Mortgage vs. rent: in which cases more profitable to buy than to shoot

A Life Avitonomika / / December 19, 2019

1. You live in the "right" city

Domofond.ru experts counted: According to records in 2018, with an increase in the cost of rent by 3% per year, while real estate prices - on 6%, in the number of cities the mortgage will not only save money, but also many times faster to buy their own housing.

The calculation was performed for a family of two working people. We suggested that each of the average salary of the region (according to Rosstat), and half of the total income of the family is ready to spend on housing. At the same time on their hands already have 20% of the average cost of a one-room apartment in the city of residence, and this money can also be put in the bank and start saving.

The top five cities with the best mortgage - Khimki, Moscow, Makhachkala, St. Petersburg and Balashikha. Here, the average credit for "odnushku" at the rate of 9.55% with an initial contribution of 20%, you will pay more quickly than if they put money on deposit and hoarded parallel renting housing.

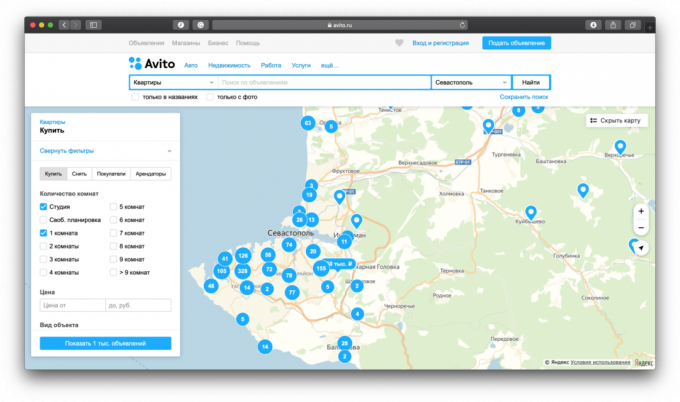

There are cities where the average salary to his own apartment to save impossible. This Sevastopol, Simferopol and Sochi. A mortgage to pay quite real: in Sevastopol, it will take 17 years and 2 months in Sochi - more than 14 years, and in Simferopol - about 12.

2. Your income is growing more slowly than inflation

It sometimes happens that a person does in life do not want to change and years of working on one and the same enterprise, improve hesitate to ask. It is logical that in this situation, the salary will not grow.

And inflation, unfortunately, do not stop. Over the past five years, she exceeded 40%. In 2018 due to inflation the real value of Russian stocks fell 3.9%, since the beginning of 2019 - by 1.6%.

If your income does not grow, the mortgage is profitable. You sign a contract with a fixed monthly payment - and we paid half the salary, and will pay for the entire period. And even if your income does not grow, you still will not be left on the street.

3. You do not know how to save

One guy started to save for "Ferrari", but then broke down and bought a shawarma. With savings on sale the same. And the larger the amount, the more tempting to spend it - buy the latest smartphone, update the car, go on vacation to the world's end.

Stash hampered by a lack of long-term goals. Only 34% of Russians watchThe Russians do not know how to save money and often take out loans expenditure and systematically lay on something - usually on vacation or "rainy day". One-third of all do not know what. At the same time 30% of the population of megacities are now paying the loan.

Mortgage disciplines. You do not throw money and budget planning. And do you know precisely when it will end. And if incomes rise sharply, you can pay off your mortgage early. And to go on vacation for a new car and a fresh smartphone.

4. Are you afraid that money will suddenly become less

Well, if you have signed a contract with the owners of the property and there indicated that it faces for the delay. But it happens that contract or not at all, or it is made not in your favor: do not pay for the next month - looking for a new home, the deposit will not be refunded.

loyal banks. They have already received part of the amount from you and want you to be fully paid. If it is fair to explain the situation, you will find a solution. You may have to overpay a little bit, but out of the apartment you will not be expelled.

5. You notice that the lease expensive

The average price of monthly rent one-room apartment in Russia for the year grew 4.6%. In Moscow, "odnushki" went up by 10%, "kopeck piece" - 12%. Options removable housing up to 20 thousand in Moscow the cost of a month on Avito Real Estate still remain, but they can be counted on the fingers.

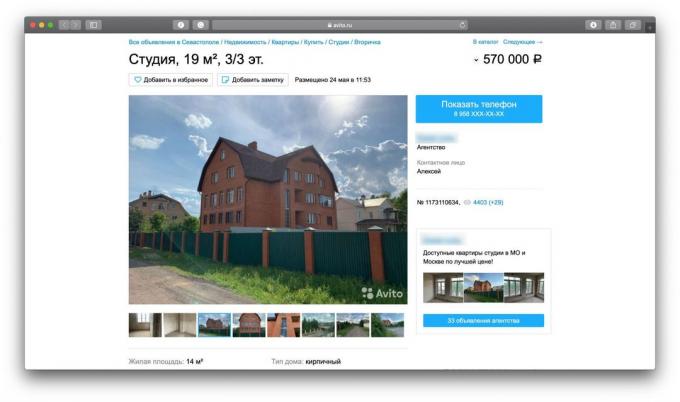

Another option - to take the area of 19 sqm in the mortgage studio. m in Krasnogorsk (15 km from Moscow on Novorizhskoe highway). Private apartment in the new cottage will cost 570 thousand rubles. The first installment of 20% and a rate of 9.55% per annum, you can pay the same 12 thousand rubles, and in 3 years 8 months will be your property.

The demand for good options always higher than supply. Therefore, the owners of apartments can dictate their terms. Arguments mass. From "We decided that it is more expensive" to "we need more money, but you have it."

The contract does not protect tenants, although there rule that during the year the lease conditions (including price) should remain unchanged. Sue is a more expensive, and accuse you of property damage - a piece of cake. Or the owner will wait for the expiration of the contract and sign a new offer, but with different numbers.

In the mortgage agreement figures are final. Monthly payment, as well as the sum of the whole, can not grow. And it protects you as mortgagee (learn this word!). Moreover, due to inflation, the money worthless. In the end, you are still going to pay, say, 30 thousand, but it is not $ 500, and 480 or less.

6. You want to live in his own apartment

Own apartment - it's priceless. You do not need to think whether you can drive a nail or re-stick wallpaper. You do not spend money on uncomfortable cheap things, which should serve only "for the time being." You can throw all the trash and have a picnic on the floor in an empty room. Finally, you are free to get a cat, dog, guinea pig, three-meter python - but at least all at once!

Note: not all suitable mortgage

Mortgage Pros do not work for everyone. About loan for housing is not necessary to think, if:

- your income is unstable;

- you do not believe in a partner, with whom you want to get a mortgage;

- you panic fear of landslides, defaults, world crises and the zombie apocalypse.

Consolation: at the rental has its advantages

Although from an economic point of view, it is more expedient mortgage long-term lease and attempts to save his own apartment, after all, there are many reasons to take shelter, but not to buy.

- Repairs that needed not your fault, always paid by the landlord.

- If does not work out with your neighbors, you can always move.

- You can buy cheap furniture and equipment. Why spend the money if in the next apartment will have a microwave or a comfortable office chair?

- Are you mobile: If you change the work, easily move to a more suitable area.

- If space is running low, simply rent a bigger apartment. The difference in price between "odnushke" and "kopeck piece" is small.

- The monthly payment on a mortgage above the rental price. So, rent an apartment for the same money can be closer to the center or in the best condition.

choose the accommodation