How to clean up the personal finances

Get Rich / / December 20, 2019

Ruslan Tsarev

Editor-in-Office Consult "not dull finances».

Today I share a way to bring order to personal finance that helped me. I work in the Consult-desk, which eliminates the mess in finance small businesses. And he decided to adapt his home needs its methods. After the first month realized - not wrong.

I can almost rule out spontaneous spending. I began to carefully weigh any cost. First, no matter how much you earn, at best, a month spent everything. Sometimes I have to think, how to hold on until the next paycheck. And now at the same income, not only do not take new loans, but also actively reduces the debt taken on before. But still remain free money that I put on deposit.

1. Find a way to deal with the mess

The method that I use, offers handy tools of analysis and planning of revenues and expenses. It allows you to combine them in a single tablet, sorted by importance, tied to specific dates. The end result - information upon which I make informed and sound decisions on his own family budget. And I see the result to which these decisions are taken by me today, lead tomorrow.

Of Pandora's box, my financial situation has evolved in a transparent, predictable and controllable process.

First, I do not manage their finances, and was a prisoner of stereotypes and not always helpful financial habits. And be guided by them when making decisions at random. And now - to manage their own budget.

2. Plan of action

When I started to put things in order for personal finance, he acted in the following sequence:

- He introduced a number of specific all your income and expenses at the end of last month and took them as the basis of income and expenditure plan for the next month.

- I set a goal of not spending all the income.

- I began to record daily income and expenses, analyze them for the month and plan the next.

- Of payments amounted to a monthly calendar.

For all this, I had the file in «Google Sheets." You can use Excel or equivalent in Open Office - as you wish.

3. Calculate the income and expenses

The reason for the first time calculate total household expenditure was another quarrel with his wife on the basis of money. Friction for each participation we have periodically occurred in the total expenditures. It seemed to me - his wife hung the all the mandatory costs for me. And their money is being spent only on themselves. She accused me that I spend too much on their own entertainment to the detriment of interests of the family.

So I decided to keep all receipts and expenses in a single table and see that in practice. Sat down, we thought, but who and what to spend this month as part of total household expenditure. And be sure - with two accusations hasty.

Now I understand the reason for our mutual claims was to evaluate the financial situation on a whim. So how people - in someone else's purse money is always more, and their costs noticeably.

When they saw the real picture in the figures of the situation fell from his head to his feet.

4. consider profits

How can there be profit in a person who lives on a salary? Same as in the business - the difference between revenue and expenditure. We have spent the past month less money than received - this is your earnings. And you can dispose of it as profit. Spend more in the next month. Postponed for a vacation or a major purchase, and just for a rainy day. To invest in the business to lend at interest, to buy securities, and the like.

But first learn consider profits. And what to do with it - decide for yourself.

To calculate their own profit I adapted the profit and loss account (OPiU). In it I liked the approach - the reduction of income and expenses in a single document and grouping by type. And yet OPiU - is not only an analysis after the fact, but at the same time a financial plan for the next month.

How to share the costs in the home version OPiU

In my home I have grouped OPiU version costs as follows:

- General mandatory - those that can not do without the family: rent, utilities, food for common needs, education (and here I refer monthly payments for school lunches son and daughter), the development and education of children, payments on loans taken for the general needs families.

- Personal compulsory - costs, can not do without a particular member of the family: clothes, shoes, gasoline, car operation (Depending on the situation, these costs can be attributed to the general mandatory or distribute among family members that their fact are), the cost of transportation, meals, compulsory payments on loans taken for personal use, and the like.

- General optional - here I have reflected the costs, for example, on a hiking trip with the whole family in the water park or the family trip out of town for the weekend, holidays and the like.

- Personal optional - here I attribute all that I spend on a loved one, and that might not make a restaurant or nightclub with friends, hiking in the mountains without a family ticket to the swimming pool and the like. Heavy smokers have a sense it is here to bring cigarettes costs. Foresee and understand the objections of the public (alas, he is). Still, you can say goodbye to this bad habit. So, if we have this waste, it's better to be in a non-binding cost - for self-education. Suddenly quit help.

- Unexpected. Let it be on the safe side.

If you prefer a different principle of spending categories - no problem.

Here is my home version OPiU July:

| total gain | 27 000 |

| not dull | 3 000 |

| Monica | 5 000 |

| Museum in Prague | 7 000 |

| Other income | 12 000 |

| Required obschesemeynye costs | –13 617 |

| House rent | –2 600 |

| Gas | –200 |

| Shine | –150 |

| Water | –67 |

| the Internet | –150 |

| mobile connection | –200 |

| products | –8 000 |

| Household expenses | –2 000 |

| sewerage | –250 |

| school meals | 0 |

| educational activities | 0 |

| Goods for school | 0 |

| Clothing for children | 0 |

| footwear kids | 0 |

| Mandatory personal expenses | –2 200 |

| credits | –2 000 |

| Health | 0 |

| Transport | –200 |

| Optional expenses obschesemeynye | –2 000 |

| Family fun | 0 |

| Games | 0 |

| Sweets | –2 000 |

| Optional personal expenses | –3 600 |

| Swimming pool | –400 |

| Service bicycle | –200 |

| Personal Entertainment | –2 000 |

| vicious habits | –1 000 |

| other | 0 |

| Unexpected expenses | 0 |

| Net profit | –5 583 |

From the first time to cover all the expenses I did not succeed. Therefore, at least the first three months will not be superfluous to record income and expenses after the fact. Ended a month - check against the actual costs with the home version OPiU - if anything had been forgotten. Lost - add the line.

5. To count money

Record all actual income and expenditure is not only useful for checking how well you have made a home version OPiU. Keep in mind all the expenses for the month, including small, unreal. And if every day to capture waste, none penny has not lost.

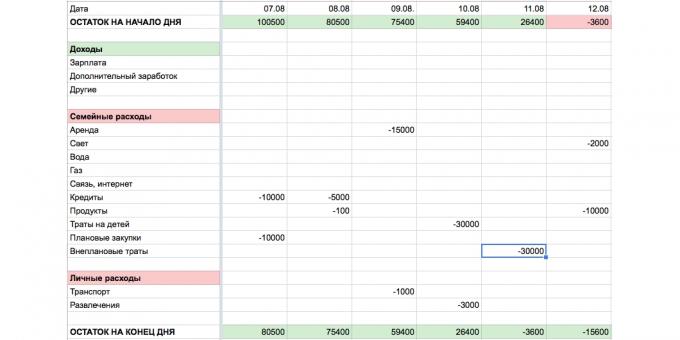

To record their financial transactions, I use the cash flow statement (SDS).

Purse - it is a place where money is kept. In this sense, the purse is considered not only a wallet, where you carry cash, but credit cards, invoices and the like. If you keep the currency on a rainy day in the mattress - mattress also becomes purse.

Top cribs for the home version of the DSS - internet banking where all the money movements are recorded on the card or the account for each day. Deal with cash checks help. It remains only to remember to take them to the seller, and not to throw away. Part of the products I buy in the market where there are no cash registers. Such spending accounts for the old record in a notebook.

The home version of the report for me DDS performs three functions:

- Self Test - Do not forget to take into account any expenditure.

- Guarantee recording of all receipts and expenditures.

- Self-discipline. At first each day to drive to the plate numbers was the most tedious part of restoring order in personal finance. Then he used to. And now need to record all income and expenditure keeps in tone.

6. Create a calendar of payments

Paying calendar - a hybrid between a home version OPiU and calendar month. Income and expenses in it scattered days. All of us know when to get a salary, pay for rent, utilities, daycare, tutoring children, to make the next payment on the loan, and the like. All this is reflected in the payment calendar.

Template payment calendar →

Paying calendar - excellent vaccine for the prevention of spontaneous purchases. In late July, I came up with the dispatch of the offer in August, rest on the sea for half the price. Tempted to arrange an unscheduled week vacation was great. But looked at the calendar of payments, he has added all related to travel and understand - even with the discount not afford. So the sea will wait until.

results

My achievements in the first five months of bringing order to finance:

- I ceased to quarrel with his wife because of the money. Because now both we know for the contribution of each to the overall cost.

- 20% reduced personal expenses - mainly due to the entertainment. But this does not mean that he abandoned them altogether.

- I learned to anticipate a situation where money is not enough for the required payments. Does not always be avoided, but they ceased to be a surprise. In July, during the holiday did not fit into the budget at the end of the month I had to use a credit card. Money back from the first revenue - literally in two days.

- By reducing expenses increased monthly mortgage payments. Previously limited to making minimum payment which covers mainly interest. Now I see how the body of the loan is reduced, and with it - and the minimum payment each month.

- I start saving the difference between revenues and expenditures. While on deposit, but look to the more profitable instruments.

- I learned how to set financial goals and saw - they are achievable.

I am sure - you get no worse, and someone - better. The main thing - to start.

see also

- How to conduct the family budget, that all were satisfied →

- Why accounting personal finance is much more effective self-restraint →

- 8 books on personal finance, which is worth reading →