R-Connect - the application with which you can forget about the offline payments

Android Ios / / December 19, 2019

Appointment banking mobile application - provides the convenience and speed of operations. And if two-thirds of all transactions carried out offline, suffering, and speed, and convenience.

In the application R-Connect realized so many different possibilities that the real bank offices simply make no sense. At least, after you get the card, "Raiffeisenbank" and connect to online banking.

Payment of utility bills, internet? You are welcome! Open a new account and throw money already available? Easily. Pay taxes, kindergarten, traffic police fines - why not? And more discounts, which the app will remind as you get closer to the store, exchange, registration costs and other useful pieces that simply can not be performed offline. In general, "Raiffeisenbank" tried to include in your application all you might want from the bank.

Transfers and payments even faster and easier

If you have a smartphone on Android, you can log into the application using a four-digit code. If iPhone, and can enter through the fingerprint scan (if biometric sensor TouchID), and using a four-digit code.

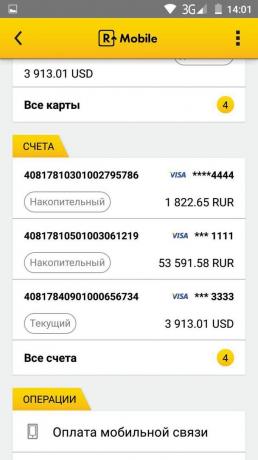

On the main screen of your account R-Connect you can see all of your cards and accounts. If you do not have the card, you have to go to the office of the bank to issue it, but you can open an account directly from the application, to replenish their money freely and flip from one to the other. You can make an account. To open the accounts are available in six currencies: rubles, US dollars, euros, sterling, Swiss franc and Japanese yen.

From the application, you can pay with any mobile communication card, transfer money to the card, for example, to borrow a relative or friend to give back to, to throw money from one card to another.

All this is done in a few tapov: enter mobile number, which is necessary to replenish the balance, or the card number on which you are going to transfer money and order.

To further simplify the operation, you can create templates. Lulu: no need to redial the parameters of the operation, to check something. Accessed by pressing the "Send" - the translation has passed.

But quick transfers are implemented is not only due to the templates. "Raiffeisenbank" so concerned about convenience, you do not even have to manually type the code by SMS operations. Everyone remembers how annoying these five-digit codes. It is necessary to turn off the app, open the SMS, to remember the code to open the application again. In the mobile R-Connect self-administer a one-time code is replaced by the automatic insertion of the push-notification. That is, you click "Translate" and do not have anything to fold and store: push comes, code auto-complete your payment will be. Very comfortably.

Another cool feature applications - currency exchange at a favorable rate. That is, you will not have to look for exchange offices, and even more so to go there. Choose the account debiting and crediting to the currency, and change them. And the rate will be more favorable than during the exchange at the bank branches.

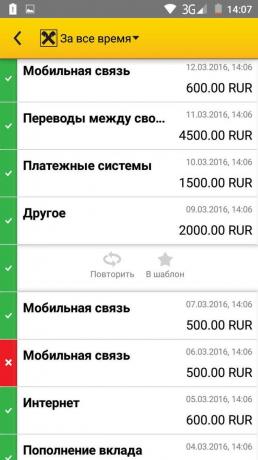

Of course, all operations fall in the "Journal of Operations." And to turn the operation into a pattern with a single tap can be there. And so it was easier to find the desired operation, you can unload the "Action Log" on time - a week, month or any period.

By the way, there is another small feature to speed. To transform the operation into a template, or to repeat it, you do not even need to go into it. Long press, and before you two icons: "Repeat" and "B pattern".

Payment services and other operations - in one tab

On the main screen there are some of the most sought-after operations and select "Templates". The remaining operations can be found in "all operations".

It is here that all the operations that can be performed in the application, and they really a lot. In addition to the transfers, currency exchange and payment of mobile, there are different types of services listed in the budget of the Russian Federation, and even managing contributions. But first things first.

From the app you can pay for internet and television, transport services and telephony, to transfer money through the payment systems like RBK Money and QIWI and pay for Utility services, as well as easy to transfer money to the number of your personal account and to forget about queues in the office and even on trips to the ATM to carry out these payments.

With regard to the transfer to the budget of the Russian Federation, you can tapov pay taxes or, for example, the penalty for speeding. And nothing prevents to create a template and next time pay even faster. With such convenience, you hardly ever pay overdue fines.

Pay for kindergarten or university education, to pay taxes - these and other services are available around the clock. And I think, once paid through the application, you simply forget the way to the real office of the bank.

Management of deposits and loans

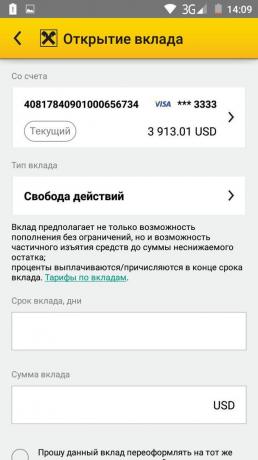

With transfers and payments, everything is clear, there is nothing exceptional. And what about banking products? For them, you probably have to go to the bank branch? Not this time. Via mobile R-Connect, you can safely open a deposit and saving account, and not only open, but also to replenish them and partially withdraw money from them (if allowed by the contribution conditions). And all this as quickly and simply as transfer money to the card.

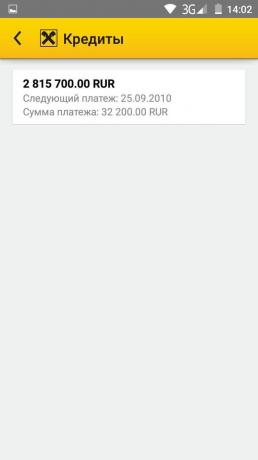

With regard to loans for them you still have to go to the office. Well, at least find out where it is. And the app will find the schedule of payments, principal and interest. At any time you can see when the next payment date, how much you have already paid and how much is still left.

Notification of discounts near you

In the R-Connect application has one unique feature that will help you not get past the attractive offer. In the truest sense of the word. It geofensing - function, using which the application tracks your location and tells you where nearby you can get a discount, paying card.

Let's say you pass by the boutique, which has a program "Discounts for you", and do not know it. Of course, you're not going to learn what retail outlets participate in the program! R-Connect app you will never miss a discount: You will receive a notification that you are not far from the desired point of sale, and will be able to make a profitable purchase.

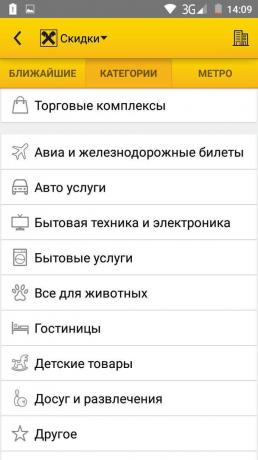

Also, you can find yourself shopping and service points of the bank partners, providing discounts, and sort them by category of goods and services or by location.

Safety first

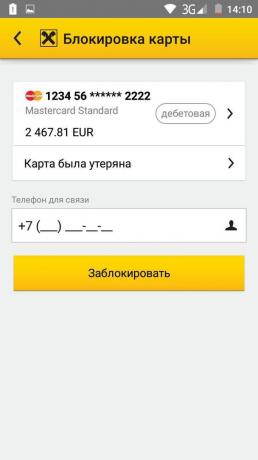

What do you do if you lose your bank card? In a panic, dial up to the bank's office and ask to block it quickly, so as not to lose their money.

With the mobile application of these situations is excluded panic and fuss. You simply open the list of operations, select the option "Block map" that indicates what kind of want to block, enter the reason and phone number. All your card is out of danger, and for further instructions, you will be contacted bank staff.

Connection to the R-Connect

In order to evaluate all the advantages of mobile banking, you need to connect to one of three ways, and to download the application. The easiest way - to connect to the R-Connect online (after registration username will be pre-installed in the form of online banking login and password will come to an SMS to your phone number). For this connection method only need a valid bank card.

The card is required when connecting via ATM "Raiffeisen Bank". But in a bank passport is required for connection.

By the way, if you choose to connect to an ATM or just want to withdraw cash from the card, the application can find the nearest ATM.

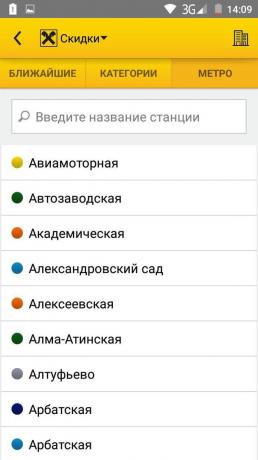

In the "Address" you will see all ATMs, branches and terminals. You can sort the ATMs to the destination and currency, to find the nearest to you or to the right subway station.

Pros and cons of the application R-Mobile

Pros:

- Almost any operation can make online.

- There are tips on discounts and the best deals.

- Intuitive interface - once it is clear that where he is.

- You can create templates from the "transaction log".

- Favorable currency exchange rate.

Minuses:

- Some operations - registration card "Raiffeisenbank" and credit - will still have to perform in a bank. Once used to pay for all the services and manage finances entirely online, is too lazy to go to the department.

- What was once a required activity and calorie expenditure, is now performed in a couple of Taps in the application. However, this disadvantage can be avoided by buying a gym membership.

If you have not tried to manage their finances online, it's time to do it all at once, and to evaluate the benefits of R-Connect application.

Try mobile banking R-Connect