Travel insurance: all the rules and nuances that need to know the traveler

Travels Educational Program / / December 19, 2019

Travel insurance: all the rules and nuances that need to know the traveler

Why do I need travel insurance

To obtain a visa

Without insurance you do not give a visa to the Schengen area, to Bulgaria, Romania, the Republic of Cyprus, Montenegro, Croatia, Canada, New Zealand, Japan and some countries in Asia, Africa and Latin America.

To obtain the desired policy check on the website of the country requirements for insurance embassy. So, for the Schengen minimum amount of insurance coverage of 30 thousand euros. For the rest, for visa satisfied with the simple policy that is easy to get online.

To compensate for the costs of treatment

Tales of expensive medicine abroad - not empty horror stories in order to reduce the flow immigrants. Access to a doctor about an injury or attack of appendicitis will cost a large sum. In order not to be ruined, better to buy insurance. If you choose the right it can cover a significant portion of the costs.

For damages

Insurance will help compensate for the loss Luggage or to make rental costs, which did not happen to go.

Which items are in the insurance

health insurance

The base variant of insurance suitable for those who are confident in their health and fears only the force majeure. It can also be sufficient to obtain a visa. Basic configuration of the policy include:

- doctor on call in case of illness;

- ambulatory treatment;

- stay and treatment in the hospital;

- transporting the doctor or the hospital;

- medical transportation from abroad;

- reimbursement for prescription drugs;

- reimbursement of the cost of telephone calls to the service center;

- repatriation in case of death.

The basic package can also include emergency dental care in case of acute pain or injury.

options

1. Travel expenses of the insured person to the place of residence after treatment in the hospital. Due to illness, you can skip the plane on which you have purchased tickets. This item will allow to get home insurance, even if the money for a new travel document you do not have.

2. Travel costs of an accompanying person to the residence after the treatment in the hospital. If indifferent companion chose to stay with you until he recovers, he will also be able to return home for the insurance.

It is better to check with the insurance company, who will be considered an accompanying person.

Typically, a person who is inscribed with you turputevku. You can also confirm the support tickets per flight, the instruments of staying in the same hotel.

3. Payment of the insured person to stay out after treatment in the hospital. If you go on the flight did not immediately from the hospital, you will need somewhere to stay, and your night will cover the insurance.

4. Travel expenses and accommodation of a third party in case of an emergency with the insured. These are two separate points, which can be useful if you needed to heal someone who is not stated in your insurance policy as an escort.

5. The fare home of minor children of the insured. If the insured person falls ill, is injured or dies, his children will be sent home at the expense of insurance.

6. Payment of travel home in the event of sudden illness or death of a relative. Health problems can occur not only the traveler, but also for his family back home. This item in the insurance will not wait for the plane, which has already bought a ticket and fly the next flight.

7. Temporary return of the insured home. If the trip lasts more than three months, the insured person will be able to go home in case of illness or of death relative, and then come back and continue the journey.

8. Assistance as a result of terrorist attacks. Injury and injury resulting from a terrorist attack, not covered by the basic insurance package, so to travel to countries where the risk of becoming a victim of great radicals, it is better to pay extra for this option.

9. Assistance in natural disasters. Natural phenomena related to force majeure, and therefore also not included in the basic package. To insure themselves against a tornado, hurricane, flood and tsunami need more.

10. Cupping exacerbation of chronic diseases. If you have a chronic disease, which periodically appear, it is better to provide cupping advance. It's worth noting that in most cases insurance will cover only acute withdrawal symptoms, it does not include treatment and rehabilitation. When you execute the policy carefully review the list of diseases that are not included in the list of insurance claims to make sure that you do not refuse payment.

Chronic disease and disability, according to insurers, are different things. Therefore, the insurance company should be notified about the status of a disabled person.

11. Relief of allergic reactions. This option will receive payments for medical procedures in case of allergy to insect stings or sea creatures, negative reaction to food, water, the sea and the pool, pollen or the sun (not sunburn).

12. Help for sunburn. Current option for countries with scorching sun, where scorch is the most thick-skinned tourist. Without insurance will have to be treated with improvised means.

13. First aid for oncological diseases. The important point for people with cancer, aid which is not included in the basic insurance policy, but you may need at any time.

14. Help in the presence of alcohol. The most tricky point, which should be added in the policy for many travelers. Not necessarily to get drunk. Enough to alcohol was found in the blood test. Therefore, the choice is simple: to drink or not, or pay.

Alcohol in the blood deprives you of the right to the payment of a basic insurance policy.

15. Sports and leisure. If you are injured while skiing, or a scooter, or conquering the mountain peaks, the insurance refuses to compensate for the treatment of the basic package. To get paid, you need to indicate in advance in the application for the policy that you want to rest actively. Of course, it will affect the final cost of the insurance. And it will make a difference whether you exercise as an amateur or as a professional. For special occasions you can make to the policy of search and rescue activities and evacuation by helicopter.

16. Insurance in case of pregnancy complications. If a pregnant break a leg in the journey, on the cast cover costs and the usual policy. However, all the problems associated with an interesting position in the basic version are not included - you need to register them in the insurance separately. Companies issue policies on different terms: up to 12 weeks, or 24 weeks, or up to 31 weeks. At a later date do not usually fear.

17. Work with increased risk. If you are injured at work, and you only have a basic insurance policy, the insurance company will not cover your costs. For the work you need to make in the agreement additional item.

18. Accident insurance. This option is not related to health care, but provides that in case of accident you will receive additional compensation.

Property insurance

You can insure against loss of baggage or documents. In this case you will pay the money to buy the necessary things or to restore stocks. If you are traveling by car, you can add to the policy corresponding item. Then the insurance company will pay the towing vehicle in case of damage or reimburse the damage caused by road accident or theft.

Travel cancellation expenses

The traveler can be insured on the departure delay the case and get compensation for that missed the connecting flight or forced to spend money on something extra. Another option - insurance against his own recognizance. If you are sick the day before travel, or you are denied a visa, you will be able to return the spent round.

Liability insurance

You can protect yourself in case you accidentally damage someone else's property or cause harm to another person's health. Count on compensation if you, for example, entered in someone skiing, we stepped on his leg and broke the little finger, shot down a passerby bicycle. But for an accident arranged by you, if you were driving a motorcycle or a car, will have to pay yourself.

A separate item can be entered in the policy to provide legal assistance in case you unknowingly violate the laws of the country.

What should be included in the insurance

The average traveler

If you are arrogant tourist without chronic diseases, go on a short vacation and do not mind the loss of baggage, it will be enough basic insurance policy. At the same time those who are planning to drink wine at the foot of the Eiffel Tower, have fun at the Oktoberfest or to taste the beauty of Turkish all inclusive, better to add to the point about the policy assistance in alcohol intoxication.

pregnant woman

For the basic package it is necessary to add the option "insurance in case of pregnancy complications." Even if you have a great feel and the doctor approved travel, climate change, atmospheric pressure, flights and many other factors that can have an impact. It is better to overpay for insurance, you get into debt due to hospital bills.

Tourists with chronic diseases

Is repelled by his illness. Perhaps, in the policy should include not only symptom relief, but also kind of payment options to return home after treatment.

Travelers with disabilities

Disabled person to issue a policy, to communicate better with your insurance agent online or offline. It should meticulously find out what items the contract covers insured events for a man of his status, and what - no. All of agreement, of course, should be as transparent as reflected in the contract. Otherwise there is a risk of being left without compensation.

Tourists with children

If currently you can try to save the young children, especially visiting the country of destination for the first time, it is better to insure in case of burns, allergies.

pensioners

On the age of the insurance company will need to notify the formation of an application for a policy. Typically, up to 65 people does not fall in the high risk group for health. Then the cost of insurance will grow with age.

When you make a policy should focus on the health and additional factors. So, if the pensioner travels to the same age, and he may at any time require medical attention, better provided in the policy for travel and accommodation of a third party, someone younger and more vigorous able to solve problems on place.

Is insurance necessary to travel to Russia

Emergency medical care, you can get anywhere in Russia under the policy of compulsory medical insurance. So what to do without additional costs can. However, if you plan on a dangerous journey to buy additional insurance it's worth. Payments will be useful family if you die, or you, if you get seriously injured.

How to take out insurance

1. The travel agency

If you buy tour, Insurance is usually included in it. Do not expect anything special from it, it will be the basic package. Those who need additional services, it is necessary to abandon the "built-in" policy and to obtain insurance on their own.

2. The insurance company

When personal visit

You need to come the insurance company, to communicate with specialists and to sign the contract.

online

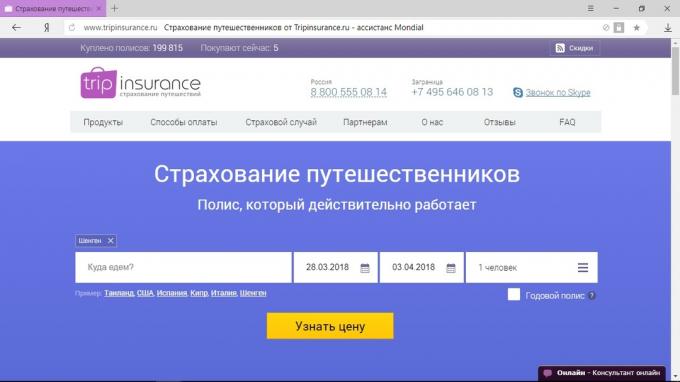

Most insurance companies buy insurance online. The algorithm for each organization about the same. First you specify the country where you are going (or more, if you arrange the annual policy), travel time and the number of people on whom the document is issued.

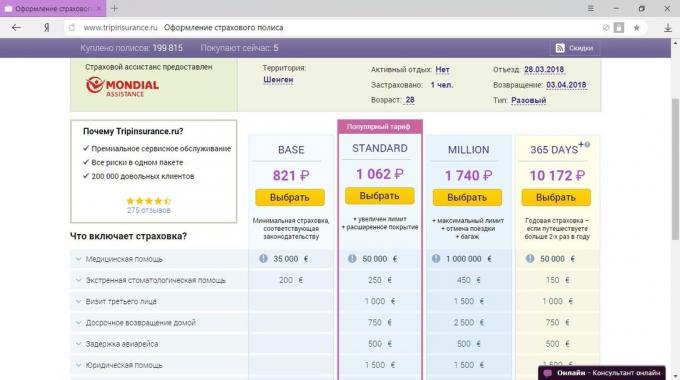

You will then need to select the appropriate tariff. For example, in the base package Tripinsurance only medical and emergency dental care, and in the standard package accounted for the majority of insurance claims related to health.

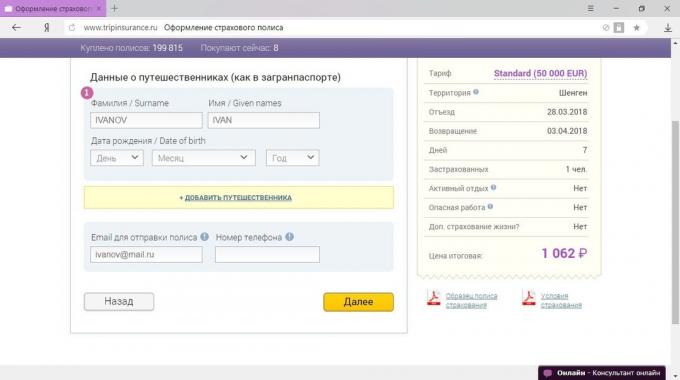

We can only fit in the policy of all travelers and contact details of the recipient policy.

3. Through special services

There are services that allow you to choose the best offer among several insurance companies. They will help find a policy that suits your needs and at the same time will cost less than if you went to the first that fell to the insurer.

Cherehapa.ru

The search algorithm policy is similar to what is offered on the websites of insurance companies. You will be prompted to select the country, travel time and the number of tourists. We should also pay attention to the possibility to choose an insurer that will give you a policy, even if you are already traveling.

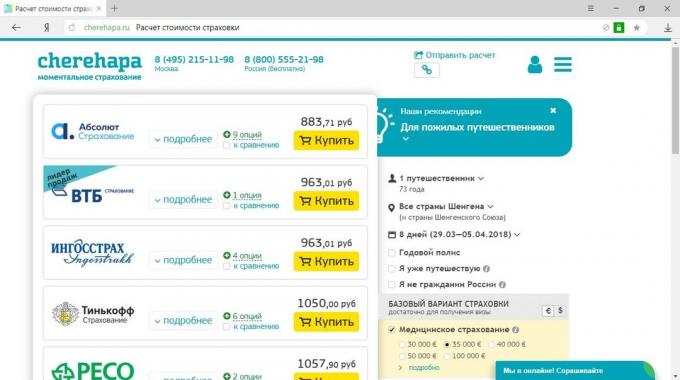

Next you need to enter your age. If you are a pensioner, the service will recommend, on what points you should pay attention.

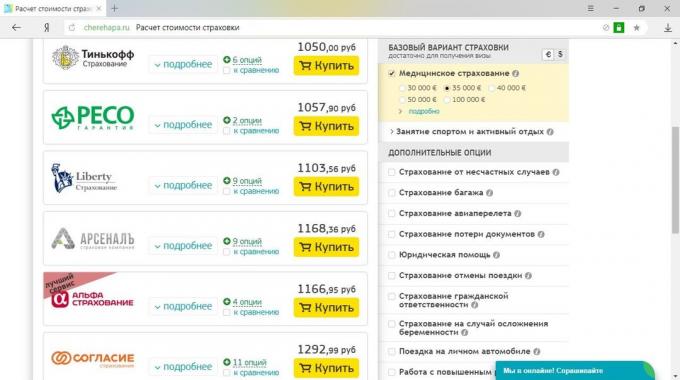

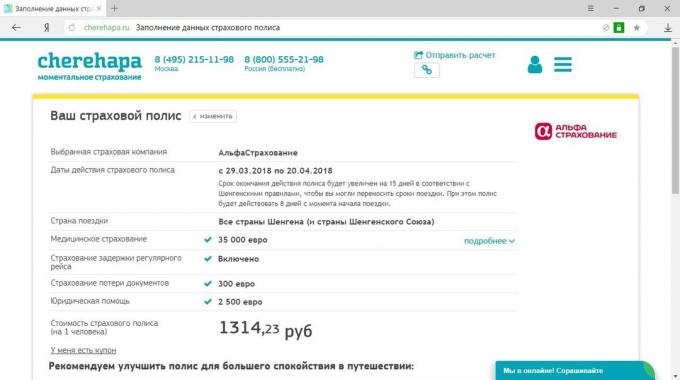

Then choose the amount of insurance and additional services.

As a result, in the list on the left will be only those companies that fit your request. It remains to study their proposals and choose the best to buy a policy.

Cherehapa.ru →

Sravni.ru

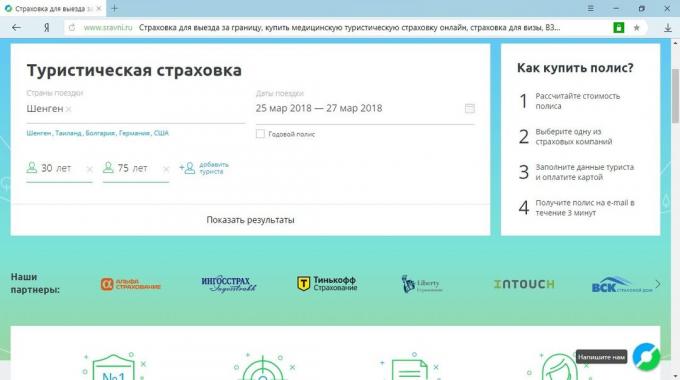

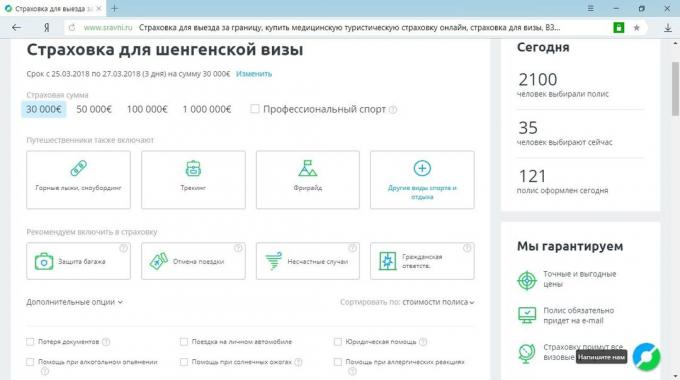

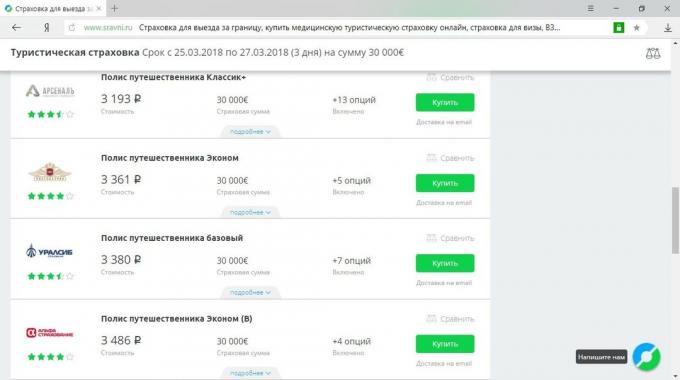

A similar algorithm works the selection policy of "Sravni.ru». Enter the country of destination, the period of travel and travel data.

You select the options you want.

Compare offers, choose the best and pay policy.

Sravni.ru →

What you need to consider in the design of insurance

Exceptions to coverage

Pay attention to this point in the contract. That it contains information to be referenced by the insurance company refusing to pay. In accordance with it, you decide not whether to choose a different policy or another insurer.

deductible

Franchise - a part of payments that the insurer will keep in the compensation of treatment or loss. It is a kind of agreement with the tourist that he is ready to take on the part of the treatment costs. For this the company will reduce the cost of insurance.

Franchise is prescribed as a percentage of the money you laid or fixed amount. So, if you break your leg and the doctor's services will cost $ 50, and the deductible is $ 30, then you will be reimbursed 20. If the deductible is $ 100, you expect to be compensated not have to.

Accordingly, if the payments are small, profitable franchise as a percentage, if large - a fixed amount.

Franchise is not a mandatory item in the contract of insurance. For example, for countries Schengen obligatory insurance without it.

How to obtain the payment of insurance

Abroad when the insured event you will have to deal with a service company (Assistance), which cooperates with your insurer. Her phone number and insurance policy number should always be at hand. Not necessarily to learn them by heart, but save your notes desirable.

If you have lost or forgotten document number of the policy, call your insurance company. There will remind the right number.

The very best policy is to take a picture and store the phone or simply download to your device the electronic document.

If the insured event occurs, the first thing you need to call your service company. It was her officer will make a decision in what clinic you need to handle, organize delivery to the hospital, and in general will coordinate your actions. Do not worry if you do not know the language of the host country: most likely, the caller will speak in Russian.

In this scheme, there is one exception: if there is a direct threat to life, you should immediately call the emergency help. Only after that contact Assistance.

The insurer may directly or compensate for your hospital treatment, or reimburse you for the cost of treatment. In the first case, just follow the instructions of the service company and do without the initiative not to call the doctor without the knowledge of assistance, disagree taking prescription drugs without consulting with him (if the insurer would think that drugs were not necessary, it may refuse to compensation).

In the second case, you will return to apply to the insurance company with a package of documents, which will include:

- policy;

- written statement of an insured event;

- all medical records;

- account for the transportation of the patient to a place of medical aid, and vice versa;

- checks confirming that the services paid for;

- bill calling for service.

It is worth checking the documents on which languages takes your insurance company. If only in Russian, you will have to provide translations certified by a notary.

see also

- 9 traveler tips from Paulo Coelho →

- How to plan a trip →

- How to arrange liability insurance policy tool in the office and on the Internet →