How to spend less and save more: simple rules that we forget

Get Rich / / December 20, 2019

How to spend less

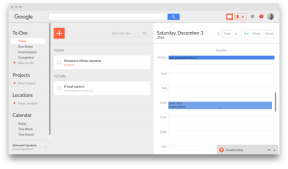

1. Keep accounting of expenses and revenues

The most common cause unreasonable expenditure - lack of control. To determine where it is funneling money, you need to keep a daily account of costs and revenues. Choose a convenient time, such as night, record expenses and the arrival of money in a special notebook or a mobile app.

Daria Balaboshina, consultant-methodologist of the Ministry of Finance of the project to improve the financial literacyCategories in which obtained the most impressive amount, it is better to divide into smaller ones. For example, "I'm going," divided into "Products", "Cafe Restaurant", "Lunch at work." This will more accurately identify the source of increased spending and optimize them. For example, instead of get-togethers with friends in a cafe you can arrange a visit to the country on the barbecue, which will be cheaper.

By the end of the first month you will be able to learn a lot about yourself and your habits. And they are correct if necessary.

2. Plan budget

CalculateHow much you need to spend each month. The ideal is considered to be a budget in which revenues exceed expenses by at least 10%.

Determine your daily or weekly spending limit for each category of expenditure and strictly adhere to it. To cope with the temptation to spend more, you can set a daily limit on the credit card costs (it can be configured in the Internet bank).

Fefilova Natalia, director of development of the 404 GroupDevelop personal rules for its expenditure on the basis of their importance. For example, food, utilities, loans, debt. So you set priorities, you avoid penalties that appear at the delays loan payments, will not spend money to pay for "forward", where it is not necessary.

3. Complicate your life

There are several ways to get rid of impulsive spending. But it will have to complicate trips to stores.

- Go shopping with a list of products and strictly adhere to it.

- Bring a limited amount of cash (or card with a day limit).

- Set the rule: if you really liked the "out those green shoes" buy at once, and the next day, if you do not change your mind.

- Forbid yourself spending on convenient but optional items, such as coffee to go, food home delivery, and so on.

4. Take inventory

Periodically (once a month or six months) disassemble your wardrobe, bookshelves, food supplies. Make lists of what you have. May show up in the closet vintage dress that today The cutting. And in the kitchen you will find stocks of cereals, which are forgotten.

Get rid of things that do not use: sell what you can, even for a small amount.

Cyrus Zhestkova, director of marketing service Fins.moneyI have made the analysis of a wardrobe with a stylist and described her style. Get rid of things that do not wear, I gave them to charity shops. Each season I start to your Pinterest board, adding to their favorite things, then delete what does not fit my style. As a result, I buy only those clothes that exactly talking to me, combined with my wardrobe and did not go out of fashion for several seasons. The amount that I spend on things fell three times.

5. Learn to give up

From conscious shopping can earn income. Every time you hold yourself from impulse buying, to submit its cost to the savings account.

Sundalov Maxim, head of online schools English language EnglishDomEach month, I find at least 10 items of expenditure, of which the refuse. These can be small things (like coffee take-out), as well as more serious purchase: the tenth in a row shirt, regular shoes, some unnecessary elements of the interior and so on. At the end of the month counts how many were able to save.

6. use privileges

Set a rule to wait for sales. The favorite stores you accurately determine if the thing really sold at a discount or is dishonest marketing ploy.

Loyalty programs, there are now almost everyone. Do not forget the house discount cards (or even better - make them a special mobile application). Follow the news that many stores arrange special pricing offers to save well.

Arthur Lyubarskiy independent financial advisorDo not forget about keshbeke. For example, there are cards with keshbekom miles at a rate of 4% of the committed purchases. The money you will spend only on the journey. But it will be more a piggy bank for a particular purpose.

7. Translate purchases during opening hours

A good incentive to start saving - compared. At a minimum, it will reflect on the necessity of certain expenditures.

Anastasia Tarasova, an independent financial advisor, bloggerTranslate purchase price during opening hours. For example, you are working from 9 to 18, five days a week, the salary - 40 thousand rubles. Your hour on average costs 250 rubles. Bought shoes for 4000 rubles - this is your two full working days.

8. Look for new ways to relieve stress

For many, shopping - effective way to cheer yourself up. However, this is a bad habit. Shopogolizm attacks lead to unnecessary spending, which is why stress may increase. You'll reproach yourself for having spent money on unnecessary things. And you can not get out of the trap, "No matter how much earns, spends everything."

Galina Ievleva, founder of the "Workshop of the objectives"It's a vicious circle. You have stress - you go to a coffee shop, for shopping, spa and so on. Spend money, growing cost of maintaining the standard of living. The result - you load yourself more work and drive themselves in an even more severe stress. Income can grow along with it grows and the cost of living, but the fun of it.

What to do? Find non-monetary ways to relieve stress: walking, lots of fun, sports, music and so on. Learn to say "anti-stress" buying firm "no."

How to save more

1. Put clear objectives

Specify your request as specific. Not "I want a car" and "I want a red car specific brand by next summer." Calculate how much you need to postpone this. When you visualize dream, limit yourself to spending will be easier.

To save money more efficiently, automate the process.

If you receive your salary on the map, adjust the translation of 10% of each entry into the storage account. On it on your savings will accrue interest (sometimes higher than for standard bank deposits).

Plus savings account is that the money for it protected more reliably than in the bank card, including from you. Remove and spend their "one movement" will not work.

2. Learn mindfulness

And squander everything cleaned down - a sign of an infantile attitude toward money. But the ability to manage finances - Skill mature personality. And it can and should be trained. Look for a way to do it.

Rostislav Plechko, athlete, entrepreneurImmediately after any received payment, divide the amount into several parts. One part of the - 5-10% - set aside as a reserve stock. This airbag that you use only in case of force majeure. The second part of invest: outsource it to a professional or yourself please create a deposit in the bank. It is important to the realization that now the money is working for you and not vice versa. The third part of the spend on everyday needs, trying to avoid impulsive spending.

3. Keep a jar for coins

Penny, as we know, the ruble protects. Get home a box or jar where you put a little thing that appears in your wallet. For a month in a piggy bank you can collect a few thousand rubles, which is not exactly to be redundant.

4. Find new sources of revenue

Today to find part time very simple. There are special online services that combine the masterminds and perpetrators of any kind of work. You can earn money constantly, in their spare time employment, or to take one-off orders, when there is a desire and opportunity.

Part is not only tedious, but also enjoyable: take a walk with the dog, take documents, find information on the Internet and so on. Choose according to your taste.

Most importantly - do not spend, and put off all the additional income, plus the monthly deductions from salary. If you follow all these rules, your financial situation will improve quite quickly.

see also🧐

- 4 key financial questions that you need to know the answers

- 7 reasons to start a piggy bank, even if you are an adult

- 17 habits that will make you rich