How to check the credit history

Right Educational Program / / December 19, 2019

What is a credit history

Credit history - that is, information about the number of loans per citizen is registered and how faithfully he returns the money.

banks specialists use this information to decide whether to give the customer credit and on what terms. A good credit history gives you the right to qualify for a lower rate on the loan to the bank assumes that you have calculated in time. With poor financial credit records may not approve.

Why check credit history

Knowledge of credit history is useful in three cases:

- You're going to take a loan and want to assess the chances of getting it.

- You are denied a loan or mortgage for unknown reasons, and you suspect the problem in the credit history.

- You fear that the fraudsters can take out a loan in your name.

How to check the credit history

Find out your financial records kept in any credit bureau

Information about the borrowers is stored in the credit bureau, full list which is on the Central Bank website. Credit institutions collaborate with different offices so information about you may be in any of them, or even a few. To find out exactly where, send a request to the Central Catalog of Credit Histories of the Central Bank in the following ways:

- After any bank or MFI at personal visit (take a the passport).

- Through any credit bureau with a personal visit.

- by wireCertified employee email and directed to the address 107016, g Ul. Neglinnaya, d. 12, the CCCH. It should be mentioned the surname, first name, full passport details, e-mail, which will come the requested information (the @ symbol in the address is replaced by (a) the sign "_" is recommended to write the words "lower underlining ").

- Through a notary.

- On website Central Bank. To do this you will need the code of the subject of credit history. A special combination of alphanumeric characters to access the online-based Central Catalog of Credit Histories, you had to come up with at the moment of the loan.

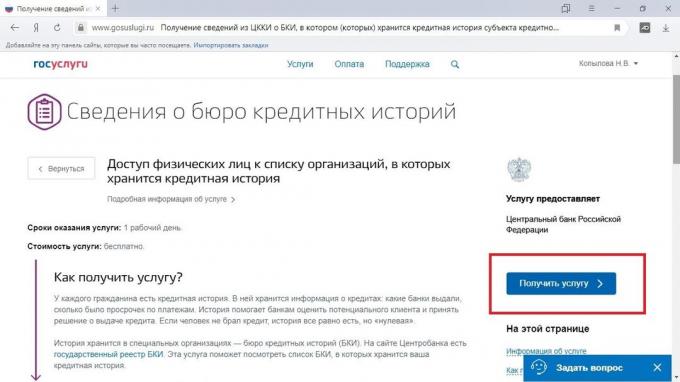

- Across "Public services" - promise to send data during the day, in fact, a response to a request may come in a few minutes.

Substituting personal data automatically. If not, fill them manually.

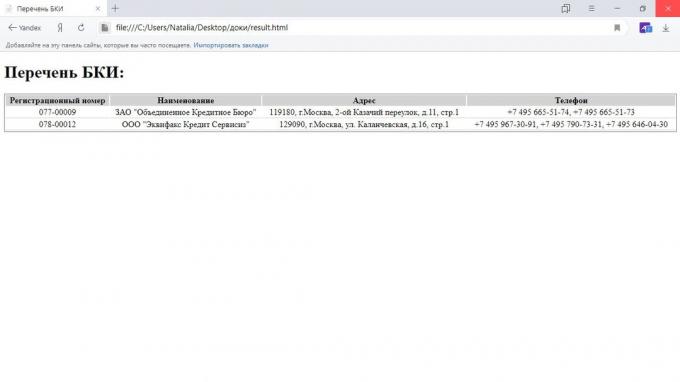

Soon you will be available a document that you can download or send mail.

It lists organizations where your credit history is stored.

If the code of the subject of credit history for some reason has not been formed (for example, you receive the latest loan when such identifiers did not exist until 2006) or you have forgotten it, please contact any bank. only a passport will need to get the ID-code. The second option - a visit to any credit bureau.

If you do not have the code, contact your bank or credit bureau. So once you get and information about where to store your financial records, and code that is useful to you in the future for similar transactions.

Send your inquiry to the credit bureau

If your credit history is stored in several offices will have to apply to everyone. Twice a year to receive information free of charge in each of the CRAs. For the third and subsequent requests will have to pay an average of 300-500 rubles. Make an application for a credit history in several ways:

- When a personal visit to the office desk or its regional partners.

- Send postal address bureau telegramWhich must be certified by an employee address.

- Send a query letter. In this case, the personal signature of the applicant must be notarized.

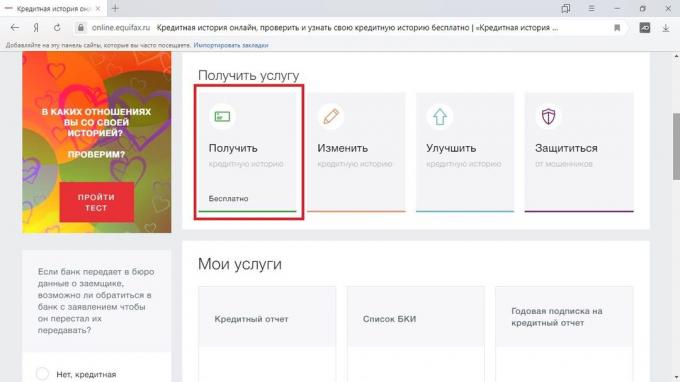

- Send online request if the credit bureau provides such an opportunity. So, OOO "Equifax Credit Services" is a service "Credit history online». Apply in Eastern European credit bureau on the official website.

- Order a credit report online through the bank if it offers this service. However, organizations can cooperate only with selected credit bureaus. Get a credit history can be Sberbank, «Binbank», «Tinkoff Bank"And others. For mediation will have to pay.

- Use the services of a commercial service history assessment "My rating», BKI and the like. For a fee, they not only collect your financial records, but also on this basis would amount to the credit rating. It shows the level of creditworthiness of the customer, and predicts the chances of getting a loan.

- The site BCI with an account "of public services." This feature is now available in the majority of organizations that store credit history.

For example, in website LLC "Equifax Credit Services," you must first create a standard way, your personal data, verify the mail and telephone. After that will be available for a credit history by using the account "public services."

A few minutes later the credit history will be available for download.

see also

see also🧐

- How to get rid of debt on the loan

- What to do if the ATM does not give your card

- How to recognize hidden in the installment loan