4 financial tips from the masters of money management

Get Rich / / December 20, 2019

John D. Rockefeller, Robert Kiyosaki, Dave Ramsey and George Clason reveal the secrets of financial well-being.

1. Track your income and expenses

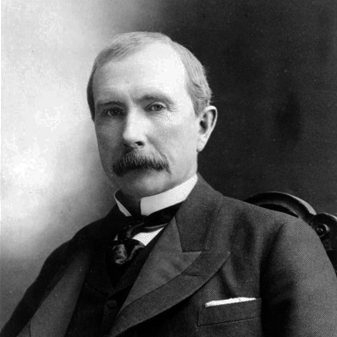

John D. Rockefeller

Entrepreneur, philanthropist, the first billionaire in history.

To begin to understand how things are now your financial affairs. Rockefeller advised always to keep a record of income and expenditure. He took into account each received, spent and invested dollar.

First, begin to keep records of their expenses. To do this, check your bank account and card statements for the last three months.

Now try to identify their priorities. Your past decisions do not have to dictate your future. I think that it is more important to you. Maybe you want to move? Go on a trip? Accounts with credit? The choice is yours.

2. At first, pay yourself

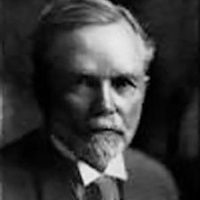

George Clason

Entrepreneur, author of "The Richest Man in Babylon».

Clason first proposed to postpone 10% of their income. This principle applies to all incomes. According Clason, you hardly notice the difference, living in the 90% and 100% of their income. But gradually you accumulate the amount needed to achieve your goals.

Try to apply this principle for at least three months and see what happens. Not to forget the 10% set aside, set up an automatic transfer of funds to a separate account.

3. live moderately

Dave Ramsey

Entrepreneur, author, radio host.

Advertising and popular culture again and again convince us that happiness can be bought. Although we still understand deep down that the new machine or latest iPhone are not able to bring this life satisfaction.

Ramsey advises to change their approach to shopping and live more moderately. So whether you need a new phone or a new pair of shoes? Remember that making money is much harder than you spend.

4. Understand the difference between assets and liabilities

Robert Kiyosaki

Entrepreneur, investor, author of the book "Rich dad, poor dad».

This item is for those who would like something more. For example, you want to retire early and devote all his time to charity. Or maybe you want to pay for his studies of children or simply looking for additional sources of income. To do this, Kiyosaki advises to learn to distinguish between assets and liabilities. Asset he calls that "puts" money your pocket and liabilities - that their "takes".

According to this classification, assets include: income-generating real estate, securities, royalties, investment - that is all that profitable. A liability can be called a house, a car, various gadgets loans.

Kiyosaki advises to continue to work on your job, but do not rely on it blindly, and take your financial future into your own hands. Do not expect that the state or someone else provide your existence. You yourself have to take care of themselves.

See also:

- The easiest and most painless way to control their costs →

- 9 most convenient program for conducting the family budget →

- 5 hidden reasons why you lose money →