For many, the concept of personal or family budgets is to obtain wages, purchases and paying bills. The main thing that lay in store for at least a month's salary - to the end of the month, you can live in peace. :) Normal narrow-minded practice. But if suddenly the funds was not enough, or need to plan a major purchase, or just wondering bring your debit with the credit - it's best to use any application to record Finance. MoneyWiz - a perfect candidate for consideration.

Electronic Ledger - a great tool to account for their finances, especially if you are lost in numbers and, seemingly simple actions arimeticheskih. And among all these applications MoneyWiz, in my opinion, one of the best. This is not an easy Counting income-expenditure - the program is quite good on a detailed record of all your cash flow, not only inciting the results for a particular period, but will plan a budget for future.

By their very nature, MoneyWiz can hardly be called a simple program, although the developers are making maximum efforts to the role of the family accountant could handle any user. Therefore, I will not delve into the intricacies of working with the product, designating only its basic virtues that allow me to recommend MoneyWiz all who need to do financial accounting.

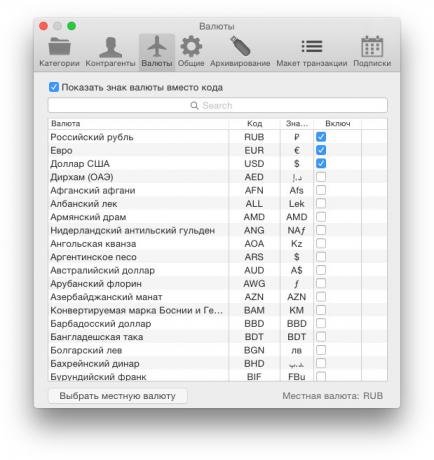

1. internationality

In addition to being a polyglot zapravsky MoneyWiz (the program is localized into 23 languages, including Russian and Ukrainian), it is easy to work with a large number of currencies - at the same time. Let's say you work for multiple clients, one pays you in rubles, the second - in euros, the third - in New Zealand dollars... Enter the actual amount of fees in the relevant currency - and MoneyWiz podobet result in the currency, which you determine how basic.

Of course, the program takes the exchange rates to international exchanges, and the real value in the local exchange points may differ. But developers and it took into account: when you enter items of income (or editing it), you can specify the actual exchange rate, and the program will recalculate.

2. multiplatform

MoneyWiz is available for OS X, and iOS as a universal iPhone and iPad app. And the design of both versions of the application the most generalized. On the Mac, it looks a little strange, but it is much easier to navigate if you have time to become familiar with the iOS-version of the product.

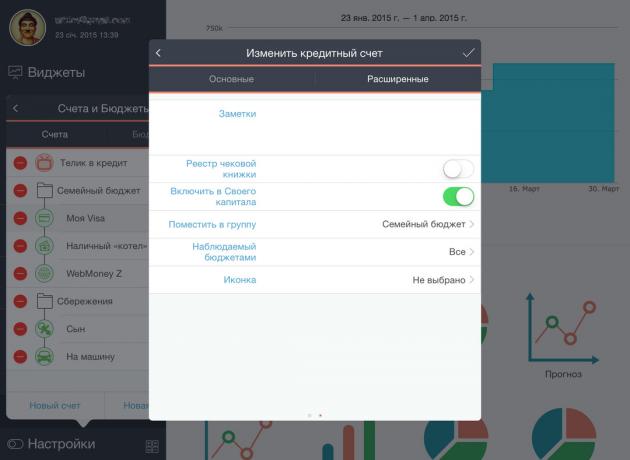

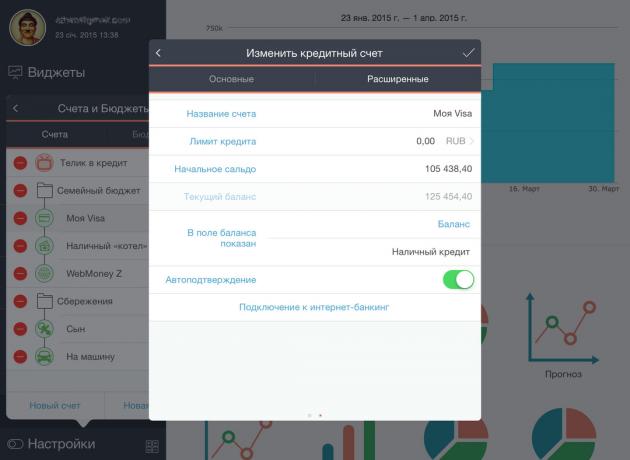

3. Easy maintenance of all accounts

The modern busy person is unlikely to be only one source of income and where to store their money. Cash in a box, card account, the electronic purse, stash for a large purchase, storage for a wedding - All this can be easily reflected in MoneyWiz as separate accounts for each of them recording income and expenses. So snap to find out how much cash spent, how much is removed from the card and how much has been added to the stash in the car. :)

The additional grouping provides convenience of accounts (for example, all useful savings and savings accounts to separate from that used for daily expenses) and taking into account the transfer of funds from one account to another (for example, conversion of electronic money of dollar purse in rubles).

4. Detailed maintenance budgets

Budgets in MoneyWiz called all planned expenditure. Actually, along with accounts maintenance budgets is the basis of any serious financial program. It is very convenient to put all on the individual articles of expenditure planned for each of them the maximum allowable limit, and watch out for in order not to go beyond the established framework.

The level of detail of costs you are asking yourself. For example, you can simply create a single budget for all utility bills by setting the total maximum. And it is possible, on the contrary, nashtampovat separate budgets for rent, cold water and drainage, hot water, heating, gas, electricity, landline telephone, radio, and so on. D. What to do depends on your decision.

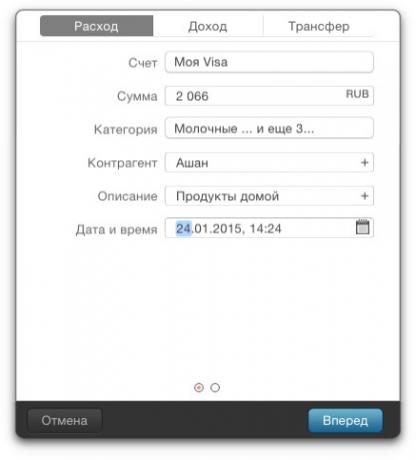

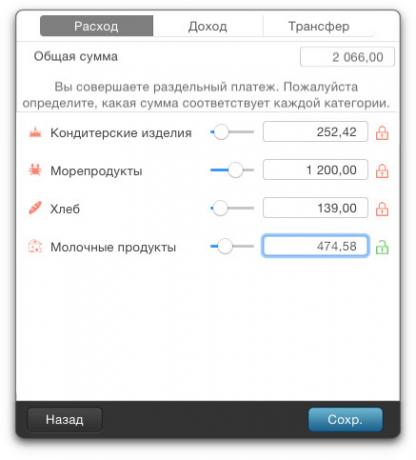

5. The division of revenues and expenditure category

Categories in MoneyWiz play a very important role, since it is based on their cost accounting. For example, you have added to a specific account to purchase products for a certain amount - this information will automatically be considered for the corresponding budget. Therefore it is necessary to remember an important rule: Each category can be associated with only one budget. So if you have the same products can be bought for different purposes (eg, for himself, his beloved grandmother, poor neighbors), and you want to take into account these costs separately from each other - to create three categories, each tied to a corresponding budget.

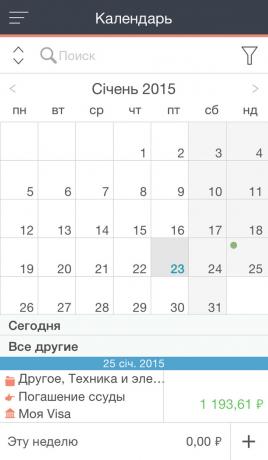

6. Planning of revenues and expenses

If you know that at a certain time you have planned specific revenue or expense - make the data in the calendar MoneyWiz. This will not only allow you to accurately predict the dynamics of capital growth, but will not let you forget time to pay the bills, to repay the debt or get another fee: a specified time program beep you.

7. data synchronization

Of course, without the relationship between all user devices in our time, anywhere. However, instead of the usual «Yabloko» iCloud MoneyWiz uses SYNCbits server (need registration account). But the speed and quality of data synchronization is not affected. Moreover, not only synchronize the data on your accounts, budget and transactions, but also expenses and income, the list of counterparties.

8. Easily import / export

MoneyWiz allows you to store transaction data in several popular formats: OFX (universal format for financial software), QIF (Quicken software format), CSV (universal format for tabular editors such as Numbers and Excel), as well as easy-to-read conventional PDF. Import data is possible in the same OFX, QIF and CSV (eg for iOS-version MonyeWiz - via the clipboard, cloud storage or application folder accessible via iTunes). It is noteworthy that in the case of non-compliance which some columns imported table with the data format most MoneyWiz, the program will prompt to manually clean up the mess before the data is written to your account.

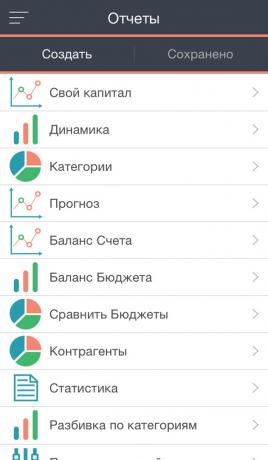

9. Reports and forecasts

Analytics - the third major tool MoneyWiz. The app allows you to explore your financial affairs in the past and make a rough prediction for the future, taking into account all planned revenues and expenditures. Of course, when the size of each month your income is unknown, it is difficult to predict the dynamics of the growth of your total capital. But if there is more or less stable regular salary analysis unit MoneyWiz will work for the full program.

All data can be displayed as graphical reports that are based on diagrams and show the dynamics of revenue growth, and supplies the components as a percentage, and for each of the accounts. Compare the income-expenditure on different accounts, determine where you more often and spend more money, which most cost categories you expensive - all this can be viewed in graphical reporting format, of which the MoneyWiz is provided as many as 10 types (plus one user).

10. additional nishtyaki

In the iOS-version of the program also supports Touch ID, the ability to export via AirDrop. The program has already been adapted for the iPhone 6 and 6 Plus. The Mac version available local data archiving, if you do not want to use the cloud-based synchronization.

I also liked the transaction search engine, including the conditional operators to search for items of income and expense for the approximate amount. Very handy when in removing any budget attached to it the transaction can be reassigned to another budget (optimization of the cost-accounting).

While I am still learning this app and all souped MoneyWiz users are urged to examine the FAQ. However, it is only in English language is available, which greatly. So experiment with if you have little experience in the management and planning of personal and family budget, without trial and can not do mistakes. Adapt himself and mastered in the program, you will be much easier to deal with their money and plan for their financial future.

Price: 379 rubles

Price: 1490 rubles