rest. Order cards directly into the app, so the swing of the App Store, fill in a standard form and wait. After about 5 days a support reports that the card is ready. The courier will deliver free card which is convenient, but only in Moscow. If you live outside of the capital, is still two options: either to wait or to go to Moscow.

life hacking

In the course of exploring the map Roketbanka had an idea on how to do everything better. The basic idea is that if Roketbank for shopping, then there is a map of the main storage savings. There are cards that charge interest to the amount stored on them. The same TCR appears to issues cards that have a percentage of the amount stored, and at a certain balance there is also abonentku not take. As a result, such a bundle of savings and roketbankovskoy cards makes a miracle: no transfer fee, at any time and how much any number of times to transfer the necessary amount to the purchasing card, and most of the money safely stored on savings and they drip interest.