How to learn to live in a plus, to secure a comfortable old age

A Life / / December 19, 2019

You can not be too young to make pension savings. Together with ITI Capital we understand why it is necessary for each and how to choose the optimal strategy.

I have enough at all, why should I accumulate?

By itself, the process of accumulation does not make sense. Important opportunities that it provides. And it is not about buying factories, newspapers and steamships.

There are a few cases where the savings needed to keep a comfortable standard of living. Here are some of them:

- Birth of a child. Theory about bunnies and lawn only works sayings. In fact, one of the parents loses a part of the income for the period of maternity leave, and family expenses grow.

- Loss of a job. Accumulation allow to disagree in a panic at the first available offer, just to fill holes in the budget, and select a great company with good conditions. For the rare specialists or top managers of the search may take months.

- Loss of a spouse. Those who stayed behind should bear on their shoulders not only the mountain, but also to ensure that the burden of the whole family. Capital does not diminish the sadness, but a little easier life.

- Retirement. The average salary in Russia after the deduction of personal income tax is 37 057Average monthly nominal and real wages of employees of organizations rubles, the average pension - 15 414In Russia, on February 1, indexed a number of social benefits rubles. Accordingly, a person loses more than half of income on retirement and additional financial contributions will not be superfluous.

In the first three cases, you can change the situation in real time: to find additional sources income, change jobs to higher-paying, climb the corporate ladder, and in general, you have the whole of life ahead. But on pensions need to take care in advance.

Do not retire the state should pay?

As we have said, after indexation in 2019 the average pension in Russia is 15,414 rubles. And in the calculations take into account the increased pension benefits to judges, officials, deputies, which improve the statistics, but not for older people who are in these categories are not included.

Subsistence level of Russian pensioners is estimated at 8615The value for subsistence III quarter 2018. in the whole of the Russian Federation, in per capita rubles. Even if you manage to keep this amount to the purchase of food, household chemical goods, payment for services, the remaining money is hardly enough to provide a comfortable old age.

In addition, due to the increase in the retirement age even these small money Russians will begin to receive five years later. A criminal liabilityThe bill №544570-7 for the dismissal of persons close to retirement age can lead to the fact that employers simply will not employ them. As a result, there is a risk of losing their jobs long before the payments from the state and remain without any source of income.

Before retirement is still far away, why worry about it now?

To provide for themselves in old age, is not enough just to save money. If you set aside each month bills in the box or under a mattress, they will lose value on the size of the inflation in the long term will not bring the desired effect.

Savings grow if to make them work. To do this, you need to invest, considering different options for investing. Age matters here: the more time left, the more you have a chance to try out different investment options and increase their savings.

Let's say, I have realized the importance of pension savings. Where to begin?

Determine the financial goal: how much money you want to receive each month or how much money has to retirement. Then assess the initial conditions: how many years you have left until retirement, how much per month you plan to postpone, how much has accumulated.

To find your earning potential, use calculator by ITI Capital. It will choose a strategy in advance to find out what you can expect at different variants of investment.

The closer retirement, the more reliable method is to choose. It employs the principle of a bird in the hand: let savings grow slowly but steadily. Young can act more boldly: you still have time to adjust the investment strategy, if something goes wrong, as planned. Remember that a high rate of return - it is always a high risk.

Do not focus on one method of investing money: it is risky.

Divide savings and invest it in various financial instruments. So you further reduce your risk of losing money.

And let's try to count?

Let's. Let's say you 35 years, you can postpone the 3000 a month and want to get out of retirement at age 65. In addition, you have managed to accumulate 100,000. Spending on pensions you do not plan for more than 40 thousand rubles a month.

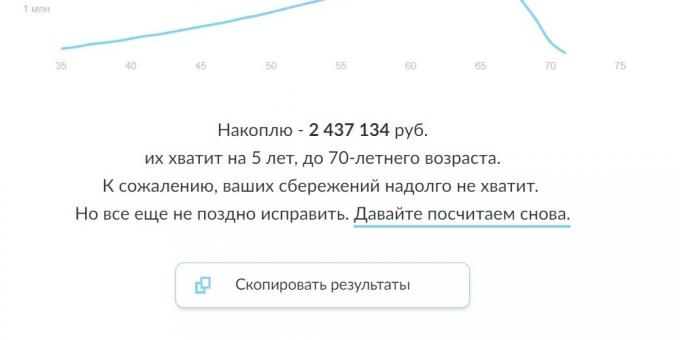

If you put money on deposit at 4% per annum, will be able to save 2.44 million rubles. That's enough for 5 years of retirement living.

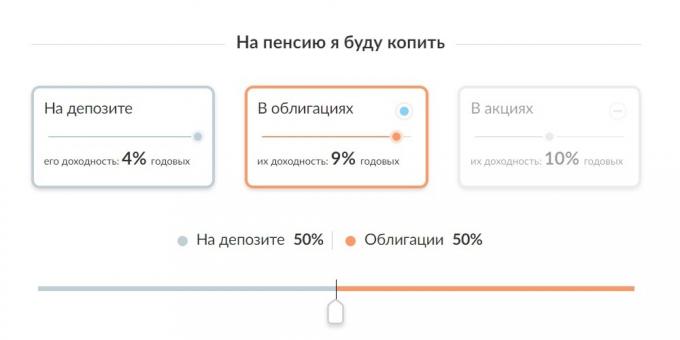

The result is you do not like, and you decide to keep on deposit only half the savings. The other 50% you invest in bonds with a yield of 9% per annum.

The result of 4 million more pleasant: this amount enough already for 11 years.

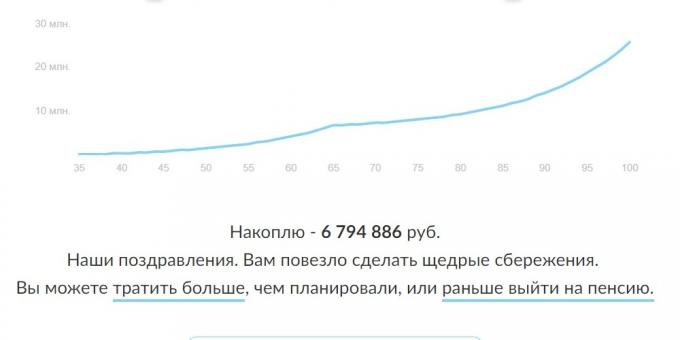

But far from retirement, so can some of the money to invest in stocks with high returns. Divide the savings and 20% leave on deposit, 60% will invest in bonds, and 20% - in shares with an estimated yield of 14%.

If all three strategies will work, these savings will be enough for a long time.

And where to invest, not to be too risky?

Consider the most popular varieties.

Deposit

Traditional tools to accumulate. According to the Central Bank, the weighted average interest rate on deposits for a term exceeding three years is 6.07%The weighted average interest rate on foreign attracted by credit organizations deposits (deposits) of individuals and non-financial organizations in rubles.

Deposits are insured by the state, but only to the amount of 1.4 million rubles.

Federal loan bonds

These securities are issued by the state, so the risk of losing money when they purchase a minimum.

The annual yield of OFZ is now estimated at an average of 8%The Ministry of Finance, federal loan bonds - higher than on deposits. If you buy them through a personal investment account, you can increase revenue through income tax refund of up to 52 thousand a year. Layfhaker together with details ITI Capital I told, how to do it.

ETF

ETF (Exchange Traded Funds) - stock investment fund, which is invested in the stock market indices, commodities, commodities or securities. By investing in an ETF, you invest in the fund generated a package of securities. It is more reliable than to buy shares of a single company.

ETF-funds can be bought and sold like ordinary stocks. In this ETF are denominated in US dollars, and if the exchange rate rises, you will earn money, not lose it.

ETF are different, so make sure you learn what assets are included in the package that you want to invest.

There is clearly need an example, it is possible?

Can. In company ITI Capital prepared portfolios for different ages with an optimal set of stocks and bonds in terms of the ratio of profitability and reliability.

For those who have already celebrated its 50th anniversary, offers investment portfolio of "Wisdom." He is about 75% of the ETF on the index Russian Eurobond issuers and 25% of the ETF on the RTS index shares most profitable Russian companies. The first part will help save money at a relatively low income, the other will provide high returns when investing for a long time.

The composition of the portfolio, "Confidence" for the 30-year-old the other: it is 25% ETF issuers in the index of Russian Eurobond and 75% - ETF on the RTS index. The growth rate of shares and possible dividends in the future may provide a good yield of the portfolio, while the risks are higher. But you have much more time to adjust the strategy of earnings if the efficiency of investments you are not satisfied.

What if I'm a lifetime to accumulate and do not live to retirement age?

Assets inherited. So that savings will go to your family or people whom you mention in the will.

In addition, their accumulation, as opposed to those that are listed in the Pension Fund, you can spend at any time, of a certain age do not necessarily wait.