How to manage money in the family

Get Rich / / December 20, 2019

Family and money - a very delicate topic. When you live alone (or one), all your money and expenses - only yours. And in a family like? Food in the refrigerator is now common and sold at all. Bills for the apartment, at the cost of equipment, furniture, leisure, entertainment - everything was a joint. Here the child has grown up, and now he, too, need the money. How to build a joint financial management? The answer is: the family budget.

What is a household budget?

Family Budget - is when each member of the family, whose income, invest part of its own funds to the general fund, which is then spent on family needs.

Why do we need a family budget?

General Fund makes managing family finances is more convenient, easier, more effective and more transparent.

Family - is trust, right? But everything has reasonable limits. It is unlikely that someone will like, if required of him to give everything to the penny or to report on every ruble spent. Family budget solves this problem elegantly, as its size is formed based on the capabilities and needs of the family.

How to manage the family budget?

How to be aware of who, how and what he took and wasted? How could decide who controls the budget? It all depends on the particular family, and that you keep the money in cash or on a map.

Family budget in cash

If all fully trust each other, any member of the family takes a family of storage it needs amount and fixes it, and item of expenditure in the accounting application, or simply label Excel. This is a great way to finally start to lead the family budget, and gain an understanding of where the money fly.

If a family has a spender or prone to impulse purchases people, that budget drives the most responsible and disciplined. He decides, if necessary, to give money or not, to what extent. Everything is written in the application or spreadsheet.

Family budget on bank cards

If you have a bank card, then there is the expense to which it is bound. We are accustomed to the fact that one card account and he is the personal, that is, access to it is only for the cardholder.

Now banks extend the capabilities of cards, allowing you to create additional accounts shared. Simply put, your sound card may have several accounts: your personal, which is only visible to you and one or more joint ventures, access to which you can give to family members, relatives and so on.

We'll show you how it works Family account in the "Alfa-Bank".

- Go to your mobile app, "Alfa-Bank", create a family account and give it a name, such as "family budget".

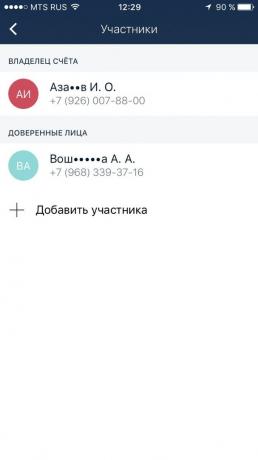

- Add to the family members of the family account. Access to the account can have four people.

- Set rights and limits for each family member. For example, limit the permissible amount of monthly child costs and close access to transaction history. So they do not spend more put and will not know what to buy the parents, but you will see the whole history of their actions.

- Including monthly Autorecharge family account from your personal to the amount agreed to by the family council. This eliminates the need to transfer money each time manually.

In this family budget can be considered established. Now the family's financial life is maximally transparent, and payment history and completions always available for all participants of the account on your phone and in your personal account on the site.

Appendix "Alfa-Bank" allows you to instantly select the account from which money will be withdrawn when buying the card. Personal purchases you pay with a personal account, and family - with a joint. It's very simple and convenient.

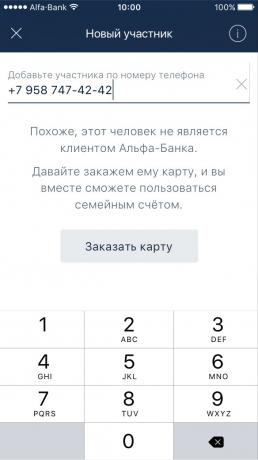

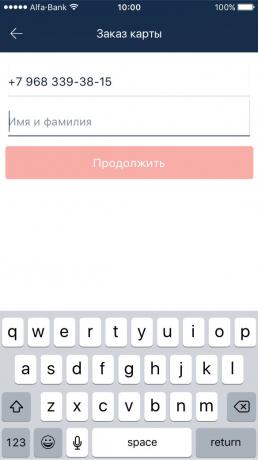

To become a member family accountYou do not even have to be a client of "Alfa-Bank." If your relatives use the services of "Alfa-Bank", you simply add them to the family account through the app - if not quickly arrange the cards for them, specifying only the name and phone. However, neither you nor the mother will not have to go to the office of the bank - courier will deliver the card to the desired address.

If you too are not a customer of the bank, you must first select and order the card online, "Alfa-Bank", get it by courier or in the office, and only then enter into a mobile application and order cards for all family members.

The use of cards in the family of one of the bank is guaranteed no commissions and instant translations.

And what about the one-off major purchases?

Each family is faced with the need to update the park and other household appliances, someone decides to save up for a car or even a new apartment, but still many people like to rest abroad. Everything is expensive and requires provisions for implementation.

In this case, the family creates additional budgets for specific purposes. There is also useful Family account in the "Alfa-Bank"As the bank allows the client to open up to four additional accounts. They can be so called, "On vacation", "In a new television", "On the car" and so on.

The required amount and the estimated date by which you need to collect the money, usually denoted by a family council and roughly known. On the basis of these determined the contribution of each member of a family whose income is.

Often, for the successful accumulation of the required amount of adjustment is required other items of expenditure, the budget and here plays an important role in the ability to manage money. You begin to count all in advance, and financial planning - is a great addition to the family accounting, and the best way to rationalize spending.

In some situations, more useful joint budget?

In all, when it comes to cost-sharing:

- Let's say you have adult children with their families. In that case, you and the parents on the other side can be folded and support the young family financially or gifts.

- Let's say you have a family yet, but has a dream to go on a journey with a group of friends. Part of the costs will be common (or at least the hostel room for three or four, so it was cheaper), and they are wiser to chip.

The advantage of a joint budget that together people can do more. Whether it's family life and leisure, financial concern for parents and children, a gift from a loved one or a trip friendly company - it is always better to chip, and with family score in the "Alfa-Bank" making it simple and convenient.