How to get the most from the salary card

Get Rich / / December 20, 2019

Benefit from the salary can be increased to give it a good debit card. Layfhaker tells how to do it.

Usually payroll card gives the employer. Why did it change?

The employer gives payroll card to the bank, where it is served. He can not pick up a card for each employee taking into account their needs, therefore, it gives all ordinary debit cards: Free, with no additional options and bonuses.

It also happens that the salary card is not just useless, but gives a lot of trouble: it is difficult to remove money, because very few ATMs and surcharge for cash withdrawals and transfers from card to card. In addition, the bank is bad and long service, and does not yet have a mobile application or internet banking.

Previously, this is called "salary slavery": we impose certain service of the bank, so we had to use them. In 2015, the law changed and now we are free to choose their own salary card.

Therefore, you can change the card and forget about problems. Salary card can be comfortable with the mobile application and online banking. From it you can benefit in the form of purchases or keshbekov miles, interest on the balance and concessional lending.

Wait. Is it possible to choose the payroll card?

Yes, payroll card, you can choose yourself, unless otherwise stated in the employment contract. To confirm your eligibility can invoke Article 136 of the Labor Code of the Russian Federation, where everything is clearly spelled out: "An employee has the right to replace the credit institution, which must be translated wages, communicated in writing to the employer about the details of the change to the transfer of wages no later than five working days prior to the date of payment of wages board. "

So go ahead.

A good option - to draw a salary map Mastercard «Alfa-Bank».

And what good salary card Mastercard «Alfa-Bank"?

Free service bank

For any map "Alfa-Bank" is connected package. This set of services and benefits - from the free mobile application to a personal assistant in the journey. Cost - from 2189 rubles a year. But if you have issued payroll card "Alfa-Bank" service becomes free. In return, you get a cool service and a lot of advantages.

soft lending

Mastercard salary card - is the ability to get a loan on favorable terms: cash up to 1 000 000 and a rate of 11.99% per annum, without guarantors and commissions.

Interest-free cash withdrawals

Withdraw money without commission in branches "Alfa-Bank" or ATMs partner banks, "Gazprombank" "Moscow Credit Bank", "PSB", "Rosbank", "Agricultural Bank", "Ural Bank for Reconstruction" and "Binbank". There are more than 17,000 across Russia. The nearest ATM can be found in Appendix "Alfa-Mobile", which will pave the shortest route and will show whether the ATM queue.

contactless payment

Pay with your smartphone. The card can be added to Apple Pay, Android Pay and Samsung Pay. In addition, you can withdraw cash from an ATM without a card, instead of using her smartphone. It works like this: hold the phone to the ATM, enter the security code and follow the instructions on the screen.

Account in rubles, dollars or euros

The card Mastercard «Alfa-Bank" at any time to change the score card with ruble to the currency that is especially convenient when traveling. Pay with card abroad without losing money due to currency conversion. You do not need to go in advance to the bank branch: change the account with ruble to the currency you can own in a mobile application.

To withdraw cash abroad without commission

Another advantage of the card - the opportunity several times to withdraw cash abroad without commission. The option is available in the Service Package "Comfort" and "Maximum +".

Free SMS notifications

Many banks charge a fee for SMS informing about card transactions. Typically, this service costs 50 rubles a month. With the salary card Mastercard «Alfa-Bank» of any operations information on the map will be coming to you on the phone without any write-offs from the account.

Salary card with extra bonuses

Can be issued payroll card with extra bonuses. For example, the card Mastercard «Alfa-Bank» Cash Back with good keshbekom.

Pay with card, and the money will return back. You will receive a score of 10% of the gas stations at the gas station, 5% of the bill in cafes and restaurants, 1% of all other purchases. Keshbek "falls" into the account each month (in rubles rather than in the "gift", "bonus" or anything else). Spending can be as ordinary money.

For example, if you spend per month 7500 rubles for gas stations, 10,000 rubles for cafes and restaurants, and out of 20 000 rubles for other purchases, your keshbek will be 17 400 rubles per year.

Calculate how much you will be able to get back through keshbeku using calculator Online "Alfa-Bank".

I want to keep track of your expenses. This card is able?

With the help of mobile banking "Alfa-Mobile". This cool app with the ability to manage accounts, accessible on any smartphone or tablet.

All your expenses are fixed by categories. You can see clearly how much to spend on food, car, entertainment and other categories, who have transferred money when removed cash.

In the application, you can transfer money (by card number, phone number or details), mobile top up your account, no commission to pay for internet, utility services and traffic fines. Use templates to not drive details from scratch each time.

Still there is an online chat with the bank. No need to call anywhere, much less walk. Just ask your question and you will answer promptly.

I need to open a savings account. Map "Alfa-Bank" can be such a crank?

Yes, you just call the bank and activate the service "Piggy bank for deposit». With it, you will receive 7% APR on the minimum balance on the savings account.

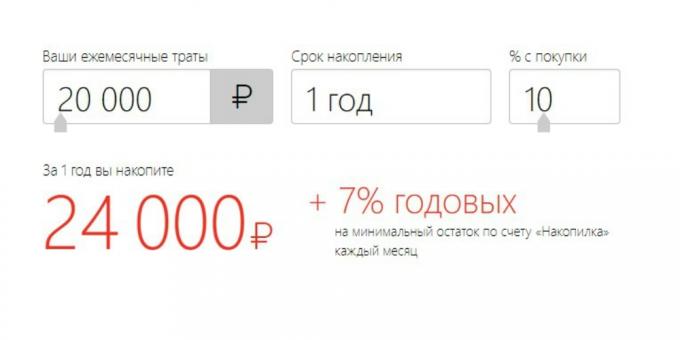

It works like this: you set a percentage of the purchase amount (from 1% to 30%), which will be transferred into your saving account. Any minimum balance on the savings account will be charged 7% per annum.

Let's say you spend each month 20 000 rubles. 10% of the purchase price you have decided to transfer to the savings account. Thus, 2 000 would be the savings account. The year is 24 000 rubles, plus 7% per annum.

Calculate how much you have accumulated over the year, you can use calculator Online "Alfa-Bank".

Perhaps this card service is expensive?

No annual service salary card Mastercard Standard free of charge. card service Cash Back Mastercard worth 1990 rubles a year. Its cost will pay for itself in the first month of use with keshbeku and interest on the savings account, after which you will receive a net income and an increase in their salary. Just.

Well, how to decorate the card "Alfa-Bank"?

On the website or in the department of "Alfa-Bank". You need your passport details, address and place of registration of temporary residence. Map takes a courier, you can pick it up on their own in a bank.

In order to receive a salary in the new card, upon receipt, specify INN employer. You can enter data in the internet bank or the hotline. Then write statement to the head and give it to the accounting department at the place of work. The statement must specify your name and the account in the "Alfa-Bank."

Done. Now you'll get the most out of your salary card.

Make a map