What is a credit score and whether you can get it through "Public services"

Right A Life / / December 19, 2019

Layfhaker understands who exposes the borrower evaluation and how they influence the bank's decision to grant a loan.

Why does everyone started talking about the credit rating

January 31, 2019 came into force amendments to the LawFederal Law "On Amendments to the Federal Law" On Credit Histories "" from 3.8.2018 number 327-FZ on credit histories. Many media, talking about innovation, focusing on two things. They wrote that since 2019 you supposedly can:

- Find out your credit rating.

- Get it and credit history through the "Public services".

Both of these assertions are not true. Layfhaker understands how things really are.

What is a credit rating

This is an estimate of your ability to pay, which shows the bank how much you can be trusted, and how likely you return the credit money. It is set on the basis of several factors. Taking into account:

- your credit history and its existence in principle;

- timely repayment of loans;

- the presence of unpaid fines, taxes, Accounts for communal exacted through the court;

- salary;

- age;

- work experience;

- and much more.

What's new with the credit rating

In short, nothing. Single universal credit rating, which would act in any financial institution, does not exist.

Each bank has its own scoring system - counting points on the entered criteria. How exactly - he knows only the financial institution. They do not disclose, because otherwise this knowledge can benefit swindlers.

Credit ratings, which are recalled in 2019 - this evaluation exhibited some BKIFederal Law "On Credit Histories" dated 30.12.2004 number 218-FZ. Uniform requirements is not here. The law says that the bureau may (but is not obliged) to prepare the credit rating of its methodology. Accordingly, organizations choose the criteria themselves, are evaluated and they can not be the same, even with different criteria Office, not to mention banks.

No innovation is not here. The Act of 2014Federal Law of December 30, 2004 № 218-FZ "On Credit Histories" year also means that credit history can be switched rating.

If the Bureau of credit rating, it comes in addition to the credit history. How to get it, already Layfhaker I wrote. But the facility where your credit history is stored, and may not be rated, and in this case you do not appear.

Can I get a credit history with a rating through the "Public services"

Availability of credit rating in history, as mentioned above, depends on the credit bureau policy. In any case, view the CT through the "Public services" is impossible. But check in on this website greatly facilitates the process to obtain it.

To credit history has become available, it is necessary to go through two steps:

- Find out what the credit bureaus store your data.

- Make inquiries into all these organizations to gain from each CI.

How do I know where the credit history is stored, through the "Public services"

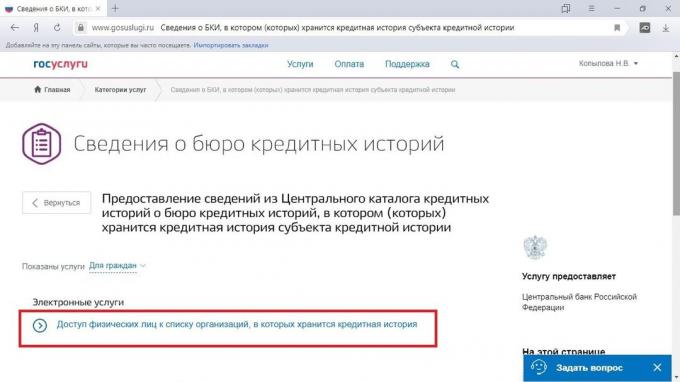

On the "public services" you can get information on the first stage. Open special section and select "Access of individuals to the list of organizations in which a credit history is stored."

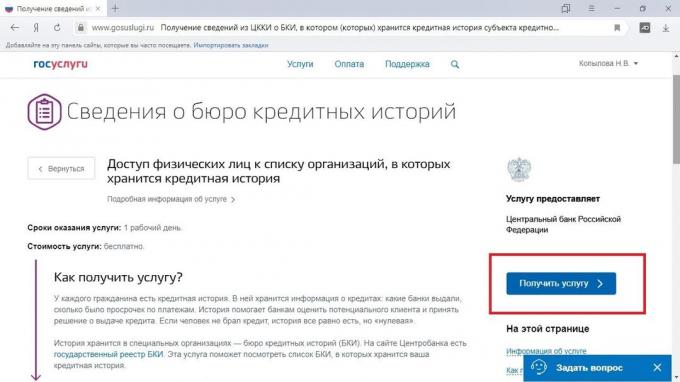

Then press the button "Get the service."

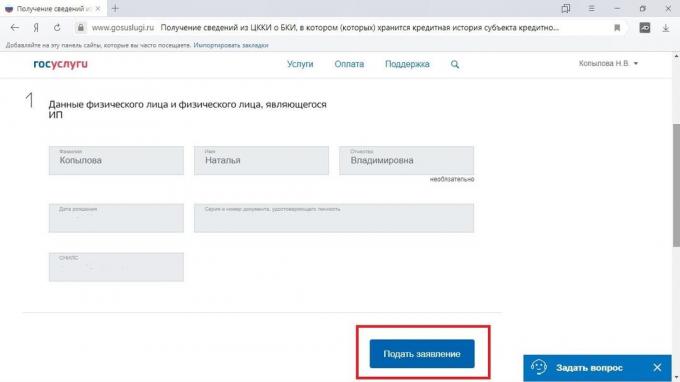

Open the form in which you need to enter your name, date of birth, passport data and SNILS. If this information is stored in the "public services" account, the fields are filled in automatically. It remains to click on the button "Apply".

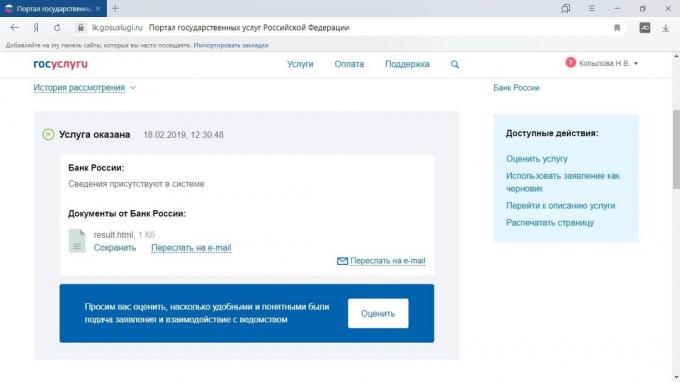

According to the website, the service is provided throughout the day. In fact, data on the CRB can do in a few minutes.

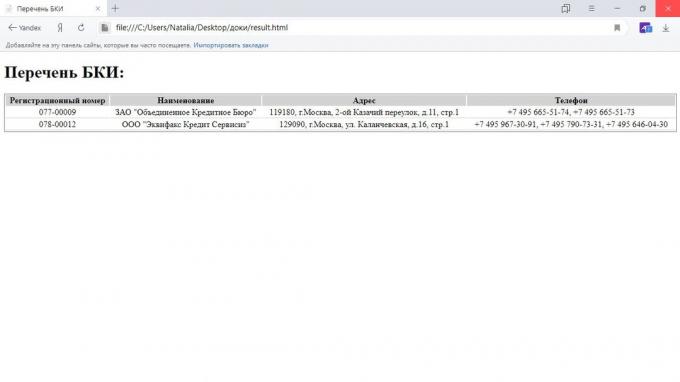

As a result, you get a list of CRAs.

How to get a credit history using the "public services"

As for the second stage to obtain a credit history, you need to apply to each credit bureau. Previously, it was necessary to come to the office in person, send a letter or telegram, e-mail inquiry. Now you can login to the CRB website using your account on "public services"And gain access to the right information. This feature provides the majority of the 13State register of credit bureaus credit bureau.

| The credit bureau services | Authorization through the "Public services" |

| Interregional Bureau of Credit Histories | there is |

| National Bureau of Credit Histories | there is |

| United Credit Bureau | there is |

| The credit bureau "Russian Standard" | Under development |

| "Equifax Credit Services" | there is |

| The credit bureau "Yuzhnoye» | Not |

| East European Bureau of Credit Histories | there is |

| Capital Credit Bureau | there is |

| Interregional Bureau of Credit Histories "Credo" | there is |

| Krasnoyarsk Bureau of Credit Histories | there is |

| BCI "Micro Finance" | there is |

| Specialized credit bureau | Not |

| Bureau of Credit Histories "Partner" | Under development |

With the result that

As we can see, the excitement around the artificially inflated credit ratings: this particular issue changes are almost not affected by the law. Here's what to remember:

- Credit rating can be found, if it is CRB. It will be included in the credit history. This is not an innovation, as it was in previous years.

- Since 2019 credit history in electronic form can be obtained free of charge twice a year in each BCI.

- List of Office, which store information about your potential borrower is available on the "public services".

- Get credit history through the "Public services" is impossible, but with an account on this website, you can login and get the majority of BCI CI.

- Credit rating, which make up the Bureau, formed by their own criteria and based on the information known to them. The Bank will evaluate you in a different way. Therefore, rated by CRAs can not say with certainty will give you a loan or not - we can only speculate. Where more effective will carefully examine the credit history - Layfhaker I wrote, how to do it.

see also🧐

- What you need to know to get a loan from any bank

- How to fix credit history

- Why the bank may refuse to credit