8 ipotechnikam rules: how to buy an apartment on credit and do not regret

A Life / / December 19, 2019

Svetlana Danilchenko

1. Choose a comfortable payment on a mortgage

Chasing the Dream apartment you can get into bondage mortgage. For example, give 70% of the salary for the loan and sit on the buckwheat. Before you buy an apartment, I clearly identified as willing to pay per month.

I chose an apartment on the secondary market, so that it could immediately call, so I decided that the payment of the mortgage should not exceed the amount that I pay for the removal rates of the apartment. Then I rented housing for 30 thousand.

There is another way to check how much you are willing to give: a few months to postpone the expected amount of the payment in a separate account. If you have not got into debt and have enough money for everything you need, such payment to you under force.

2. Determine which apartment you can afford

Of course, I want to live in a dream apartment: bright, with high ceilings and panoramic windows. I almost bought one apartment impulsively. I thought, "Oh well, I will take a mortgage than 20 years, and 25, and will not pay 30, and 40 thousand per month. But what apartment! "- but in time he abandoned the idea. Now I understand that it was the right decision: in the first year I barely have enough money for a normal delivery, to give 10 thousand more, I could not.

I advise you to consider what kind of apartment you can afford. I did so.

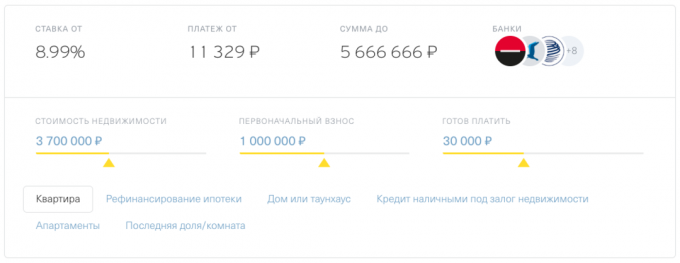

First formulated options for the purchase of:

- initial contribution - 1,000,000 rubles;

- comfortable payment per month - 30 000 rubles;

- loan term - ideally 15 or 20 years.

Then in the mortgage calculator to determine the maximum amount of the loan: to enter the size and term of the mortgage and watching what the monthly payment is obtained. On the site "the Banki.ru"You need to know the interest rate for the calculation, I took the average for 2013 - 12%. The site of the mortgage "Tinkoff Bank"Calculator automatically display the average rate on mortgage bank partners.

I got that from the payment of up to 30 000 rubles and maturity of the mortgage 20 years, I can afford an apartment worth up to 3.7 million rubles.

3. Reduce financial risks

Before buying, I studied online tips on how not to remain with unaffordable mortgages and no money. Some of them approached me, some - not.

- Accumulate financial safety cushion. Option is not for me. I think this is a long and strange. Accumulated half want to make for the mortgage to reduce debt and not to keep on the safe side. But many financial advisers do not agree with me.

- Have a second job. This option means that I will continually work only on the mortgage. Dedicate his life to the full and credit I'm not ready.

- Have a plan for reduction of case. This is my working version. Even before signing the mortgage agreement, I decided that if the work is really bad, then get settled as a waitress or hostess in the restaurant. You can earn about 50,000 rubles a month - so I can pay the mortgage.

Note: when money problems still will want to contact your bank for help. Banks are not profitable to the client becomes bankrupt, he disappeared and did not return the debt. Therefore, if the mortgage payment became too heavy, ask for a vacation credit or revise the amount of payments for some time.

4. Find a better interest rate

The difference even in the 0.5% per annum can save 200 000-500 000. Use aggregator bank, which will send the documents for the loan immediately in several banks. So you get several offers and choose the most profitable.

If you want to apply yourself in different banks, it is better to do it in offices that specialize in mortgages. Otherwise, an employee of the usual department will mediate between you and the mortgage lending department - on the forwarding of documents will go the extra time.

5. Check your credit history before the mortgage registration

Due to the bad credit history, banks may refuse to mortgage or increase the interest rate. Outstanding loans, overdrafts or late payments can affect the sentence. Before requesting a mortgage is best to check the credit history and repair schools, if any.

6. Check the "purity" of the apartment

This means that before you buy you need to examine all the documents. They will ask for and check the bank, but better to do it yourself with the realtor. I'll tell you what documents and what should be checked.

- The base property of the seller. A contract of sale, deed of gift, contract of privatization, certificate of ownership or an extract from USRRE no more than a month ago.

- apartment Datasheet. In it you will see whether the redevelopment and whether they have been legalized. The passport must not be older than five years. If the apartment is illegitimate redevelopment, the bank may not approve a mortgage. And if the apartment you still buy, redevelopment will still have to legitimize - otherwise fine. Some services help you understand the requirements for redevelopment. For example, in "Tinkoff mortgage" can make all the redevelopment, and the service will select a bank that will agree to give credit for such an apartment.

- Extract from the house register. It will show who is registered in the apartment. At the time of purchase should not be one.

- The seller's statement that the purchase and sale of real estate, he was not married. If the seller is married, you need a marriage certificate and a notarized consent of the spouse to sell. If the seller is a widower - a death certificate. If there are no documents, the spouse will be able to challenge the transaction.

- Help from psycho- and narcological. They need to prove that the seller in his right mind. Some banks make the examination directly to the transaction. Help ensure that later will not come relatives seller with a statement that he was not himself. If the court will prove that the seller could not make sound decisions, the transaction terminated.

- Information about the fact that buying an apartment was not involved maternity capital. And if involved - a certificate from the guardianship authorities, permits the sale. If vskroyutsya violations deal can recognize invalid.

7. Do not rush to buy an apartment after the first inspection

On examination, the seller of one apartment hurried me and said that at her place, and the answer must be given right now. I decided to wait and miss the apartment. Very upset. But after a day of announcement renewed: it turned out that other buyers refused (or were not), and I was the first in the queue again.

At re-examination, I noticed a lot of drawbacks: the wallpaper come unstuck, tiles cracked, bad wiring, windows on the bustling avenue, a very small bathroom.

When choosing an apartment you can not rush. The seller wants to sell it soon, and then you 20 years to pay.

How to:

- View the apartment twice, at different times of the day. Pay attention to the traffic jams on the road.

- Do not bail immediately after the first inspection.

- Ask for a discount for visual defects.

8. Examine the services that make it easier to obtain a mortgage

In addition to the banks with which borrowers can negotiate directly, there are mortgage brokers, and services. For a certain amount a broker communicates with the bank on behalf of customers and protects their interests.

«Tinkoff Mortgage"Cooperates with 10 mortgage banks and helps them get a mortgage. In fact, the service works as a broker, but for free, instead of your money the bank receives bonuses from partners for the reduced customer. In addition, the "Tinkoff Mortgage" gives discounts to the rate of banks. These discounts also bonus from partners, which brings customers the service for free with a ready package documents. Partners "Tinkoff Mortgages" do not spend money on advertising, and the work of managers, so they can offer a lower rate.

Here is what are the advantages of "Tinkoff Mortgages":

- Applying online: come to the office have only once - in the transaction;

- solution for 2 minutes;

- tool for checking the apartments under the requirements of the bank;

- personal manager, who will help to the transaction;

- one set of documents for all banks;

- favorable refinancing: Partner "Tinkoff Mortgages" will repay your loan in an old bank, will give a new at a lower rate and, if necessary, additional money, for example, for repair.

These simple rules will help to take the mortgage and do not regret it. If you have already drawn it, do not relax. I recommend about once every six months to monitor current mortgage rates. If they decline, there is a chance to issue mortgage refinancing and save on interest.